Body

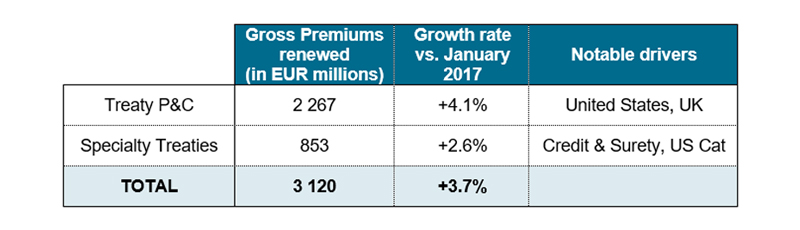

SCOR grew P&C reinsurance renewal premiums by 3.7% at constant exchange rates at the January 2018 renewals, from EUR 3.0 billion to EUR 3.1 billion. Following strong growth in 2017, the renewal outcomes are in line with the “Vision in Action” strategic plan.

Risk-adjusted pricing improved 3% compared to January 2017. Expected profitability, which is measured by both technical profitability (loss and commission ratios) and return on risk-adjusted capital, improved by two percentage points on each measure.

Reinsurance pricing is broadly improved across nearly all lines of business and geographic markets. Loss-affected programs and layers show the greatest improvements, most notably catastrophe-exposed reinsurance in the United States and motor reinsurance in the United Kingdom. SCOR benefits from improved primary insurance market conditions both through reinsurance and through SCOR Business Solutions, the Channel Syndicate, and the MGA business.

SCOR takes a client-by-client approach at each renewal season, considering each relationship over time and across lines of business. Compared to January 2017, SCOR’s renewal portfolio shows SCOR’s increased support to clients on non-proportional treaties with improved expected profitability.

SCOR reduced or declined some high-volume proportional treaties with less-attractive margins or risk profiles, particularly when pricing improvement was insufficient.

Approximately 69% of SCOR’s P&C premiums renew in January, and the Division’s risk appetite and profile are not substantially changed.

SCOR Global P&C continues to have robust retrocession protection at a single-digit increase in spend versus last year.

Treaties renewal book at January 2018:

Victor Peignet, CEO of SCOR Global P&C, comments: “SCOR has a strong position in the 2018 renewals, resulting from the Group’s multiple recent rating upgrades, a client-by-client approach, and the expansion of our capabilities as described in our ‘Vision in Action’ plan. We negotiated to reduce, cancel or decline business that did not meet our hurdles without damaging our franchise. As a result, our portfolio renewed in January is both larger and more profitable while still being well-diversified.”