Victor Peignet

CEO OF SCOR GLOBAL P&C

"In 2017, new technology began showing more tangible signs of impact on our industry. We’ve entered a transition period that will create both challenges and opportunities – from new risks and protection needs, to new ways and means to link risk to capital. SCOR is adapting to emerge as a leader in the transformation."

A TOP-TIER GLOBAL POSITION

The Property and Casualty (P&C) division of SCOR combines advanced tools, human expertise and experience in multiple lines of business across more than 160 countries. We underwrite reinsurance treaties covering Property, Motor, Casualty and Specialties. We also underwrite insurance and facultative reinsurance.

SCOR’s P&C experts stand out thanks to their spirit of long-term partnership. Their aim is to evolve alongside their clients, while ensuring direct access to decision makers. SCOR’s teams:

- Lead business and provide a full range of solutions to clients.

- Are committed to serving clients locally, while bringing them all the benefits of a global reinsurer.

- Provide shock-absorbing capacity.

SCOR’s ambition in P&C is to continue to be a market leader and good corporate citizen, while producing excellent results.

94.3%

Normalized P&C Combined ratio

94.3%

Normalized P&C Combined ratio(103.7% actual)

6.0

Billion euros in 2017

6.0

Billion euros in 2017Gross Written Premiums

Leading on around

30%

of business

Leading on around

30%

of business

1,026

Professionals

1,026

Professionalsglobally

Operating in more than

160

countries

Operating in more than

160

countries

29

Underwriting centers

29

Underwriting centersthroughout the world

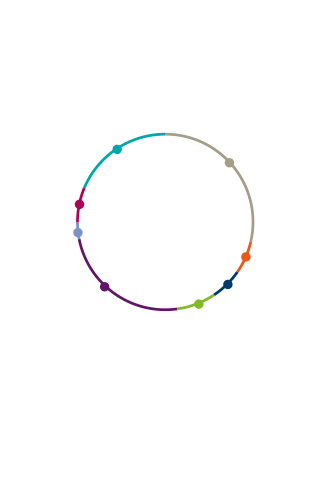

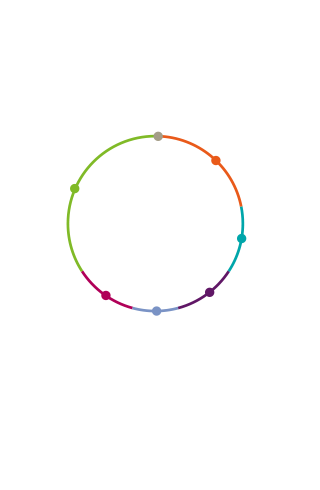

A WELL-DIVERSIFIED BUSINESS MIX,

WELL SPREAD ACROSS BUSINESS LINES

AND GEOGRAPHICAL AREAS

A STRONG GLOBAL FRANCHISE

WITH BROAD CAPABILITIES

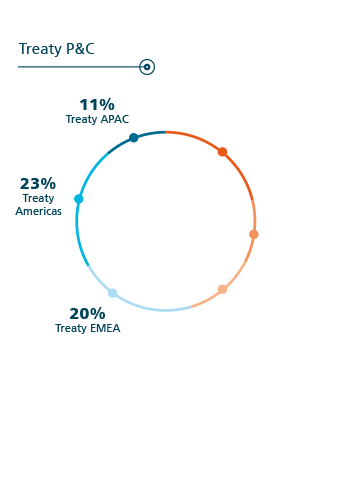

Treaty P&C

SCOR’s Treaty P&C teams provide proportional and non-proportional reinsurance in many forms across Property and Casualty Treaties. In order to build a genuine and long-term partnership with clients, SCOR is committed to a consistent underwriting philosophy.

PROPERTY TREATIES

Covering damage to underlying assets (vehicles, homes, businesses and industrial sites) and direct or contingent business interruption losses caused by fire or other perils, including natural catastrophes.

Motor

Covering original risks of motor property damage and bodily injury.

CASUALTY TREATIES

Covering general liability, professional liability, product liability, environmental liability and umbrella policies.

SPECIALTY LINES

P&C Specialty Lines are mostly written as treaty reinsurance on a proportional or non-proportional basis.

SCOR P&C underwrites on the basis of sophisticated risk evaluation, seeks flexibility and innovative approaches, and provides continuity and consistency through the backing of a strong Group.

Agriculture

Pasture insurance

Pasture insurancePastures are critical for many food industries. Only a tiny portion of pasture land and animals is insured against climate events such as drought, flood, and extreme temperatures.

Loyal to its long-term commitment to the sustainable development of insurance, SCOR is bringing technical expertise to develop a new pasture insurance scheme in Canada. SCOR’s agriculture team is leveraging the cutting-edge satellite processing technology developed by Airbus Defense and Space, which was already used to implement a successful pasture insurance scheme in France.

Alternative

Solutions

Aviation

Credit &

Surety

Cyber

solutions

Engineering

Inherent Defects

Insurance (IDI)

SCOR provides:

• Basic cover of construction damage caused by inherent defects in structural works,

• Tailored cover, including material damage caused by inherent defects in waterproofing works and/or in other specific parts of a construction,

• Additional extensions to IDI policies.

Marine &

Energy

Space

U.S. Property

Cat

Large

CORPORATE RISKS

SCOR Business Solutions is the large corporate risk insurance arm of SCOR.

The consistent and long-term approach of the 90 underwriters on the team, combined with advanced technology, risk management expertise and a healthy dose of creativity and flexibility, is what makes SCOR Business Solutions a strong insurance partner for companies in sectors like energy, oil & gas, property, liability and financial lines.

SCOR supports clients who demonstrate strong and/or improving Environmental, Social and Governance (ESG) behavior and expects to continue to increase its support for renewable energy-related projects.

In 2017, SCOR P&C:

- Encouraged sustainable underwriting by creating a scoring grid to help insurance and facultative underwriters to assess Environmental, Social and Governance (ESG) practices in sensitive sectors & lines of business. The grid combines internal and external measures and is integrated into SCOR’s underwriting and referrals systems.

- Stopped issuing insurance or facultative reinsurance that would specifically encourage new greenfield thermal coal mines or stand-alone lignite mines or plants.

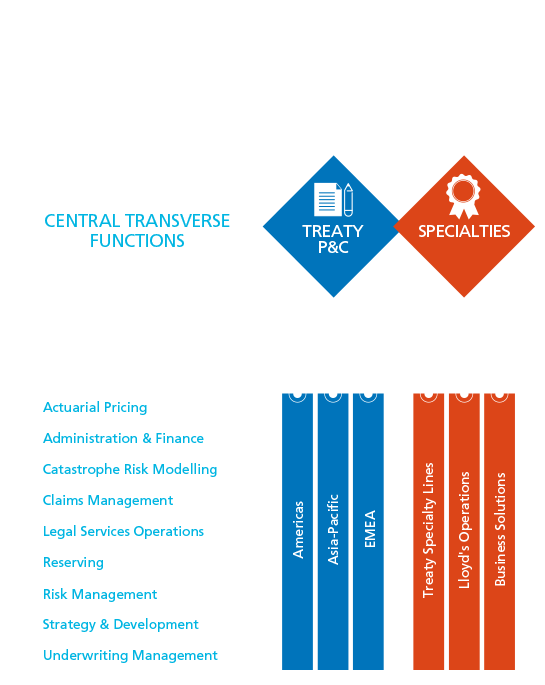

THE STRATEGY OF THE P&C DIVISION

FIVE STRATEGIC PILLARS

The current “Vision in Action” plan, built on continuity and consistency, focuses on five strategic pillars for the P&C division:

- Treaty reinsurance is the core business.

- The core is complemented with compatible insurance risk: no competing retail platform.

- Using “owned” capital and underwriting produces better returns: SCOR does not rely on the capital of others to underwrite risks.

- Four critical markets U.S. reinsurance - International reinsurance & specialties - Large corporate insurance - Broad distribution

- Platforms, people and systems should be highly integrated: SCOR has an integrated business model that combines a worldwide network of experts, enabling proximity to clients, with transversal functions that provide strong technical drive, supervision and governance, supported by a sophisticated and consistently developed global IT infrastructure.

TECHNOLOGICAL INNOVATION

SCOR’s underwriters have access to a number of sophisticated tools. Recently major improvements have been made to the following:

- “Cat platform”, which enables the Group to monitor Cat exposures in real time and therefore to optimize the portfolio and provide timely responses to market opportunities.

- “Forewriter”, the underwriting platform for large corporate and industrial risks enabling real time exposures, accumulation, pricing, contracts and portfolio management.

These tools provide granular and high-quality data, accurate handling of complex programs, simultaneous multiple and blended model views, and the factoring-in of retrocession, thereby constituting a strategic competitive advantage.

LLOYD’S

OPERATIONS

SCOR P&C provides capital to several Lloyd’s syndicates.

The Group also manages its own fully aligned Lloyd’s syndicate: The Channel Syndicate. The Channel Syndicate brings clients the SCOR Group’s expertise, combined with the benefits of the Lloyd’s market. The Channel Syndicate’s underwriting teams offer a full suite of insurance products: from core lines of business such as international direct & facultative property, marine hull & cargo, general casualty, financial lines and accident & health, to specialist lines such as political & credit risks, environmental impairment liability, cyber risks, fine art & specie and terrorism.

To learn more about SCOR’s Channel Syndicate: www.channel2015.com