François de varenne

CEO OF SCOR GLOBAL Investments

"SCOR Global Investments delivered a strong financial contribution to the Group in 2017, with a return on invested assets reaching 3.5%. We continued to execute on the “Vision in Action” strategic plan and repositioned our portfolio in line with targets."

SCOR Global Investments

SCOR Global Investments is the asset management division of the SCOR Group. It is composed of two dedicated business units: (i) a Group Investment Office and (ii) an asset management company, SCOR Investment Partners, regulated by the French Autorité des Marchés Financiers ("AMF").

18.6

billion euros of invested assets

18.6

billion euros of invested assets

3.5%

Return on Invested Assets

3.5%

Return on Invested Assets

4.6

Years: Duration of the fixed income portfolio

4.6

Years: Duration of the fixed income portfolioas of Q4 2017

5.4

billion euros of expected financial cash flow over the next 24 months as of Q4 2017

5.4

billion euros of expected financial cash flow over the next 24 months as of Q4 2017

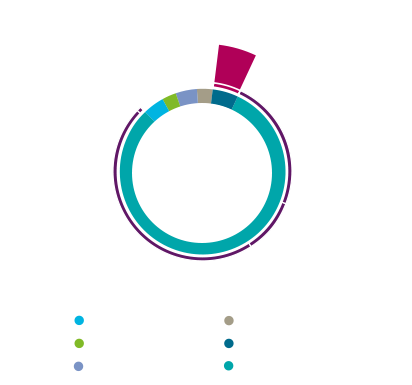

TOTAL INVESTED ASSETS:

EUR 18.6 BILLION AT 31/12/2017

DISTRIBUTION OF SCOR'S INVESTMENT

PORTFOLIO BY CURRENCY

The Group Investment Office

The Group Investment Office is in charge of the interaction between the SCOR Group and its asset managers. In accordance with the Group’s risk appetite, it sets and monitors investment constraints. It is also in charge of regulatory reporting and data quality, and of the Group's ESG investment policy.

SCOR Investment Partners

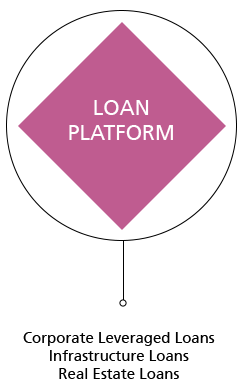

Leveraging the expertise initially developed for the management of SCOR’s own investment portfolio, since 2012 SCOR Investment Partners has opened innovative investment strategies to institutional investors in asset classes with high barriers to entry. The product offering external investors is structured around the following areas:

Recent developments

The division has been proactive over the last few years in terms of incorporating ESG criteria into its strategy. As an asset owner, SCOR, through the Group Investment Office, has developed a holistic and integrated risk management framework for managing climate risks. Over the course of its strategic plan, the Group has committed to financing the energy transition to a low carbon economy and to promoting life and knowledge sciences. It applies ESG criteria to its investment decisions consistently and pragmatically, and seeks a level of controlled risk that is compatible with the specificities of its activity and its profitability targets.

SCOR Investment Partners has signed the United Nations Principles for Responsible Investment (PRI) and developed a wide range of products addressing ESG challenges. These products serve the Group’s strategy as well as external third-party interests. In particular, SCOR Investment Partners has developed impact strategies which focus on protection against natural catastrophes, on financing the energy transition to a low carbon economy and on excellence in terms of the energy efficiency of buildings.

Impact investing strategies

Insurance-Linked Securities (ILS)

Financial products such as Insurance-Linked Securities offer protection against natural disasters and help to fund prompt reconstruction after such events. SCOR’s positioning on the ILS market is clearly focused on natural catastrophes, with a blended approach of catastrophe bonds and private transactions. As well as supporting reconstruction following natural disasters, this strategy has undeniable diversification benefits for the global portfolio thanks to decorrelation from traditional financial markets.

Real Estate debt and equity

The Real Estate debt and equity markets offer extensive opportunities to actively finance energy efficiency in the building sector. In 2005, the Real Estate team took note of the increasing obsolescence of office buildings and the importance of incorporating high environmental standards into its strategy.

Consequently, the Group began renovating and restructuring assets in its portfolio. Since 2007, the Real Estate investment strategy has been driven by a more proactive approach, consisting of buying buildings with a view to renovation and value creation. In addition, a range of Real Estate Loan funds finance energy-efficient building projects. This “green value” positioning has become the hallmark of the Group in Real Estate.

Infrastructure debt

Financing infrastructure projects offers a vast and diversified playing field for investors wishing to participate in the energy transition. Since 2013, the Infrastructure team has been active in traditional market segments (e.g. transport and social infrastructure) and in more innovative segments such as telecommunications and renewable energy. As a result, the Group was the first institutional investor to finance the construction of an offshore wind farm in the Netherlands in 2014.

Significant assets have always been allocated to Renewable Energy. The Energy and Ecological Transition for Climate (EETC) certification, awarded to the SCOR Infrastructure Loans III fund on January 17, 2018, underscores the Group’s long-term commitment to reducing the causes and impacts of climate change.