Vicky

Gardner

Head of Life Data Analytics Solutions

13 décembre 2024

In this article, which first appeared online in The Actuary Magazine on 29th October, Vicky Gardner, Head of Data Analytics Solutions considers the impact of Generative AI on life and health underwriting.

Over the past few decades, the life and health insurance industry has made significant progress in automating the underwriting process. Today, many consumers around the world can obtain an insurance policy almost as soon as they complete a digital application form. Underwriting rules engines can automate the underwriting decision using application form answers and, in some markets, using structured real-time third-party data, such as prescription drugs history.

However, there are still some consumers for whom additional unstructured data is needed to make appropriate underwriting decisions, because they have complex medical conditions, or they request a large insured amount. The data needed here often requires manual review by an underwriter, resulting in significant operational costs.

Generative Artificial Intelligence (GenAI) is a type of AI that can generate new content, such as text, images or videos. One example of where it can be powerful is in interpreting unstructured documents, which have traditionally been difficult for machines to process. The big technology companies have developed large language models (LLMs) to achieve effective natural language processing and have made these widely available for use by other entities.

The swift advancement of GenAI brings many opportunities to the insurance industry. This article highlights the opportunities GenAI brings in improving the efficiency of UK protection insurers’ underwriting process, bringing significant operational savings with no negative impact on the risk assessment.

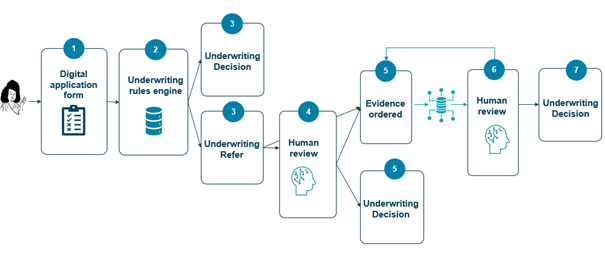

Figure 1 shows the underwriting process for protection products in the UK.

Figure 1: Underwriting flow for protection products in the UK

When a consumer wants to buy a protection product:

Medical records are one of the more complex types of additional evidence and can vary considerably in length, with some having hundreds of pages. The average time an underwriter spends per medical record will vary by insurer but can exceed an hour. Reducing the time spent per case by underwriters can have significant operational cost savings.

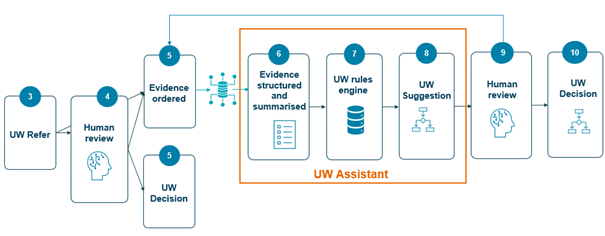

How can AI improve this process? Figure 2 shows a proposed underwriting process, where an AI tool assists in the latter stages.

Figure 2: Proposed underwriting flow for protection products in the UK

There are two main benefits of using an AI underwriting assistant: Firstly, underwriters can focus more on high-value tasks by reviewing the findings and refining the underwriting decisions, instead of having to read through reports in detail. Secondly, an AI underwriting assistant tool should help reduce human error and improve consistency. The tool itself may create errors, but the manual review of cases will mitigate this risk.

The business case for using an AI underwriting assistant is formed around the operational savings that can be made without having a negative impact on the risk assessment.

An AI underwriting assistant tool can make use of one of the commercially available large language models (LLMs) to generate summaries of medical evidence. We must adapt the models to make them work for the insurance industry and standardise output to integrate with underwriting rules engines.

We need to ask the right questions of the model by creating well-designed prompts that extract the information we need for a particular applicant. We need a tool that can summarise medical conditions, test results or measurements, lifestyle factors such as smoking, symptoms and medications. Even extractions that may seem simple at first can present challenges. For example, Body Mass Index (BMI) is easy to calculate but decisions need to be taken on what to show in a summary to ensure it is sufficient for underwriting purposes. For example, do we return just the latest value, or look at averages or trends? How do we detect potential errors in the medical record itself? If multiple data sources have different readings, which one do we place our trust in?

Many health conditions have a range of possible underwriting decisions. Therefore, we need underwriters’ help in writing and testing prompts that extract all the relevant information to form an accurate view on the severity of the condition.

Data protection is essential, particularly when dealing with sensitive medical information. Factors such as the models’ access to the internet, usage of external documents, data retention limits, data use in developing and testing, and potential use of prohibited data all need to undergo careful legal review.

We need to test how well the models perform, so we know how carefully underwriters need to check the outputs for each applicant. However, this requires attention as GenAI may not always act in a deterministic way. If we run the same applicant through the model twice, both times using the same medical reports and the same prompts, we may get different responses.

We need to standardise our prompts and testing with a large and representative set of documents. Testing may be insufficient in some areas, particularly where data is sparse. This needs highlighting to underwriters so they can increase their review of these sections.

We also need to monitor the time taken on underwriting cases. High accuracy scores by an AI underwriting assistant tool are meaningless if they do not translate to a reduction in underwriting time. We should always design our testing metrics to reflect our business case i.e. are we making operational savings without negatively impacting the risk assessment?

One significant risk with using GenAI is hallucinations, where the model returns something that sounds plausible but is wrong, such as telling us an applicant has a medical condition that they do not have. We don’t want a tool that enables underwriting decisions that are either too harsh or lenient; an error in either direction has a significant negative impact. This is why we still need underwriters to review what the model proposes.

This article is focused on the underwriting process. Such a tool could also be used in other areas of the customer value chain, such as post-issue review of underwriting decisions or claims assessment. The risks of a tool and the required safeguards will be different for each use case.

There is a trend across industries and the public sector towards digitalisation and structuring data in a way that’s easier for machines to assess. In the future, this may enable a move back to a rules-based approach and remove some of the uncertainties related to GenAI, at least for some types of medical evidence.

In the meantime, we will integrate GenAI into our business where appropriate, while mitigating the risks it presents when used to underwrite consumers. An important part of this is the manual review of every case and regular testing of the tool.

In conclusion, GenAI holds great potential for the insurance industry. Nevertheless, we need to leverage our human expertise to ensure we use it in a safe way that delivers real, measurable business value without risking customer detriment.

CONTACT

OUR EXPERT

Vicky

Gardner

Head of Life Data Analytics Solutions