-

Looking Forward

SCOR's 2023 Activity Report

-

Letter to shareholders

A message from CEO Thierry Léger & Chairman of the Board Fabrice Brégier

As we reflect on the landscape of the reinsurance industry in 2023, it’s evident that the persistent challenges and evolving dynamics have shaped a complex environment. Against this backdrop is SCOR’s historic full year net income of EUR 812 million, which speaks to the value of our business, the commitment and expertise of our employees, and the ongoing relevance of our Raison d’Être.

The trajectory of climate change continues to exert substantial pressure on our industry – and, indeed, our world – manifesting in the increased frequency and severity of natural perils. Notably, 2023 marked the fourth consecutive year where insured natural perils surpassed USD 100 billion globally, underscoring a concerning trend that demands our sustained attention and collective proactive measures.

Moreover, the emergence of systemic risks looms large, propelled by the interconnected nature of modern societies. Events such as pandemics and cyber-attacks exemplify the potential for localized risks to escalate into global crises, highlighting the need for robust resilience frameworks.

These and other emerging and evolving risks continue to reshape the face of our industry, underlining the need for innovative and adaptable solutions for prevention, protection, and resilience.

Alongside these trends, the digital transformation and the ever-quickening pace of new technologies are ushering in a new global dynamic – one to which our industry is not immune – and creating a push and pull of new challenges and opportunities. Not only does this transformation bring with it a slew of new risks, it also represents an incredible chance to improve efficiency, adapt how we approach questions of risk, and better meet our clients’ needs.

And, indeed, SCOR is transforming to meet these changing needs and anticipate the needs of tomorrow with the launch of SCOR’s eighth strategic plan, Forward 2026, in September 2023. This strategic plan marks a turning point for the Group as we look to create value and become the reinsurer of tomorrow. Concretely, this means future-proofing our business: having a clear vision of the risks of tomorrow and proactively developing the innovative solutions needed to address them.

Forward 2026 outlines strategic goals for all of SCOR’s businesses – P&C, L&H, and Investments – and serves as a roadmap for the coming years. In 2024, we will ensure our clients remain at the heart of our business by first streamlining our internal organisation to bring our experts closer to our clients and faciliate agile decision-making.

-

As SCOR navigates the needs of an evolving industry – in a changing world – our commitment to our Raison d’Etre does not waver. We have always been and will continue to be dedicated to combining the Art and Science of Risk to protect societies.

We are convinced that as societies grapple with escalating and evolving risks, the role of our industry is more essential than ever. (Re)insurance serves as a crucial financial safety net, enabling societies to navigate large-scale losses and ensuring stability and resilience for individuals amidst uncertainty. SCOR recorded a contribution of over 13.8 billion euros toward covering claims payments throughout 2023. But beyond this, we also have a responsibility to push for preventative measures that can reduce the impact of risks or keep them from being realized in the first place.

Consider, for example, the risk of cyberattacks. Cyber risks are surging due to society’s reliance on digital technologies yet as much as 90% of risks are under- or uninsured. The (re)insurance industry can go beyond risk-bearing: By promoting awareness, encouraging prevention, developing standards for incident and loss reporting, and enhancing risk modeling, we create a robust framework for addressing cyber risks.

Similarly, our industry has long since enabled recovery after a climate-related events such as floods or drought. But, here again, reinsurers can do more by pushing for preventative measures. Backed by the extensive data accumulated by risk experts, we can advise building codes, promote resilient engineering, and oppose unsustainable development, while also backing sustainable development, support new energy projects, and push for innovative initiatives that will limit CO2 emissions – all of which will help to prevent climate-related damage from occurring in the first place.

With Forward 2026, SCOR is committed to driving value creation, while shaping the reinsurer of tomorrow. This means leaning into the current hard market while recognizing future opportunities as we evolve our business around four key axes: asset and liability management (ALM), capital management, risk partnerships, and data and AI. We explore Forward 2026 and our ambitions for the coming years on page 26.

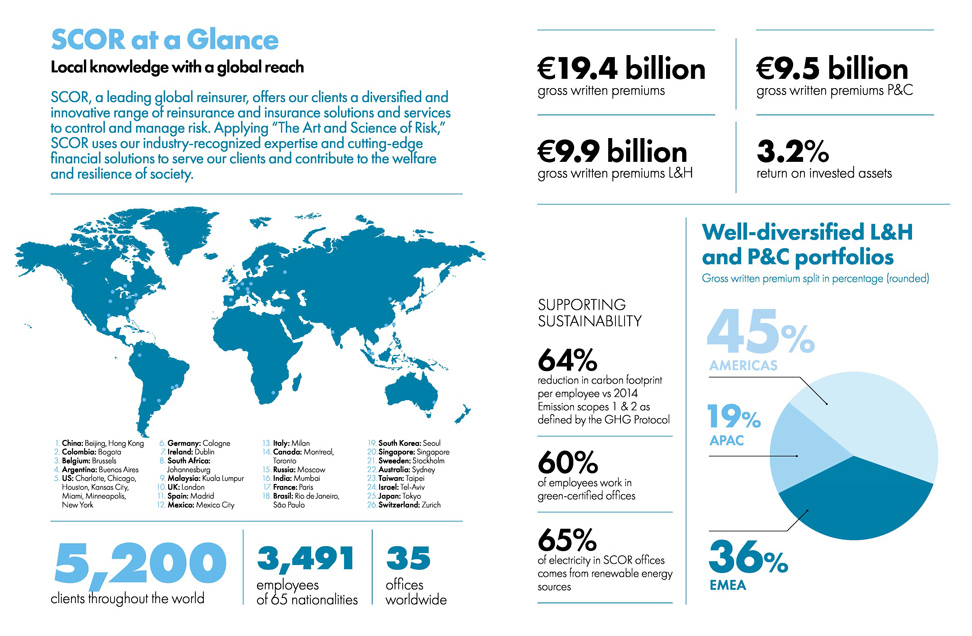

To do so, SCOR leverages its strong leadership team (page 18) and relies upon the full breadth of our employees’ expertise, spanning underwriting and claims management, actuarial science, risk modeling and management, data science, and more. Operating from 35 offices in 26 countries, we combine global shared knowledge with local insights to meet clients’ unique needs. Learn more about our people on page 48.

For every risk, there is an opportunity and it is our responsibility to ensure that the solutions we offer serve to minimize impact, enable recovery, and foster sustainable growth. In the hands of our (re)insurance experts, our vision is transformed into successful solutions that support the protection and resilience of societies.

Throughout this report, you will have the chance to explore the many facets of SCOR’s business, dive deeper into our strategy, and discover many examples of how our teams are having an impact.Our Property and Casualty (P&C) teams are working toward a more sustainable future by supporting the energy transition and the development of new, green infrastructure projects. In 2023, SCOR launched the New Energy Practice within SCOR Business Solutions (formerly Specialty Insurance) to meet the energy transition needs of existing and potential clients around the world. By creating further opportunities for collaboration among SCOR’s construction, property, liability, political and credit risk, and cyber insurance teams, we are developing bespoke, data-driven solutions to ensure the success of our clients’ projects. You can learn more about SCOR’s P&C business on page 60.

In Life and Health (L&H), changing demographics are driving many of the new needs appearing around the world. Aging populations threaten to place an increased strain on national healthcare systems. More than 12,000 people are turning 65 each day in the US alone and, in France, 20,000 people are expected to lose their autonomy each year. At the same time, as people live longer, they risk outliving their retirement and savings, putting individuals in precarious financial situations in the final years of their lives.

Across our protection and longevity lines, our teams are working to ensure that people are not just living longer, but also healthier so they can enjoy more of those years in good health – both physically and financially. Learn more on page 72.

Both our P&C and L&H teams are integrating new sources of data and cutting-edge technologies that offer new precision in risk modeling and automate repetitive tasks so our experts can dedicate more of their time to creating value for our clients (page 34).

Meanwhile, our Investments teams are committed to supporting the energy transition and sustainable development of societies, so that our shared future will be a bright one. Sustainability is an integral part of our investment strategy and ESG criteria are embedded in our investment decisions through carefully considered exclusions, targets, and trajectories (page 84).

The future will doubtless hold challenges – but it will also bring opportunities to shape a better tomorrow. As a top global reinsurer, we have the important job of inspiring resilience and empowering societies to overcome the risks they face. We would like to thank our clients, partners, and shareholders for their continued confidence in our business and our experts for their unwavering commitment to our vision and their dedication to the Art and Science of Risk.

Together, we are all moving in the same direction – forward.

-

A turning point.

2023 proved to be a defining moment in SCOR’s history, marked by the death of Dennis Kessler, who was at the company’s helm for two decades; the appointment of a new leadership team, who is confident in the Group’s future; and a new strategic plan that sets the course for the coming years.

At the same time, historic full year results prove that the Group is moving in the right direct, building momentum while staying true to the Art and Science of Risk. Backed by the expertise of our people and alongside our clients and partners, SCOR is moving forward as we prepare to become the reinsurer of tomorrow with a strong vision and concrete solutions for some of the biggest challenges facing societies today.

Happy reading.

Building financial momentum

An interview with François de Varenne

Coming out of a year where elevated natural catastrophes, inflation rates, and other market conditions led to a pinch in the reinsurance industry, 2023 has marked a significant turning point for the Group. With decisive action to right-size exposures leading to improved profitability and the publication of a new strategic plan, SCOR delivered a record net income and overall positive results in 2023.

-

SCOR reported very positive full year results in 2023, including a record net income of EUR 812 million. What results stand out to you?

In the first year of reporting under IFRS 17, SCOR achieved our overall profitability and solvency objectives for the full year of 2023. This translated into a high return on equity (ROE) of 18.1%, well above our target for the year.

We are very pleased with this excellent performance, which was achieved while maintaining strong discipline and increasing our confidence level in our reserves.

These strong results come from all SCOR’s business activities — P&C, L&H, and investments:

- We ended 2023 with a very strong P&C combined ratio, supported by a low Nat Cat Ratio in Q4.

- On the L&H side, we continue to grow profitably.

- And we are particularly satisfied with our regular income yield on the investment front, reaching 3.7% over the fourth quarter 2023.

We are also improving our liquidity position overall with EUR 10.2 billion financial cash flows expected within the next 24 months. And our Solvency Ratio remains in the upper part of the Optimal Range at 209%.

Can you highlight any specific strategic decisions that contributed to SCOR’s success in 2023?

Clearly, the right-sizing of the P&C NatCat portfolio bore fruit, as did the strong discipline we applied on pricing and reserving. The NatCat ratio stood at 1.5% in Q4 2023 and 7.3% for the full year, well below our annual NatCat budget of 10%. It is particularly important that we are not over-exposed to climate-related events, considering the increasing frequency and severity of these events in the last decade and, as such, SCOR will maintain a prudent approach to these exposures moving forward.

What are your key priorities for 2024?

For 2024, all assumptions and targets of the Forward 2026 plan remain unchanged. We will remain focused on the delivery of the Forward 2026 plan throughout 2024.

We have also started implementing some major projects for Finance in 2024, including the Asset Liability Management (ALM) project and the Capital Allocation Project, which speak to the cross-functional and collaborative way of working at SCOR, as these projects will involve the contribution from the Data and Data Platform Office (DDPO) team.

Can you elaborate on the importance of data for SCOR and the CFO domain in particular?

Data and Artificial Intelligence have been identified as one of the long-term differentiators to prepare SCOR to be the reinsurer of tomorrow.

And data itself is at the heart of the reinsurance business. Without data, we cannot price, underwrite, or reserve. At SCOR, we have access to various sources of data. Through the creation of the DDPO and the launch of our new data platform using Foundry from Palantir, we aim to build a single source of truth to give everyone at SCOR easy access to qualitative, secured data that is compliant by design.

This single source of truth will be linked to SCOR’s existing information systems and will respect our high standards in terms of security, availability, and governance.

-

Transforming and simplifying

An interview with Claudia Dill

SCOR has embarked on a transformation journey to become the reinsurer of tomorrow, a key ambition of the Group’s new strategic plan. SCOR's Transformation Journey is structured around six pillars, which are designed to generate tangible value for the company and improve profitability:

- Build on People and Culture

- Leverage New Ways of Working

- Reach Business Excellence

- Drive Operational Excellence

- Promote Technology and Data

- Improve Financial Performance

With multiple initiatives under each pillar, the Transformation program has already led to improvements in terms of efficiency, automation, and digitalization.

-

Why is this Transformation Journey important for SCOR right now?

The world continues to undergo fundamental changes. Geopolitical uncertainties, economic volatility, cyber threats, and climate change are generating new risks or intensifying existing ones, which is creating unprecedented challenges for societies. The insurance industry itself is also undergoing significant changes, mirroring shifts in customer preferences and protection needs. In such a dynamic environment, with significant technological advances from outside the industry setting the benchmark, it is important to build an organization that can transform these challenges into opportunities and adapt to changing client needs.

How does the Transformation Journey align with the broader goals and objectives outlined in Forward 2026?

One of the Forward 2026 ambitions is to transform SCOR’s operating model to be future-ready. To that end, SCOR is driving efficiency and accelerating innovation through its Transformation program. Within this program, several initiatives are leveraging digitalization and automation to simplify processes and the way we work. The Transformation Journey is already beginning to deliver tangible value and will continue to support the implementation of the strategic plan in the coming years. Also, as we shift to a more data-driven organization, transformation will be necessary to ensure that our experts’ roles and responsibilities, IT infrastructure, and application landscape adapt to the new data-centric model.

How do you define and measure success in terms of transformation and simplification initiatives?

Before being put into action, we assess each initiative against the tangible value it delivers. This assessment is not limited to the monetary value an initiative is expected to deliver, but also considers its alignment with the program’s six levers – or pillars – of change. A value realization assessment group steers the assessment process by reviewing the business case and any operational risk before execution. During the execution phase, the delivery of a given initiative is monitored against its initial target, with mitigating actions put in place when deviations are anticipated. Lessons learned from completed initiatives are taken into account when assessing the value realization of subsequent ones.

How are new technologies being considered within your transformation and simplification efforts?

Several of our transformational initiatives aim to increase operational efficiency and effectiveness through process simplification. To achieve this, we are focusing our efforts on process digitalization and automation, both within the initiatives themselves and via our broader process re-engineering approach, which systematically considers automation opportunities and leverages new tools and technologies, including AI and Machine Learning. As a global reinsurer with leading in-house expertise in data science, machine learning, analytics, and technology, SCOR is committed to staying at the forefront of the industry’s data processing revolution.

Considering the importance of cultural alignment in successful transformations, how is the company addressing cultural shifts to ensure they are consistent with the ambitions of the new strategic plan?

Transformation typically requires a well-coordinated approach among people, technology, and processes to be successful. As we aim to move towards a data-driven organization, innovation and agility will become critical drivers of change. Against this backdrop, nurturing a culture that fosters accountability, trust, collaboration, and learning from mistakes becomes even more important. This is what we are doing with the SCOR Way values (page 52). As of 2024, these values will be an integral part of each employee’s annual targets to ensure full alignment with our Forward 2026 ambitions.

What was accomplished in 2023 and what do you expect for 2024?

Since its inception, SCOR's Transformation program has delivered rapid and substantial financial improvements, mainly driven by tactical optimizations and relatively easy improvements implemented early in the process. In 2024, there will be a strong focus on process re-engineering and the modernization of SCOR’s IT landscape, to make our operations future-ready while ensuring that we remain at the forefront of operational excellence and business resilience.

-

Supporting a sustainable future through investments and underwriting

Q&A with Yun Wai-Song & Pauline des Vallieres

As we focus our attention on becoming the reinsurer of tomorrow, sustainability will be a key consideration for SCOR, both in our business solutions and our investments.

From a strictly business perspective, a focus on sustainability is more than justified by the potential for risk mitigation, improved long-term profitability and viability of the Group, and the need to adhere to regulations.

But, at SCOR, our motivation far outpaces these factors. We believe that we have a responsibility to have a positive impact through our business and that when sustainability is prioritized, we all benefit. We want to leverage the full force of our business to contribute a cleaner, greener, more resilient future for our planet and people around the world.

While at first glance that might seem like a big ask from a reinsurance company, we don’t think so. Our P&C business is well-positioned to contribute to preventive measures and respond to many climate change-driven natural catastrophe risks and support promising technological and energy advancements like the construction of state-of-the-art wind turbines. L&H helps build social and financial resilience while encouraging healthier lifestyles and wellbeing to improve individuals’ quality of life and reduce strain on national healthcare systems. Meanwhile, investing in green infrastructure and technologies helps to assure the transition to a low-carbon future for all.

-

What sustainability/ESG milestones did SCOR hit in 2023?

Yun Wai Song: In our role as an asset owner, we deepened our engagement with investees on climate and nature in 2023. On the sustainable investment front, SCOR considers that an open dialogue with companies is one of the most important levers to drive real economy transition because it gives us the opportunity to share our expertise and work collaboratively to bring about meaningful change. We continued to leverage initiatives that SCOR has participated in in the past, while also joining new collaborative engagement initiatives to extend our reach.

In May 2023, SCOR joined the Institutional Investors Group on Climate Change’s (IIGCC) Net Zero Engagement Initiative (NZEI) to engage on topics around decarbonization with investees that are not in the scope of the Climate Action 100+ initiative.

SCOR is also concerned about the pressures on biodiversity and the declining health of ecosystems and in February 2023 we had the opportunity to join the Investor Initiative on Hazardous Chemicals (IIHC) in our capacity as an asset owner. Our teams were then able to engage with investees to encourage them to reduce the production and use of hazardous chemicals that can have an adverse effect on ecosystems and biodiversity. In September 2023, SCOR also joined Nature Action 100 (NA100), which is a global investor engagement initiative focused on driving greater corporate ambition and action to reverse nature and biodiversity loss.

SCOR further believes that a consistent and ambitious regulation framework is necessary to foster the transition to a more sustainable economy, so our teams also performed some policy advocacy actions. That’s why, in March 2023, SCOR joined the Business Coalition for a Global Plastics Treaty which brings together businesses and financial institutions committed to supporting the development of an ambitious, effective, and legally binding UN treaty to end plastic pollution.

Finally, we turned our attention to concerns of deforestation. In March, SCOR put in place in a first version of our deforestation policy for our investments, which drives collaborative engagement to achieve specific targets. SCOR plans to expand this policy in the coming years

Pauline des Vallières: In 2023, on the insurance and reinsurance side, SCOR continued and accelerated its ESG journey with the launching of the new strategic plan Forward 2026. While continuing to follow what had already been put in place, we reinforced the reduction of our environmental impact by, for example, not providing any new (or increase its commitments on existing) standalone direct insurance and facultative reinsurance coverage in respect of oil sands operations (both extraction and upgraders).

Furthermore, to strengthen our support to the transition, it has been decided to multiply insurance and facultative reinsurance coverage for low carbon energy by 3.5x by 2030. This target complements the ambition previously announced at the 2022 General Assembly of doubling such coverage by 2025.

Finally, our ESG ambition couldn’t be achieved without ESG engagement. Our target is to engage with clients representing at least 30% of SCOR Specialty Insurance Single Risk premium regarding their ESG commitments and their transition strategy, over the course of the new strategic plan.These targets are based on SCOR’s double-materiality assessment and exemplify the theory of change SCOR is following to reach net zero emissions by 2050 by reducing negative impacts of our business, supporting the transition, and engaging with employees, stakeholders, and clients.

How is sustainability prioritized in Forward 2026?

P.V.: The pace of our sustainability initiatives is accelerating, while always being well-founded and measured. The new strategic plan underscores the importance of ESG by developing essential IT tools, as well as increasing our employees' commitment1 to these issues, for example with the deployment of the Fresque du Climat (Climate Fresk) workshop that helps contextualise the issues leading to and stemming from climate change and encourages employees to reflect on how their work can alleviate some of these factors. Forward 2026 ESG ambition will further help us to contribute to new European regulations like EU Taxonomy and CSRD.

On the (re)insurance side, we are lucky to have our investment colleagues because they have tested a lot of approaches and projects before us. Thanks to their experience and learnings, we can approach our projects even more efficiently under Forward 2026.

Y.W-S.: In addition to that, under Forward 2026, SCOR will continue to work towards net-zero emissions by 2050 and reversing biodiversity loss by 2030 for its investments, which is expected to contribute to the transition of the real economy.

What is one project that represents the potential for SCOR’s business to address sustainability concerns?

P.V.: : I'd say that the fact that there isn't just one project underlines the potential for SCOR’s business to address sustainability concerns. Sustainability is not the icing on the cake. More and more ESG projects are springing up in various SCOR departments, from product development, to underwriting guidelines, to claims.

This year our teams preformed an in-depth assessment of 29 P&C initiatives rooted in sustainability and one we can share is SCOR’s coverage of Polar POD. This zero emissions vessel is designed for scientific expeditions to monitor impacts of climate change ranging from measuring atmosphere-ocean exchanges to taking inventory of marine biodiversity and assessing levels of pollution. Without SCOR’s backing, this and other impactful projects wouldn’t be able to receive financial backing needed to launch.

Can you share examples of ESG factors integrated into underwriting and investment decision-making processes?

P.V.: Integrating ESG into the underwriting process enables us to understand the risk and the customer in a different and complementary way to what underwriters have already put in place. More and more business lines are developing their own assessment grids to evaluate their customers' maturity in this area and to provide better support. ESG ratings, controversies, and GHG emissions are factors that are more and more integrated into underwriting decisions.

Y.W-S.: On the investment side, one example is how SCOR refined investment criteria for the fossil energies sector. This was a decision we made several years ago and since then any companies not fulfilling these criteria have been excluded from the investment universe.

How does SCOR ensure a holistic approach to sustainability across all operations?

P.V.: Collaboration is central to integrating ESG! It would be a big mistake to detach ESG from the business, which is why it's so important to work together across the board. This holistic approach is the way to embed ESG into the business.

Y.W-S.: Exactly. For example, on the investment side, the Sustainability team collaborates with the risk management department on topics like climate stress testing and Solvency 2 climate related topics to ensure a common understanding and approach to the challenges at hand.

How do you engage with clients and stakeholders to promote sustainable practices and communicate the importance of ESG considerations in reinsurance?

P.V.: We discuss ESG more and more with our clients. It is important for us to understand where they stand and how we can support them in their transition.

To properly engage, we also need to assess their ESG maturity and we’re able to do so thanks to SCOR underwriters’ knowledge of client portfolios and market, external, and internal data. It is also crucial to explain our targets and our net zero ambition by 2050.

To engage with clients and stakeholders we need first to engage with SCOR collaborators with trainings and tools.

What role does innovation play in advancing sustainable underwriting and investment practices within the industry?

Y.W-S.: In the sustainable investment field, innovation is key to creating measurement tools in order to monitor the potential risks and impacts of investments more closely – but also to shape investment policies that address sustainability issues.

P.V.: (Re)insurance plays a key role by providing financial protection that allows innovation to develop in and beyond the industry ecosystem.

Consider net zero ambitions. Net zero can only be achieved by combining technological solutions for hard-to-abate sectors and alternative technical solutions to transition the global economy. For instance, even if we disregard thermal coal for a moment, coal will remain a critical resource as it is needed to produce cement. While thermal coal is not part of a net zero economy and should be replaced by other low carbon energies, there remains a need to find technologies to remove GHG emissions from the atmosphere when producing non-thermal coal.

And as we transition, this need leads to a lot of new opportunities: investments in new technologies, development of green business, and other opportunities are already arising. Green technologies, batteries, and grids are prime new investment fields stemming from the need to transition to a low carbon economy. In this respect, the EU taxonomy is a good guide when determining which activities are most needed and should be financed to adapt our economies to tackle climate change.

Of course, we can’t speak about innovation without saying a few words about competencies. In fact, investing in the transition to a low carbon economy is not enough and none of this business could be sustainable without the support of the (re)insurance industry. This means a tremendous amount of work to develop new competencies linked to new risks and to prepare for the risks of tomorrow. SCOR has already been preparing for this transformation for years and the work is ongoing as new technologies become more mature. We’re optimistic. Further scaling up will be possible once investments and insurance capacities have been adjusted and markets become more efficient.

For more about our Sustainability strategy, click here.

Footnotes:

1 Exceptions may be made for direct insurance and facultative reinsurance coverage for insureds with a verified strategy that is aligned with a credible Net-zero by 2050 transition plan and will be based on the Science Based Targets initiative (SBTi), once available, or comparable third-party issued science-based target setting guidance for the upstream oil and gas sector

-

Tech-driven transformation: SCOR is harnessing the potential of Tech, Data, and AI

Harnessing the tools of tomorrow with Bastien Albertus & Thibault Antoine

The (re)insurance industry is built on data. If leveraged effectively, it can help us to understand risks and propose solutions that have a real impact for our clients, their policyholders, and societies. When paired with new and emerging technologies designed to enhance risk assessment, operational efficiency and customer experience, we believe data has the potential to revolutionize the reinsurance ecosystem.

SCOR’s strategic plan identifies five key pillars to transition to a more data-centric operating model, which will enable the Group to further accelerate value creation:

- A sole and unique data platform, to collect and process data across the Group

- A rigorous governance of data based on clear ownership

- An agile scaling approach to promote collaboration and continuous improvement

- Effective change management to cascade best practices across the business

- Enhanced AI capabilities to offer additional value to clients

Together, these pillars will support and improve core business capabilities and foster the development of new models, products, and services.

By embedding tech and data into our day-to-day business, we’re not just adapting to the digital age – we’re shaping it.

-

Why is it important for SCOR to embrace tech, data, and AI? What risks and opportunities come with these new technologies?

Bastien Albertus: Data is at the core of SCOR. In this sense, we are a data company. Data is our raw material and our value proposition. It allows our employees to model and assess risk. Technology, in a broad sense, and now AI, have an increasingly important role to play in our business and operations.

We have obvious opportunities to simplify, streamline, secure, and accelerate our operations, as well as to better serve our clients. At the same time, the pace of transformation has never been as fast as in the digital era, so we need to quickly adapt and balance protection, security, compliance, and ethics while learning from our own experiences.Thibault Antoine: In a B2B2C business, our clients are looking for us to be ever smarter and quicker, which can only be achieved by embracing tech, data, and AI and applying these to our significant business expertise.

The AI rollout can’t be done blindly. Our AI solutions are impacting the way we select risk, which could ultimately impact a family or a company – real people. We have a responsibility to do things correctly and not rush in. After several years of research and development, we can now say that fairness, ethics, and transparency are at the core of our AI approach. SCOR, of course, will ensure we remain compliant with the incoming AI regulations springing up around the world (EU AI Act, US Colorado regulation, etc.).How does SCOR keep pace with the constantly evolving tech and data landscape?

B.A.: We are at the forefront of tech and data changes. Data being at the core of our business, we are embracing new technologies as part of our current technology stack and philosophy.

T.A.: We are not aiming to test everything; the pace at which these technologies are developing is just too quick to do so. But by combining our business and tech expertise, we are able to quickly understand what evolutions can bring value to SCOR and our clients. After careful consideration and testing, those new trends are then integrated smoothly into our digital products thanks to our agile development principles, which accelerate the go-to-market process for interesting new tech trends.

B.A.: We are also connecting with the tech market through events ranging from committees and trainings to ensure a smooth and ethical application, to hackathons and other employee-led initiatives that encourage a collaborative, creative, and innovative approach to working with tech and data.

The future is here. How is SCOR already harnessing AI technologies?

B.A.: SCOR has designed a framework for AI, shaping our approach around Standard Secured AI and GenAI tools created by various partners, which we run in our secure environment. We are embedding AI into our operations, including verifying wording changes for underwriting, capturing data capture from emails, summarizing medical documents, and more.

T.A.: SCOR has been using the technology behind ChatGPT since 2019 and, as Bastien mentioned, we already have multiple AI solutions in production to improve our core operations. Our internal GenAI solution, which will go live in mid-2024, will further improve our efficiency in areas like underwriting and claims by up to 50%. But with all this buzz around GenAI, we should not forget our other AI solutions. SCOR is at the forefront of the UW and Claims revolution; we have a lot of AI risk algorithms supporting the underwriting of our L&H business and the adjudication of claims. These are key elements of our reinsurance value proposition and a must for our clients.

Another example of how AI is being leveraged at SCOR is an AI-driven data-capturing solution that was developed by our data science team in 2021. This solution employs Optical Character Recognition (OCR), Natural Language Processing (NLP), and insurance knowledge, to enable more efficient electronic document reading. OCR extracts text from images, and NLP enhances it with human language insights, creating a dynamic tool that optimizes data capture for underwriting, treaty, and various customer journey touchpoints, resulting in 60% time savings on the data capture process.How will the DDPO improve SCOR’s approach to tech and data and facilitate the development of new solutions?

B.A.: The DDPO’s mission is to distribute data across SCOR entities, so all employees can easily access data and leverage technology built on qualitative and governed data assets.

While the DDPO team is enabling the goals outlined in our strategic plan, Forward 2026, a lot of the team effort is focused on our culture at SCOR. To ensure our people get the most out of our data, we need to first connect the right stakeholders to the right data as we continue to improve our data protection framework.How will the DDPO and Data Science teams collaborate to make data a driver of success at SCOR?

B.A.: Data scientists are natural clients of the DDPO.

Both teams need to work together to accelerate and facilitate the data science process. This requires a collaborative approach to align on reliable definitions, ensuring a rich context, and proper data-as-a-product processes such as standard distribution channels and versioning. This also goes for establishing infrastructure sandbox environments, computing power, and collecting structured/unstructured data.T.A.: Data scientists are leveraging business knowledge, data, and tech to create value for our business. The DDPO will empower our data scientists with better access to data, fostering the development of insights and algorithms that will lead to significant value creation moving forward.

What are your expectations for tech, data, and AI at SCOR in 2024?

B.A.: I expect strong collaboration with our business experts so we can improve our understanding of how tech and data can bring more value to our teams and reduce the time-to-market for new solutions.

The reinsurance business relies on the expertise of our underwriters, actuaries, claims managers, and all other employees. Making tech an accelerator, and data an opportunity, is a way for SCOR to shape the reinsurer of tomorrow, with more informed decisions and predictions, automated workflows, transparency, and traceability of our data assets.

I hope that 2024 will stay in people’s minds as a real step in the right direction, to make SCOR an even stronger leader in both P&C and L&H reinsurance.T.A.: 2024 will really mark the scaling of our AI strategy, with some significant planned rollouts that will impact both our core operations and our client digital solutions, augmenting the capabilities of each. It is good to see all the pieces of the puzzle – business, tech, data, and AI – coming together in 2024. SCOR is ready to make an impact!

-

Anticipating the unknown

An interview with Fabian Uffer

A strategic approach to risk modeling and management is essential for SCOR to effectively identify, measure, monitor, and mitigate the Group’s risks and develop solutions for the risks facing our clients and societies. SCOR strives to have a consistent and unified view of risk across all its operations, while recognizing that different lines of business may have unique risk characteristics that require specialized modeling and management techniques. SCOR’s approach to risk is evolving under Forward 2026 as we leverage new datasets combined with new technologies to refine the accuracy and efficiency of our operations.

-

Why is risk analysis and modeling so essential for SCOR?

Understanding different kinds of risk and trying to quantify their impact is at the heart of any (re)insurance company. While we can only profitably underwrite the risks that we understand, it’s often not possible to have all the answers to every “what if.” However, that is what we aim for by developing deep-dive analyses on different risk subjects – to try to uncover and understand the consequences of some of the unknowns more fully.

Modeling risk, including understanding the evolution of future trends, is also central in helping to adequately price the risks that we underwrite, monitor resulting accumulations, and stay within our predefined risk appetite limits. SCOR’s own internal model is essential for us to accurately calculate the Group’s capital requirement, tailored to its risk profile, which is crucial for capital allocation, and the management of regulatory requirements.

How is SCOR’s approach to risk evolving under Forward 2026?

Risk Management will become more data-driven during Forward 2026. For example, we should have more direct access to centralized sources of data on all aspects of the company, enabling us to perform our risk analyses in a more streamlined and efficient way. There will also be a focus on using technology to make processes more efficient, so that we can free up our team to work on more value-added tasks. Other areas that will be a focus for Risk Management during the new strategic plan include a more refined approach to capital allocation and asset-liability management.

Given the global nature of reinsurance, how does SCOR approach risk management in different geographic regions with diverse regulatory frameworks?

Local risk teams are present in each of the regions where SCOR operates. These teams ensure that we adapt to the local specificities and requirements of different regulators, while also being able to leverage risk management expertise at the Group level, for extra support and advice where this is needed.

How do you collaborate with other departments, such as Underwriting and Finance, to align risk management strategies with overall business objectives?

As part of the risk team’s daily activities, there is regular collaboration with various departments across SCOR. For example, Risk Management regularly interacts with the Underwriting department during business referrals, where business deals over certain thresholds have to be approved by Risk Management. Deep-dive risk analyses are also produced in consultation with Life and P&C to arrive at an accurate assessment concerning the impact of a certain risk subject on SCOR’s business. Coordination of work on emerging risks monitoring also requires close collaboration with the business teams. Risk teams also collaborate with the finance department, for example during the validation of SCOR’s reserves, and also to obtain operating results and metrics (e.g., historical or planned profitability of books of business) that may be used in regular reporting to executive management, or in specific exercises, such as in the definition of the Risk Appetite Framework.

What were the most pressing emerging risks in 2023 and what can we expect for 2024?

Geopolitical instability has been a prominent and tragic feature of 2023 and unfortunately this situation seems likely to deteriorate in 2024. Elsewhere, developments in artificial intelligence were high on the agenda in 2023. These innovations will further unfold as we move into 2024, alongside the constant backdrop of the developing risks associated with climate change and environmental risks.

For more about our Risk strategy, click here.

-

Preparing our people to create the reinsurer of tomorrow

An interview with Claire Le Gall-Robinson

At SCOR, we are committed to attracting, promoting, and retaining strong talents in the reinsurance industry. We strive to ensuring a work environment where our people can thrive and grow professionally, in a culture of trust and integrity, where inclusivity is the norm, wellbeing is prioritized, and employees find fulfilment. In 2023, we took several significant steps in each of these areas.

-

What were the significant milestones in HR for SCOR in 2023?

One of the biggest steps we took this year was the successful launch of The SCOR Way, which outlines our new corporate values and will help to foster collaboration, innovation, and employee wellbeing. The launch of our new strategic plan, Forward 2026, was also an important moment as reinforced our commitment to gender diversity, setting a target that 30% of top management should be women by 2025.

This target is reflective of the DEI initiatives coming from all levels of the Group: throughout the year employee-led initiatives celebrated key DEI moments like International Cultural Diversity Day, World Mental Health Day, and the International Day of Persons with Disabilities. The SCOR Inclusion Global Network (SIGN+) organized internal conferences focusing on a wide variety of DEI topics and employees participated in industry conferences and initiatives such as the DiveIn Festival, which explored the theme of “Unlocking Innovation: The Power of Inclusion.” As a testament to these efforts, SIGN+ was nominated for the Gender Inclusion Network of the Year prize at the Women in Insurance Awards.

As part of our commitment to the physical and mental wellbeing of our employees, a new version of the SCOR Good Life App was launched and we deployed ifeel, a new app dedicated to mental health, across most SCOR offices. We also signed the Parenthood Charter, under which SCOR promises to change the way parenthood is considered in the workplace and create a favorable environment for working parents by taking into account all forms of parenthood.

We also prioritized employee engagement through our regular Pulse surveys, which were designed to promote a culture of feedback, understand employees’ motivations and needs, and facilitate discussions within teams.

And lastly – but most certainly not the least of these accomplishments – we are proud of our employees’ remarkable community engagement in 2023. Driven by SCOR for Good initiatives, particularly our annual Engagement Month and our Sustainable Development Days, our teams donated more than 90K euros to various charitable causes and volunteered more than 4000 hours this year. Our employees’ commitment is unparalleled and I’m excited to see how these initiatives will continue to grow in 2024.

In an industry like reinsurance where specialized skills are crucial, how does HR ensure continuous learning and development opportunities for employees to stay ahead in their roles?

In an industry as dynamic and complex as reinsurance, ensuring that employees have opportunities for continuous learning is paramount for several reasons. Firstly, the reinsurance landscape is constantly evolving, with new risks, regulations, and market trends emerging regularly. To navigate these changes effectively, employees must stay abreast of industry developments and acquire new skills and knowledge. Secondly, specialized skills are crucial in the reinsurance sector, where professionals are often required to analyze complex data, assess risk exposure, and develop innovative solutions for clients.

By providing continuous learning and development opportunities, SCOR’s HR teams ensure that our employees have the necessary expertise to excel in their roles and adapt to evolving market demands. For example, SCOR University (page 54), our Learning & Development framework, offers learning paths, group learning, and certification programs that are designed to meet different business needs and strategic objectives.

We have found that, continuous learning also fosters employee engagement and satisfaction by demonstrating a commitment to their professional growth and development. This, in turn, enhances employee retention and contributes to a more skilled and motivated workforce.

With all this in mind, it is clear that continuous learning is not just a nice, optional perk but a strategic imperative for both individual and organizational success in reinsurance.

The (re)insurance industry is quickly evolving. What skillsets will SCOR be looking for in new hires as the Group adapts to meet these changing needs and take advantage of new technologies and ways of working?

As the (re)insurance industry evolves, SCOR is actively seeking individuals with diverse skill sets. While technical expertise remains crucial, we also value attributes such as adaptability, creativity, and a collaborative mindset.

Data science profiles in particular are becoming increasingly important for reinsurers like SCOR. With the proliferation of data sources and advancements in technology, the ability to analyze large datasets and derive actionable insights has become essential for risk assessment, pricing strategies, and decision-making processes. Data scientists play a crucial role in developing sophisticated models and algorithms to better understand and manage risk, ultimately enhancing the accuracy and efficiency of reinsurance operations.

With hybrid working becoming the new normal, how is SCOR adapting ways of working and office spaces to facilitate collaboration and efficiency?

SCOR is embracing hybrid working models to accommodate the changing needs of our workforce. We are implementing flexible office arrangements, including flex office spaces, to promote collaboration, innovation, and efficiency. These initiatives ensure that employees have the flexibility to work remotely while also providing opportunities for in-person collaboration when needed.

Several of our offices – including Singapore and Zurich – are already operating in a flex office structure and the learnings from these implementations help to guide the rollout in other offices.

Can you discuss any innovative approaches SCOR’s HR teams have taken to promote diversity, equity, and inclusion within the reinsurance sector and the impact these initiatives have had on SCOR?

At SCOR, we believe that by championing diversity, equity, and inclusion, we can create a workplace where every employee feels valued, respected, and empowered to contribute their best, ultimately driving innovation, collaboration, and business success.

Our strategic plan Forward 2026 strengthens our commitment to DEI by outlining targets to increase the representation of women among SCOR’s leadership teams, primarily through internal promotions, leadership programs, and clear succession planning. These efforts are complemented by external hires as needed, ensuring a diverse and inclusive leadership pipeline.

What are the key areas of focus for HR in 2024 and how do they align with the strategic objectives outlined in Forward 2026?

As SCOR’s business structure evolves to become a simpler and more effective organization, HR is strategically aligned with the Group’s overarching objectives. Reflecting our commitment to being the reinsurer of tomorrow, we seek to improve efficiency, bringing our experts and leaders closer to our clients. In this way, we will also drive empowerment and accountability, place additional importance on expertise and collaboration, and increase our ability to adapt and support profitable growth. Much of our HR teams’ attention will continue to focus on the seamless implementation of this evolution throughout the year. We will prioritize talent deployment, ensuring the right expertise is in place to drive success within each region while fostering collaboration and knowledge sharing across teams.

We will also continue our efforts in employee wellbeing, DEI, and engagement as we are convinced that employees who evolve in a workplace where everyone feels valued, respected, and empowered, perform at their best, in turn fostering innovation, collaboration, and business success.

-

The SCOR Way

An interview with Yves Goldschild

For an international company like SCOR, a unified company culture has the power to enhance alignment, engagement, and collaboration. At the same time, it helps to foster an open and understanding work environment where every employee is encouraged to achieve their full potential.

In 2023, the Group launched The SCOR Way to define our common culture. Serving both to build momentum that drives the Group forward and as a compass to guide our actions and choices, The SCOR Way is anchored by five core values, reflecting the input of more than 1,000 SCOR employees.

We care about clients, people, and societies. We perform with integrity, act with courage, encourage open minds, and thrive through collaboration.

-

What inspired the launch of The SCOR Way?

Over the last few years, there have been various initiatives on culture at the team, office, and Group levels, but these initiatives were often disconnected from one another and didn’t represent the voice of the company as a whole. With a new leadership team and new ambitions for the Group, we felt it was time for us to establish a unified and enduring company culture.

The launch of The SCOR Way was inspired by our commitment to fostering a collaborative culture that drives alignment, engagement, and innovation across our international company. Recognizing the importance of a unified culture in today’s interconnected global marketplace, we sought to define a set of core values that would serve as a compass to guide our actions and choices while also reflecting our strong Raison d’Être.

The SCOR Way not only builds momentum to propel the Group forward but also creates an open and understanding work environment where every employee is encouraged to reach their full potential.

How did you involve employees in the process of defining and shaping the new company culture?

We prioritized employee involvement from the very beginning of the process. Our employees were key in defining and shaping The SCOR Way to ensure that it truly reflected the collective ethos of our organization. Based on the results of the various focus groups and open forums that have worked on our identity over the past years, ten key values were identified on which employees were asked to vote and react. Over a thousand of our employees – representing nearly a third of our workforce – participated in the survey, providing valuable input that informed the selection of the five core values.

This collaborative approach not only enhanced buy-in and ownership of the new culture but also reinforced our commitment to inclusivity and transparency.

Why were these values chosen in the end?

The final selection of our values was the result of what was important to both our employees and the leadership team. “Integrity” was an important value for everyone as it was ranked first value across the board. “Collaboration” and “care” were the most frequently suggested as missing values by employees. “Courage” and “open minds” were particularly important to the leadership team since we want to encourage diversity, innovation, empowerment, and accountability across the Group.

Building a unified company culture within a global workforce can be challenging. What strategies did you implement to ensure that the new culture resonated with employees from diverse backgrounds and locations?

The first important choice we made was to involve employees in the process. We didn’t want to impose values that didn’t accurately reflect our employees and the traits they find most important, so our approach focused instead on inclusivity and communication. We chose to use a bottom-up approach, encouraging input from employees across all levels and regions to ensure their voices were heard in shaping our new values.

Reaching a consensus and announcing the values was the first step. It is now time to make them real – then it will be the time to make them operational. During each step, our people will be playing leading role.

Cultivating a culture of continuous improvement is essential for long-term success. How do you plan to sustain momentum and evolve the company culture over time, while ensuring it remains relevant and impactful in the face of changing dynamics?

Our strategy for sustaining momentum involves embedding culture of feedback and adaptability into our everyday operations. We will regularly solicit input from employees at all levels to identify areas for improvement and innovation. Additionally, we will invest in ongoing learning and development opportunities to empower employees to embrace change and contribute to the evolution of our culture. By staying agile and responsive to changing dynamics, we aim to ensure that our company culture remains not only relevant but also a driving force behind our continued success.

For more about Careers at SCOR, click here.

-

Adapting to a new normal

An interview with Jean-Paul Conoscente

SCOR’s Property and Casualty business protects against a wide range of manmade and natural events and other losses to contribute to the resilience of societies. Throughout 2023, the P&C market saw hardening conditions, leading to opportunities for reinsurers as we adjust to a new normal.

-

Can you provide insights into the latest trends impacting the property and casualty reinsurance industry, and how SCOR P&C is adapting to these changes?

On the property side, the industry continues to see an increase in climate change-related costs as these events continue to become more common, and more costly – with both severity and frequency increasing. This is the continuation of a trend we have been seeing for the past seven years and we expect this will continue in the foreseeable future. In fact, 2023 was the fourth consecutive year where insured natural perils cost more than USD 100bn globally, making this the sixth year out of seven where this was the case.

Meanwhile, inflation and social inflation are persistent, leading to a sharp increase in the cost of claims on the casualty side of the portfolio.

At the same time, systemic risks are becoming more common as some previously localized risks may now have global consequences, due to our ever-more interconnected societies and ways of living. Some risks are systemic in nature, as is the case with a pandemic that leads to business interruption claims or a cyber-attack that could potentially harm multiple key systems worldwide. Others, however, are local risks that we’re seeing could very quicky become global due to intricacies of supply chains. For example, attacks on commercial ships in the Red Sea have the potential to increase global inflation, or you could imagine that an event blocking access to a key metal in semi-conductor fabrication could cause global supply-chain disruption.

This increase in the complexity of P&C risks requires that a reinsurer has both a strong expertise in and understanding of the fundamentals and is able to harness trends and new technologies to propose innovative, creative, and effective solutions for clients.

At SCOR, we have a forward-looking view of risk that allows us to take a long-term perspective while continuously refining our existing models and maintaining consistent underwriting discipline. We also have a strong culture of innovation, which is motivated by our desire to provide clients with solutions tailored to their specific needs. In particular, our Alternative Solutions team leverages in-house expertise to find solutions where traditional (re)insurance approaches are not adequate.

When we look back at 2023, it is clear that the year served as a reset when it comes to both pricing and terms and conditions: SCOR held strong to maintain our long-term relationship with insurers and ensure sustainable conditions for both sides.

In an increasingly technology-reliant world, how is SCOR P&C leveraging data analytics, artificial intelligence, and other technologies to enhance decision-making processes and provide more customized solutions for clients?

Data analytics has come to play an increasingly important role over years, both in the solutions we offer and the way we work. More recently, artificial intelligence has started to accelerate transformation.

In 2023, after thorough work to ensure we have a secure environment where all our data and our clients' data is protected, SCOR gave all employees access to generative AI technology, allowing everyone to increase productivity and focus on higher-value tasks.

In tandem, SCOR has built a leading data-analytics team, covering the technical as well as the data governance aspects. Work on data has intensified with the launch of the Data and Data Platform Office (DDPO, see page 34) to centralize and streamline SCOR’s data use and meet the targets outlined in Forward 2026.

This platform was designed to evolve over time as it is extremely flexible. Apps can be developed directly by the business to fit their needs and best leverage the data. AI can also be integrated into the platform over time to help with visualization and analysis as we work to meet the current and future needs of clients.

At the same time, we continue our investments to equip our teams with state-of-the-art tools to better manage the business pipeline, speed up referrals, and streamline the overall underwriting process. To name just a few, the “Alpha Program” for the MGA business was completed at the end of 2023, and the Single Risks Underwriting Platform (“UP”) is progressively extending its coverage of lines of business. These developments benefit our teams and our business partners because they improve response time through automation of data processing and reporting to allow our experts to focus on value-added tasks for our clients.

How does SCOR balance the need for profitability with the social responsibility inherent in the insurance industry, especially in the context of environmental, social, and governance (ESG) considerations?

Insurance’s business model embeds sustainability naturally by providing financial security to private actors and governments in a world of heightened natural catastrophe activity.

Beyond that, SCOR actively supports the energy transition through the targets we set for our business. In May 2023 we implemented several sustainable underwriting commitments around gas, Arctic oil & gas, oil sands and coal, which was further strengthened with the release of Forward 2026 in September 2023, where we set additional sustainability goals, including multiplying insurance and facultative reinsurance cover for low carbon energy by 3.5 by 2030. This leverages our leading position in the Construction and Energy sectors and is further supported by the launch of the New Energy Practice, which is designed to be a one-stop-shop for the ongoing energy transition needs of existing and potential clients throughout the world.

SCOR also set a target to engage with clients representing at least 30% of SCOR Specialty Insurance Single Risk premium regarding their ESG commitments and transition strategy over the next three years.

In 2024, SCOR Specialty Insurance will also lead by example and partner more and more with major actors to drive the change, notably in lines such as Environmental Impairment Liability, construction, and renewable energies. Here again, there is alignment between profitable business and helping societies become more sustainable.

2022 was a monumental year when it came to NatCat. In the US alone there were 18 separate weather and climate events costing at least 1 billion USD. How did 2023 compare and what might we anticipate for 2024?

2022 was monumental indeed. The market as a whole hit very hard and SCOR was no exception. This prompted a strong and quick hardening of the market in 2023, with climate-exposed business in particular registering price increases nearing 40% range (global average, risk-adjusted), with peaks for US loss-impacted programs at sometimes 100% increases.

In 2023, we saw slightly less NatCat activity overall around the world – but it’s important to understand that these levels are still very elevated by historical standards, exceeding USD 100bn of insured losses and above USD 300bn of total economic losses. Unfortunately, it is possible that this represents a new normal rather than an exception.

This is why SCOR thinks that changes of 2023 are a reset, both for prices and for risk-sharing across the (re)insurance value chain. In 2023, up to the January 2024 renewal, SCOR was vocal on requiring underwriting discipline. Of course, prices will vary over time, but the (re)insurance market needs to find a sustained equilibrium where each party handles what it is best placed to take on with reinsurers absorbing the peak losses in a capital-protection role.

We are very satisfied with the January 2024 renewal in this regard. SCOR and the reinsurance market held ground. We expect the attractive market conditions to continue over the remainder of the year, fueled by the demand from cedants and continued discipline by reinsurers.

How does the leadership team foster a culture of collaboration and expertise within the organization?

To face the fast pace and complexity of the industry today, the expertise of one individual is not sufficient. Instead, individual expertise needs to serve the collective work being done. To foster collaboration, SCOR’s leadership team has to lead by example in how things are done.

With Forward 2026, the leadership team outlined our vision for SCOR, provided clear goals, and aligned all teams on common objectives.

We aim to build trust and a safe environment, encouraging a feedback culture and seek input from diverse perspectives. For example, when we worked on defining our company culture, the SCOR Way, we wanted to ensure the process was a collaborative one that involved employees across the Group. In this way, we were able to identify what is close to their heart and how it applies to the way SCOR conducts its business.

An example of where collaboration delivers value to the company and to clients is the remarkable achievements of our Alternative Solutions team in 2023.They have fully embraced the global goals of Forward 26 – even outpacing business goals – and have pooled their expertise to develop innovative solutions in answer to clients’ demands.

But SCOR’s leadership extends beyond our own organization. As reinsurers and specialty insurers, expertise is at heart of what we do and we know this expertise is reaching a wider audience.

For example, the success of our publications, reports, and expert-led articles and podcasts is an illustration of their quality and the recognized expertise of their authors.

SCOR is also contributing to the next generation of risk management professionals, for example with the SCOR Foundation presenting actuarial awards in half a dozen countries in 2023, highlighting and supporting insightful work that contributes to pushing back the frontiers of insurability and improving the welfare and resilience of societies.

For more about Property & Casualty, click here.

-

Creating the solutions of tomorrow

An Interview with Frieder Knuepling and Redmond Murphy

The dynamic landscape of the global life and health reinsurance industry is transforming in the face of evolving consumer demands and technological advancements. With a focus on digitalization, product innovation, and global diversification, SCOR’s Life and Health teams are transforming these trends into opportunities to bring new solutions for protection and resilience to the forefront and close the persisting protection gap.

-

Can you provide insights into the latest trends impacting the life and health reinsurance industry and how SCOR L&H is adapting to these changes?

Frieder Knuepling: The global life and health reinsurance industry is in a period of strong momentum. The current environment we are in is very positive, supported by stable market cycles, growing consumer demand, a favorable macroeconomic environment, changing demographics, diminishing impact of Covid-19, and persistent protection gaps. SCOR L&H is fully committed to taking advantage of this positive momentum and leveraging our leading position in key markets.

Redmond Murphy: To adapt to this favorable environment and maximize our return, we have identified our strategic business focuses – growing our Protection portfolio across targeted geographies, expanding our Longevity and Financial Solutions footprints globally, leveraging data analytics, and deploying digital services to differentiate our product offerings. We are confident that with this fine-tuned strategy and our people – who are committed to working with partners to make a positive impact on society – we will be able to achieve great success.

How do you see advancements in technology shaping the future of life and health reinsurance? Do you have any examples of this already happening at SCOR L&H?

F.K.: Long before the arrival of generative AI, we were proactively deploying AI and data analytics, which is positively impacting our business. As highlighted in Forward 2026, a crucial focus area is our dedication to digital solutions. We use advanced models with previously unused data, incorporating additional features that traditional models cannot handle. This ensures automation for tasks that were previously too complex to implement using traditional rules and segmentation. One example is our AI-based data-capturing solution utilizing optical character recognition (OCR) and natural language processing (NLP) which speeds up multiple touchpoints of the insurance application process (page 78).

R.M.: Another example is VClaims, an advanced digital claim-processing solution combining technology with behavioral science elements (page 78). We are very proud of this addition to our extensive range of innovative technology solutions, as it has a tangible positive effect on our client companies and policyholders. We want to provide value to our clients by tackling rising claims costs, enabling scaling for increasing volumes, and enhancing the overall experience. Claims management is often overlooked but is a very important part of improving the insurance customer journey. VClaims has delivered visible improvements such as streamlined automation, greater consistency, and faster claim processing with the power of advanced analytics and technology.

How does the L&H team approach innovation in product development? Can you share examples of successful initiatives from 2023?

F.K.: We prioritize solutions that positively impact our end customers. One notable example is our emphasis on how we meet people’s needs to manage their life and health risks, and that starts with our employees. That is why we are proud of our 2023 internal launch of ifeel, an innovative engagement solution combining technology and clinical psychotherapy to address the growing mental health issues around the world. We are very happy with the positive impact this initiative has made on over 1,500 employees so far and are convinced that creating and delivering human-centered innovative solutions like this is at the core of our raison d’être and the right strategic direction to take.

R.M.: We focus on building innovative products suited to specific consumer needs in the relevant market. For example, to make life protection products easier to understand, SCOR’s Southeast Asia team designed and developed a new hospitalization product with their client to pay a lump sum claim if the insured suffers a major condition and needs to be hospitalized for an extensive number of days. This innovative product, which has already sold over 2,000 policies within the first six months of launch in 2023, is much easier to understand compared to the current critical illness products, where the claim definitions can be complex and less than intuitive.

How will SCOR L&H contribute to positive outcomes during Forward 2026?

F.K.: L&H has a lot to contribute to the success of Forward 2026. Financially, our strong global franchise and market positioning will allow us to continue to develop our business through a diversified business strategy which will help deliver the Group’s new business and deliver Economic Value throughout the coming years. In addition, our actively managed portfolio will ensure positive and streamlined cash flows generating in line with our Forward 2026 targets.

R.M.: In addition to the financial contribution FK has mentioned, we believe Life and Health contributes strongly through our people’s market-leading expertise, innovative mindset, and collaborative culture focusing on our mission – closing the protection gap and shaping the reinsurer of tomorrow – will be the most significant contributors to the success of our Forward 2026 strategic plan.

On the P&C side of the business, global diversification is essential to protect against overexposure to certain risks like natural catastrophes. Is this also true for L&H?

F.K.: Life and Health does also benefit from global diversification, though the considerations may differ compared to the Property and Casualty side of the business. While P&C risks are often more directly influenced by regional events like natural disasters, L&H risks can be impacted by demographic trends, regional market cycle, healthcare and social security systems, and regulatory environments that vary across countries. Our strategy is very intentional about actively diversifying our lines of business globally. Global diversification helps mitigate concentration risks and navigate diverse regulatory landscapes. It also allows us to tap into opportunities arising from demographic variations and emerging markets. Additionally, spreading risk globally can provide stability in the face of localized economic downturns or health crises.

R.M.: Product diversification is also critical to ensure that we meet regional demographic changes and consumer needs.

Our solutions are tailored to each market to ensure we offer the most relevant solutions and respect local regulations. That means that a solution originally developed for the UK might be adapted for other markets like Australia, allowing our local teams to share their knowledge and previous learnings with their colleagues around the world.

What can we expect from the L&H (re)insurance industry in 2024?

F.K.: We expect the continuation of the favorable L&H environment, but we may also experience increasing geopolitical, economic, and market uncertainty in 2024. SCOR’s global teams are collaborating with clients and partners to adapt to emerging trends and challenges, leveraging innovation and strategic partnerships to drive growth, narrow the protection gap, and create value in a dynamic evolving landscape. Admittedly, predictions are challenging as so much depends on various factors such as market conditions, global events, regulatory changes, and technological advancements. However, some general 2024 industry expectations relate to changing demographics.

On one hand, the world’s population is aging more rapidly than ever and it is important that we adapt our product offerings and distribution strategies for demographic shifts. As populations around the world age and become older, consumer behavior and preferences change.

On the other hand, we are currently witnessing the rising power of young consumers. While the world is aging, the younger generations are increasing their buying power. We must better understand the next generation of L&H insureds – Gen Z and Millennials. They desire new types of coverage as their lifestyles and needs are more diverse. To support this generation, we are adding and combining various flexible and personalized coverages and riders to their policies, such as a pay-as-you-go features, which are more appealing to these populations. Understanding every generational group is essential, but defining the right target strategy is key when bridging the divide as Generation Z is entering the life insurance purchase stage and Millennials are living longer, remaining in the insurance customer base.

R.M.: Product innovation and technological integration are also at the top of our minds. The development of innovative life insurance products and solutions to meet changing customer needs is imperative. Continued integration of AI, data analytics, and machine learning to enhance underwriting processes, risk assessment, and client customer experience are additional factors that we continue to consider.

Climate change remains one of the top global issues in 2024. Life and Health reinsurers continue to monitor climate change and address its implications on mortality and morbidity risks, as well as ensure we maintain a focus on environmental, social, and governance (ESG) factors that often come with risk assessments and underwriting processes.

We will also continue to use learnings from the pandemic to enhance our preparedness for similar future global pandemics and unforeseen health crises.

For more about Life & Health, click here.

-

Harnessing short-term investments for long-term success

An interview with Carole de Rozières

Informed by SCOR’s wealth of risk knowledge and supporting our core underwriting businesses, SCOR’s Asset Owner Office plays a key role in the financial health of the Group, while acting as an important lever to drive change and meet sustainability targets. SCOR’s investment professionals keep a finger on the pulse of economic trends and anticipate future risks and opportunities.

-

Can you elaborate on any recent changes to SCOR’s investment strategy, particularly in light of Forward 2026?

The primary objective of the investment strategy is to generate recurring financial income in compliance with our risk appetite and sustainability preferences.

We are convinced that our strategy must be oriented toward the long term and Forward 2026 is perfectly in line with this. For our invested assets, our strategic asset allocation is maintained – that is to say, it remains prudent and consistent with our risk appetite and supports a more sustainable future. We also intend to pursue the diversification of our portfolio into Value Creation Assets, with the objective of bringing additional diversification and long-term returns.

For SCOR IP, the objective is to expand third-party asset management.

Given market dynamics and strategic considerations, have there been any notable shifts in the composition of SCOR’s investment portfolio? Which asset classes have seen adjustments, and why? Do you anticipate further changes?

With a long-term oriented strategy, the allocation is quite stable over time. We mainly invest in fixed income securities, with a preference for corporate bonds, and a high average credit quality. But we also invest in loans strategies: corporate, infrastructure, and real estate loans which have interesting risk/return characteristics. Since the last strategic plan, we increased our allocation towards Value Creation Assets, notably private debt, private equity, and infrastructure equity, and will pursue this strategy which is expected to bring additional return over the long term.

And within this long-term strategic asset allocation, we invest tactically and with agility, favoring investments with the best relative value depending on the market environment.

How does SCOR assess and manage investment risks?