Accelerated underwriting programs are becoming more prevalent, and it will be years before we have credible mortality data to assess the long-term effectiveness of these programs. Monitoring these programs from the beginning helps companies mitigate risks associated with accelerated underwriting. SCOR has underwriters, actuaries and data scientists who can help your company design an AU program or consult on monitoring.

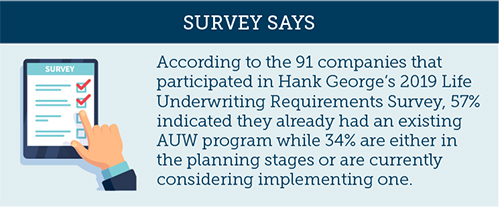

The number of companies that have implemented some version of an accelerated underwriting (AU) program has increased significantly in the last few years. Whether your company is among those who successfully developed an AU program or is still planning or considering one, congratulations! This is a monumental accomplishment for any organization.

The implementation of an AU program requires a significant amount of time, research, resources and training. It is likely your company had to navigate multiple hurdles and roadblocks in order to bring your AUW product to market.

However, this is the just the beginning.

Importance

The success of any AU program is highly dependent on routine monitoring and detailed reporting analysis. Due to the relative infancy of accelerated underwriting, it is premature for any credible mortality data to be available and, therefore, frequent monitoring is paramount to identify any gaps in the program or concerning trends.

The SOA estimates it will require anywhere from two to 10 years, perhaps even longer, before credible mortality data become available. As a result, monitoring AU programs is vital to mitigating the risk of higher-than-expected mortality, particularly in the beginning stages as AU programs continue to evolve.

Benefits

Monitoring provides an opportunity and the ability to modify existing rules, update guidelines and eligibility requirements, evaluate the effectiveness of data sources and fill/close potential gaps in your program should they arise. Monitoring provides opportunities to discover potential training needs for both agents and underwriters.

In addition, reinsurance pool members rely on companies to provide detailed reporting of their AUW results in order to validate the original pricing assumptions. The more information and verifiable data that is shared with your reinsurance partners, the greater the overall comfort level reinsurers will have with your AU program.

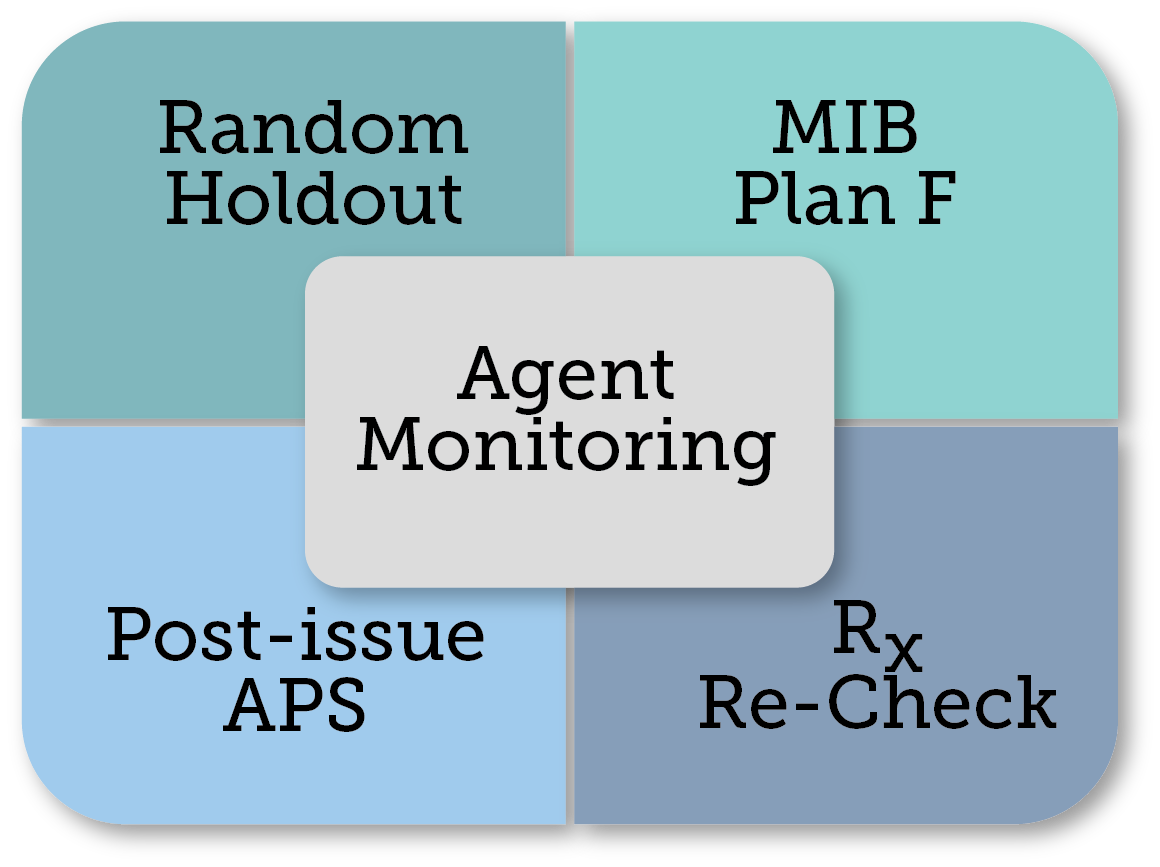

Figure 1 - Monitoring techniques

Multiple pre- and post-issue monitoring techniques exist, and most companies currently use more than one monitoring technique to evaluate the accuracy of their AU program. Techniques include (but are not limited to) Random Hold Out (RHO), Post-issue APS, RX Recheck and MIB Plan F.

Random Hold Out (RHO), a pre-issue monitoring technique, is a process in which the company elects to put an applicant, who has otherwise qualified to have underwriting requirements waived via AU, through the full underwriting process. This method may reveal what could be missing in the absence of fluids.

Not surprisingly, RHO is often unpopular with agents who may be selling the AU concept to a prospective client without explaining the potential hold out for full underwriting review. Agents may be uninformed of the process or simply be setting high expectations without full disclosure.

The percentage of RHOs varies by company but is typically between 5% and 10%. Some companies may also elect to have a much higher hold out percentage at the launch of their AUW program and adjust downward once they have developed a level of comfort and determined that results align with their initial expectations and assumptions.

Note, a higher percentage or number of random holdouts permits companies to obtain and validate results much faster. Companies are able to react more quickly and make modifications to their program much sooner if needed.

RHO provides a “sentinel effect” when the agent and applicant are aware they may be selected for further underwriting evaluation. Tracking the percentage of RHOs and at what stage in the AUW process an applicant withdraws their application may provide insight into potential anti-selective behavior.

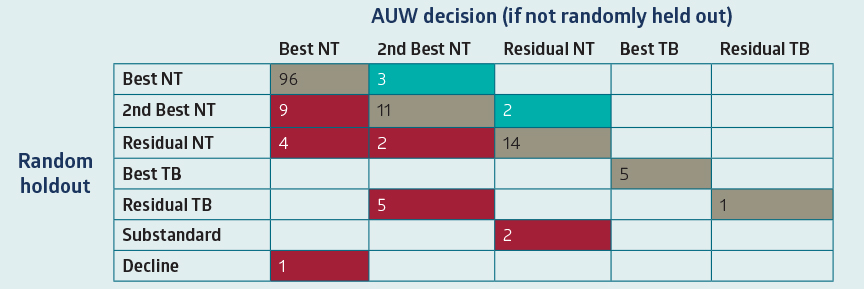

Figure 2 - Confusion Matrix

Cells shaded in red denote areas where the random hold out identified new information resulting in a worse class/decision. Tobacco misclassifications, substandard and declined/postponed outcomes in the RHO/Post-Issue APS results are the most concerning and would have the largest impact to mortality slippage.

A confusion matrix uses results from either RHOs or post-issue APS reviews and compares the decision that would have been assigned (prior to the RHO or APS) to the decision made with the RHO and/or APS results. Ideally, there should be very few cases that have a different decision.

Post-issue monitoring: Post-issue APS may assist in revealing undisclosed medical information. According to the June 2019 survey completed by Milliman on behalf of the SOA, primary reasons for companies obtaining a post-issue APS are to determine:

- the magnitude of cases that slipped through

- the weaknesses in the underwriting process

- the percentage of cases that slipped through

- whether the applicant has properly disclosed past or current tobacco use

Review of an APS post issue affords companies the opportunity to audit the accuracy of the applicant’s responses and validate the accuracy of the AU assessment without inconveniencing the applicant or agent.

Post-issue APS does have limitations; for example, a special authorization may be required, and requests for records may simply be ignored and go unfilled. APS may not be available on all applicants since not all of them will have primary care physicians.

When an APS is obtained, it may contain only limited information and not include lab information or vitals (blood pressure and build). Nicotine use in the APS is self-reported by the applicant and, therefore, not always a good source for verifying tobacco use history.

Post-Issue APS ordering varies by company but hovers around 10%.

RX Recheck is the reordering of an Rx report post-issue. The purpose is to identify newly prescribed medications that could have potentially impacted whether the risk qualified for AU as well as the impact to the overall risk assessment.

MIB Plan F provides an alert to members when new applicant information is received and reported by another company for two years after the original MIB inquiry. Plan F helps prevent anti-selection and provides a safeguard for companies with the option to rescind a policy should a material misrepresentation or non-disclosure be discovered within the contestable period.

Agent monitoring should also be considered for inclusion into the AU monitoring and audit process. Doing so permits companies to identify outliers and inconsistencies in the business. Potential red flags include significant shift or uptick in AUW case submissions compared to historical fully underwritten business, a considerable percentage of withdrawn applications selected for RHO and no admitted history on application, but RX recheck shows otherwise.

Other metrics for monitoring to ensure actual results are in line with expected include:

- AUW eligible as a percentage of total cases submitted over a given time period

- Accelerated cases as a percentage of AU-eligible cases

- AU approved and placed percentages overall and by risk class

- Fully underwritten (FU) approved and placed percentages overall and by risk class - how is the AUW program affecting the residual FU business?

- Percentage of AU business qualifying by age group

- Percentage of AU business qualifying by amount

- Percentage of cases withdrawn once it becomes an RHO

- Of those targeted for post-issue APS review, what percentage didn’t have an APS available and what was the total % of APSs actually being reviewed?

Accelerated underwriting programs are becoming more prevalent, and it will be years before we have credible mortality data to assess the long-term effectiveness of these programs. Monitoring these programs from the beginning helps companies mitigate risks associated with accelerated underwriting.

SCOR Global Life has underwriters, actuaries and data scientists who can help your company design an AUW program or consult on monitoring. Contact your account representative or one of us for additional information.

References

- Kerbeshian, J, FSA, MAAA & Matson, Patricia, FSA, MAAA, Emerging Underwriting Methodologies and Their Impact on Mortality Experience Delphi Study. 2018;32

- Klein, A, FSA, MAAA & Rudolph, K, FSA, MAAA, Company Practice Survey of Individual Life Insurance Accelerated Underwriting – Preliminary Results. 2019;34

- George, H, 2019 Life Underwriting Requirements Survey. 2019;4