Body

Throughout the past 50 years SCOR has built its reputation on being there for its clients, its employees and all its stakeholders in the most difficult times. The unprecedented crisis we are now facing is no different. On March 11, 2020, the World Health Organization declared the Covid-19 outbreak a global pandemic. The first quarter 2020 results of the SCOR group were not materially affected by the Covid-19 pandemic and the related economic and financial crisis, but this event is ongoing. The impact for the remainder of the financial year cannot be accurately assessed at this stage given the high uncertainty related to the magnitude and duration of the pandemic and of its wide-ranging social, economic and financial consequences on the one hand, and to the possible effects of ongoing and future governmental actions on the other hand. SCOR may see an increased level of claims in its Life and P&C businesses and an increased level of asset impairments during 2020.

As we go through this crisis, we will do everything in our power to support our business partners, employees and local communities throughout the world, while ensuring that our operations continue efficiently.

SCOR is doing its utmost to help stop the spread of the COVID-19 virus, starting within the company. Actively protecting the health of our employees and their loved ones is our top priority. This is why we adopted early and strict prevention measures, before fully activating our Business Continuity Plan and switching to working from home in all Group offices, a move that came before lockdown and social distancing measures were even implemented in most countries. But we are also acting outside the company. SCOR has launched a call to action with the “Spread knowledge, not the virus” campaign, which explains the importance of strict containment measures to combat the pandemic and calls on everyone to contribute to the fight against its spread. The Group is also sharing knowledge on the evolution of Covid-19 with the regular publication of appropriate epidemiological data.

The resilience of SCOR’s operational capability, supported by high-performance IT systems and applications, means that the Group can continue to serve its clients in this period of crisis and immediately respond to their reinsurance needs.

The coronavirus pandemic is being addressed by governments via lockdown policies and fiscal stimulus and by central banks via monetary policies to support financial markets and liquidity concerns. The outcome of these efforts, and notably the timetable at which the spread of the virus subsides, will become clearer over time.

***

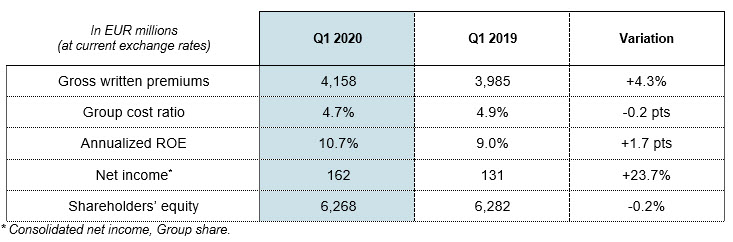

SCOR delivers a strong set of results in the first quarter of 2020, combining disciplined growth, strong profitability and robust solvency.

- Gross written premiums total EUR 4,158 million in Q1 2020, up 2.2% at constant exchange rates compared with Q1 2019 (up 4.3% at current exchange rates).

- SCOR Global P&C gross written premiums are up 2.9% at constant exchange rates compared with Q1 2019 (up 4.8% at current exchange rates). SCOR Global P&C demonstrates solid technical profitability in Q1 2020 with a net combined ratio of 94.5% in line with “Quantum Leap” assumptions.

- SCOR Global Life continues to successfully expand its franchise, with gross written premiums up 1.7% at constant exchange rates compared with Q1 2019 (up 4.0% at current exchange rates). SCOR Global Life delivers a strong level of technical profitability in Q1 2020 by recording a technical margin of 7.4%.

- SCOR Global Investments pursues a prudent asset management strategy and delivers a strong return on invested assets of 3.1% in Q1 2020, benefiting from capital gains.

- The Group cost ratio, which stands at 4.7% of gross written premiums, is better than the “Quantum Leap” assumption of ~5.0%.

- The Group net income stands at EUR 162 million for the quarter, up 23.7% compared to Q1 2019. The annualized return on equity (ROE) stands at 10.7%1, 1007 bps above the risk-free rate2, currently exceeding the profitability target of the strategic plan “Quantum Leap”.

- Group net operating cash flows stand at EUR 246 million in Q1 2020, with good contributions from both SCOR Global Life and SCOR Global P&C. The Group’s total liquidity is very strong, standing at EUR 2.7 billion at March 31, 2020.

- Shareholders’ equity stands at EUR 6,268 million at March 31, 2020, down by EUR 106 million compared with December 31, 2019. This variation is largely explained by the evolution of credit spreads and equity markets in Q1 2020. This results in a strong book value per share of EUR 33.41, compared to EUR 34.06 at December 31, 2019.

- Financial leverage stands at 26.6% on March 31, 2020, slightly increasing by 0.2% points compared to December 31, 2019. Allowing for the intended call of the debt3 callable on October 20, 2020, the adjusted financial leverage ratio would be at 25.5%.

- The Group’s estimated solvency ratio stands at 210% on March 31, 2020, in the upper part of the optimal solvency range of 185% - 220% as defined in the “Quantum Leap” strategic plan. The reduction in solvency compared to December 31, 2019 was driven by market movements.

SCOR group Q1 2020 key financial details

SCOR’s status on the exposures to the Covid-19 pandemic

SCOR benefits from a strong capital position, high solvency ratio and resilient global franchise. The Group’s current status is the following:

- On the Life side, the current situation remains well-below the 1-in-200 year pandemic extreme scenario disclosed by SCOR:

- The key exposure relates to mortality business, primarily in the U.S., where SCOR has a diversified portfolio predominantly exposed to younger age and higher socio-economic groups.

- There is limited exposure to lines of business impacted by economic downturn, for example disability in France and Australia.

- There are some potential positive offsetting impacts over time from our longevity and long-term care (France) portfolios.

- On the P&C side, SCOR is continuously monitoring its exposures to the Covid-19 outbreak in light of a rapidly changing environment, considering lines of business (LOBs) according to the degree of materiality of potential impacts:

- Many LOBs are simply not loss impacted or have minimal loss exposure even if they may be affected in terms of volume due to the nature of their coverage;

- SCOR Global P&C is not involved or has incidental and immaterial exposure in many of the LOBs most affected by the pandemic and the ensuing financial and economic crises, such as event cancellation or contingency business;

- The Business Interruption development is being closely monitored, in all relevant jurisdictions;

- Potential exposures could also arise within the Trade Credit, Surety and Political Risks portfolio, limited to ~7% of the SCOR Global P&C premium base.

- On the investment side, whilst SCOR may in the future see reduced investment income through lower yields and experience higher asset impairments, SCOR entered the Covid-19 crisis with a resilient and defensive investment portfolio:

- SCOR has a prudent investment portfolio with limited appetite for asset risks;

- Throughout 2019, SCOR voluntarily decreased the risk of the investment portfolio with a material reduction of the credit exposure and a stronger liquidity profile. SCOR’s investment portfolio has a very limited exposure to listed equities (0.6% of invested assets);

- At the end of Q1 2020, its fixed income portfolio, of very high quality with an average rating of A+, and highly liquid, has limited exposure to the oil and gas sectors (1.7% of invested assets), as well as to the airlines, retail, leisure, hotel and entertainment sectors (2.4% of invested assets);

- The liquidity of the investment portfolio is very strong. The invested assets portfolio (EUR 20.3 billion) benefits from its short duration positioning, with a fixed income duration of 3.2 years (versus 4.3 years at the end of 2018), and with EUR 8.3 billion of financial cash-flows4 expected over the next 24 months, equivalent to 41% of invested assets.

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “The Covid-19 pandemic is a shock of historic severity. It has become a multifaceted crisis which is profoundly impacting the lives of billions of people worldwide. In this context, SCOR has been proactive in taking immediate actions to help stop the spread of the pandemic and to contribute more generally to the wellbeing and resilience of society, for the benefit of all its stakeholders. Our top priority has been to actively protect the health and safety of our employees, to continue operating efficiently and supporting our clients through this disruptive period, to share our knowledge on the evolution of the pandemic and to emphasize the importance of preventative and protective actions to help contain the virus. The current crisis is an ordeal for all of us. The Group is fully mobilized to anticipate, measure and manage the impacts of this major shock, just as it has done for other disasters in the past. We wish each and every one of you the best of health and safety during this very difficult period.”

1 There is uncertainty on the potential negative impacts of the COVID-19 crisis stemming both from claim developments and the capital markets environment. The Q1 figures were not significantly impacted by the crisis and the Q1 financial information may not necessarily be indicative of the interim and full year financial results

2 Based on a 5-year rolling average of 5-year risk-free rates (62 bps in Q1 2020)

3 CHF 125 million undated subordinated note lines, issued on October 20, 2014, and callable in October 2020

4 Investable cash includes current cash balances, and future coupons and redemptions