-

Ratings

SCOR and its subsidiaries are assessed by four independent ratings agencies

-

Group Ratings

Financial Strength Senior Debt Subordinated Debt Standard & Poor's

22/07/2024A+

Stable outlookA+ A- AM Best

23/01/2025A

Stable outlooka+ a- Moody's

05/09/2024A1

Stable outlookN/A A3 (hyb) Fitch

14/10/2025A+

Positive outlookA BBB+ -

January 23 2025: AM Best has removed from under review with developing implications and affirmed the Financial Strength Rating of A (Excellent) of SCOR SE and its main operating subsidiaries. The outlook assigned to these ratings is stable.

July 24 2024: AM Best has placed under review with developing implications the Financial Strength Rating (FSR) of A (Excellent) and the Long-Term Issuer Credit Ratings of “a+” (Excellent) of SCOR SE and its main operating subsidiaries.

July 22 2024: S&P affirmed the ‘A+’ Financial Strength Rating of SCOR with Stable outlook.

February 1 2024: Moody’s has affirmed the A1 insurance financial strength rating of SCOR with Stable outlook.

November 14 2023: Fitch affirmed SCOR SE’s and its core operating subsidiaries Insurer Financial Strength Rating’s at ‘A+’ and Long-Term Issuer Default Rating (IDR) at ‘A’. The Outlooks are Stable.

March 9 2023: AM Best has downgraded the Financial Strength Rating (FSR) to A (Excellent) from A+ (Superior) and the Long-Term Issuer Credit Ratings (Long-Term ICR) to “a+” (Excellent) from “aa-” (Superior) of SCOR SE (SCOR) (France) and its main operating subsidiaries. The outlook of Credit Ratings (ratings) has been revised to stable from negative.

February 3 2023: Moody's Investors Service ("Moody's") has downgraded the Insurance Financial Strength Rating ("IFSR") of SCOR SE ("SCOR") and its key operating entities to A1 from Aa3, downgraded its subordinated debt rating to A3(hyb) from A2(hyb), changed the outlook to stable from negative.

17 November 2022: S&P has revised the rating of SCOR to “A+” from “AA-“ and changed the outlook to “stable” from “negative”.

31 January 2022: S&P has revised the outlook of SCOR and its main subsidiaries to "negative" from "stable", as well as affirming the financial strength rating of "AA-".

1 September 2017: A.M. Best has upgraded the Financial Strength Ratings (FSR) to A+ (Superior) from A (Excellent) and the Long-Term Issuer Credit Ratings (Long-Term ICR) to “aa-” from “a+” of SCOR SE (SCOR) (France) and its main operating subsidiaries.

23 September 2016: Moody’s Investors Service (Moody’s) has upgraded SCOR SE’s insurance financial strength rating to Aa3 from A1, and its subordinated debt rating to A2(hyb) from A3(hyb). The outlook is stable.

15 December 2015: Moody’s provides further recognition of SCOR’s financial strength with a positive outlook to the Group’s A1 rating.

11 September 2015: A.M. Best has revised the outlook of SCOR and its main subsidiaries to “positive” from “stable”, as well as affirming the financial strength rating (FSR) of “A” (Excellent) and the issuer credit ratings (ICR) of “a+”.

7 September 2015: Standard & Poor’s (S&P) has upgraded SCOR’s Insurer Financial Strength rating to ‘AA- stable outlook’ from ‘A+ positive outlook’ and raised the Group counterparty credit ratings to 'AA-/A-1+' from 'A+/A-1'.

21 July 2015: Fitch Ratings has upgraded SCOR’s Insurer Financial Strength (IFS) rating to ‘AA- stable outlook’ and affirmed the Long-Term Issuer Default Rating (IDR) at ‘A+’. Fitch notably mentions having taken into account “the development of SCOR’s reinsurance franchise, the scale and diversity of which have improved significantly through external growth and swift integration of acquired operations, helping to generate a more stable level of profitability”. The rating agency also notes “the level of capitalisation that Fitch considers to be very strong” as well as “a consistent and prudent reserving philosophy”.

20 August 2014: Fitch has raised to “positive” the outlook on the ’A+’ rating of SCOR SE and its main subsidiaries. This reflects, according to Fitch, “SCOR’s improved profitability, strong solvency and financial leverage for its risk profile”.

21 November 2013: Standard & Poor’s has raised the outlook on the “A+” rating of SCOR SE and its main subsidiaries to “positive” as, according to S&P’s statement, “capital and earnings expected to rise due to very strong ERM”.

4 June 2012: Standard & Poor's Ratings Services raised to 'A+' from 'A' its long-term counterparty credit and insurer financial strength ratings on France-based reinsurer SCOR SE (SCOR) and its guaranteed subsidiaries. The outlook on all entities is stable.

9 May 2012: Moody’s has upgraded the insurance financial strength ratings (IFSR) of SCOR SE (SCOR) and various guaranteed subsidiaries to A1 from A2, and SCOR's subordinated debt rating to A3 (hyb) from Baa1 (hyb). All ratings have a stable outlook.

2 May 2012: A.M. Best has upgraded the issuer credit ratings (ICR) to “a+” from “a” and affirmed the financial strength rating (FSR) of A (Excellent) of SCOR SE (SCOR) (France) and its main subsidiaries. Concurrently, A.M. Best has upgraded the subordinated debt ratings of SCOR. The outlook for all ratings is stable.

15 March 2012: Fitch Ratings has upgraded SCOR's Long-term Issuer Default Ratings (IDRs) and Insurer Financial Strength (IFS) ratings to 'A+' from 'A'. Fitch has simultaneously upgraded SCOR's junior subordinated debt to 'A-' from 'BBB+'. The Outlook on the IDRs and IFS ratings is stable.

3 May 2011: Fitch Ratings has affirmed SCOR's Long-term Issuer Default Ratings (IDRs) and Insurer Financial Strength (IFS) ratings at 'A', respectively. The affirmations follow SCOR's announcement that it intends to acquire the mortality business of Transamerica Re.

27 April 2011: Standard & Poor's Ratings Services affirmed its 'A' long-term counterparty credit and insurer financial strength ratings on France-based reinsurer SCOR SE (SCOR), as well as on SCOR's guaranteed subsidiaries, following the announcement of Transamerica Re acquisition. The outlook on all entities remain positive.

26 April 2011: A.M. Best has affirmed the financial strength rating (FSR) of A (Excellent) and the issuer credit rating (ICR) of "a" of SCOR SE and its Subsidiaries after announcement of Agreement to Acquire Transamerica Re Life Portfolio. The outlook for all ratings remains stable.

26 April 2011: Moody's ratings on SCOR SE (A2 insurance financial strength, outlook positive) and its rated subsidiaries are unaffected by SCOR's proposed acquisition of the life mortality business of Transamerica Re which has recently been announced.

7 October 2010: Moody's Investors Service has revised to positive its rating outlook of SCOR SE and various guaranteed subsidiaries and has affirmed the entities’ A2 insurance financial strength ratings (IFSR) and SCOR's Baa1 subordinated debt rating.

1 October 2010: Standard & Poor's Ratings Services revised its outlook on reinsurer SCOR SE and its guaranteed and core subsidiaries to positive from stable. At the same time, S&P affirmed the 'A' long-term counterparty credit and insurer financial strength ratings on these entities.

10 September 2010: A.M. Best Europe – Ratings Services has upgraded the financial strength rating (FSR) to A (Excellent) from A- (Excellent) and the issuer credit ratings (ICR) to "a" from "a-" of SCOR S.E. (SCOR) (France) and its subsidiaries. At the same time, A.M. Best has upgraded the ratings on subordinated debt either issued or guaranteed by SCOR. The outlook on all ratings has been revised to stable from positive.

24 August 2010: Fitch Ratings has revised the rating Outlook on SCOR group entities to Positive from Stable, whilst affirming the entities' Long-term Issuer Default Ratings (IDRs) and Insurer Financial Strength (IFS) ratings at 'A' respectively. Fitch has simultaneously affirmed SCOR's junior subordinated debt at 'BBB+', whilst affirming its Short-term IDR and commercial paper at 'F1' respectively.

-----

13 March 2009: Standard & Poor's Ratings Services raised its long-term counterparty credit and insurer financial strength ratings on France-based reinsurer SCOR SE and its core guaranteed subsidiaries (collectively SCOR or the group) to 'A' from 'A-'. At the same time, the short-term local currency counterparty credit rating was raised to 'A-1' from 'A-2'. The outlook on all of these entities is stable.

-----

4 December 2008: Moody's Investors Service announced today that it has upgraded the insurance financial strength rating (IFSR) of SCOR and various subsidiaries to A2 from A3, and SCOR's subordinated debt to Baa1 from Baa2. All ratings have a stable outlook.

21 August 2008: Fitch Ratings has upgraded SCOR SE’s ratings to "A" on Insurer Financial Strength (IFS) and to "A" on its Long Term Issuer Default Rating (IDRs). The rating on the Junior Subordinated Debt moves to "BBB+". The outlook for the IFS rating and the long-term IDRs remains stable. Previously, the ratings were "A-", "A-" and "BBB" respectively.

-----

11 May 2007: Standard & Poor's and Moody's announce that they have maintained SCOR’s financial strength ratings ("FSR") following the conclusion of a friendly agreement between SCOR and Converium with regard to their combination.

20 August 2007: AM BEST affirms the FSR at A- to SCOR and upgraded the FSR of Converium to A-.

24 August 2007: FITCH affirms the Insurer financial strength ("IFS") rating at A- to SCOR and upgrades the IFS of Converium to A.

-

Subsidiaries Ratings

03 February 2023 Country

S&P

AMBest

Moody's

Fitch

Other

SCOR SE France A+ A / Stable A1 / Stable A+/ Positive SCOR Global Life

Australia Pty LtdAustralia A+ SCOR Canada Reinsurance Company Canada A+ A / Stable A1 / Stable A+ / Positive SCOR SE Canadian Branch Canada A / Stable SCOR Reinsurance Company

Asia LtdHong Kong A+ A+ / Positive SCOR Global Reinsurance

Ireland dacIreland A+ A+ / Positive SCOR Ireland dac Ireland A+ A+ / Positive SCOR Perestrakhovaniye Russia ACRA: AAA(ru) / Stable SCOR Reinsurance

Asia Pacific Pte LtdSingapore A+ A / Stable A+ / Positive SCOR Africa Ltd South Africa A+ SCOR U.K. Company Ltd United Kingdom A+ A / Stable A1 / Stable A+ / Positive SCOR Europe SE France A+ SCOR Global life USA

Reinsurance CompanyUnited States A+ A / Stable SCOR Global Life Americas Reinsurance Company United States A+ A / Stable A+ / Positive General Security Indemnity

Company of ArizonaUnited States A+ A / Stable A+ / Positive General Security National

Insurance CompanyUnited States A+ A / Stable SCOR Reinsurance Company United States A+ A / Stable A1 / Stable A+ / Positive SCOR Global Life Reinsurance Company of Delaware United States A+ A / Stable SCOR Brasil Resseguros SA Brasil A+ All rated subsidiaries listed in the table above benefit from parental guarantees which are, except as otherwise indicated in this table, issued by SCOR SE (the issuer of any such parental guarantee, the "Guarantor"). These guarantees cover all of these subsidiaries' payment obligations under the insurance and reinsurance contracts issued by them. These guarantees are unconditional and continuing and shall be binding upon the Guarantor. The owners of the insurance and reinsurance contracts issued by these subsidiaries are express third party beneficiaries of these guarantees. The obligations of the Guarantor under these guarantees rank pari passu with all other unsecured indebtedness of such Guarantor. -

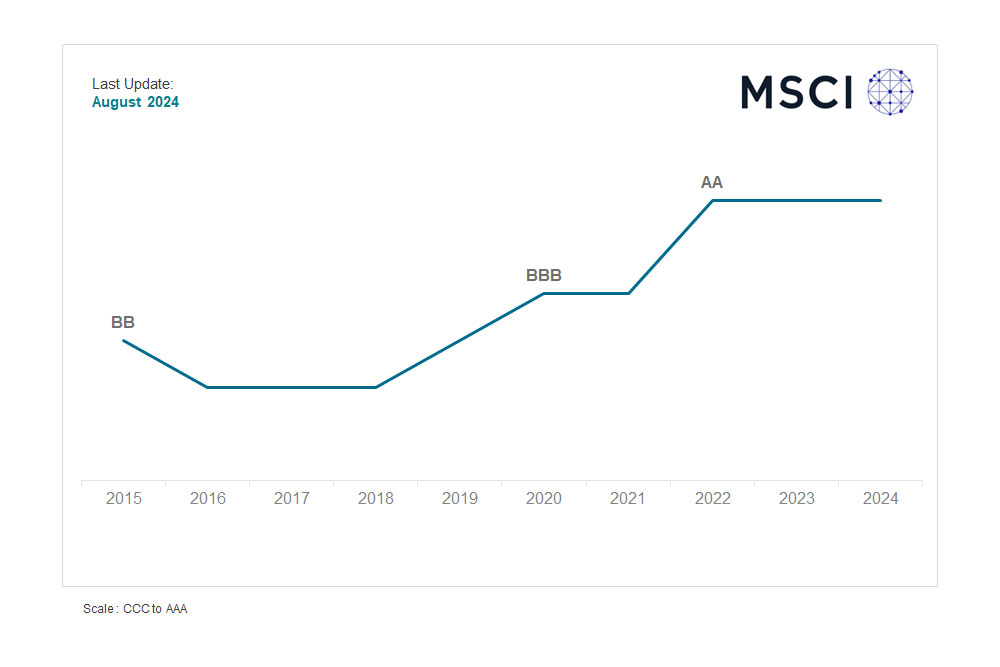

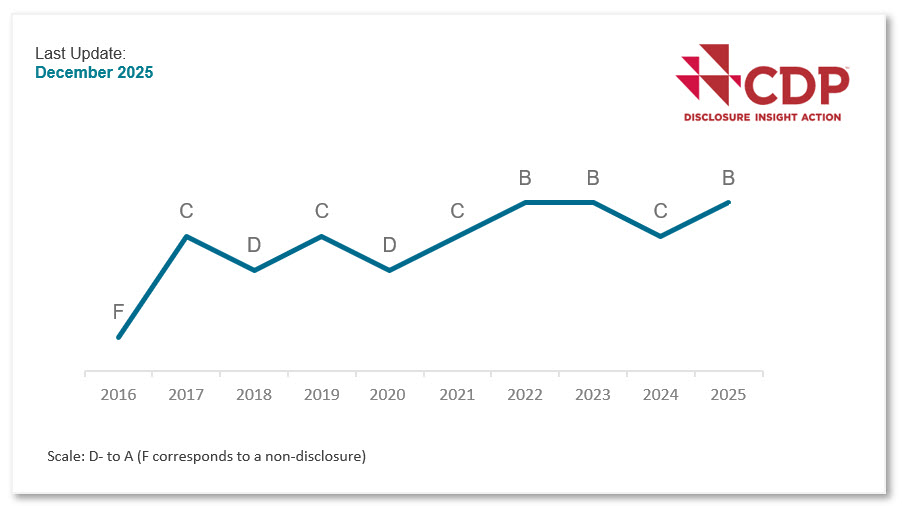

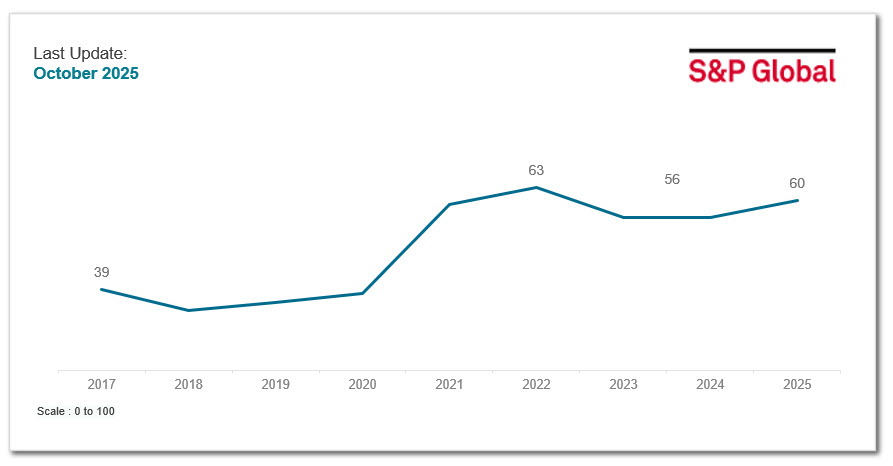

ESG Ratings