Body

SCOR Global Life SE, a subsidiary of SCOR SE, has added a new layer of protection to its current four-year mortality swap transaction with the financial services firm J.P. Morgan. Under the new, extended arrangement, SCOR will be entitled to USD 75 million in the event of a rise in mortality over the course of the period from 1 January 2009 to 31 December 2011 notably due e.g. to major pandemics, natural catastrophes or terrorist attacks.

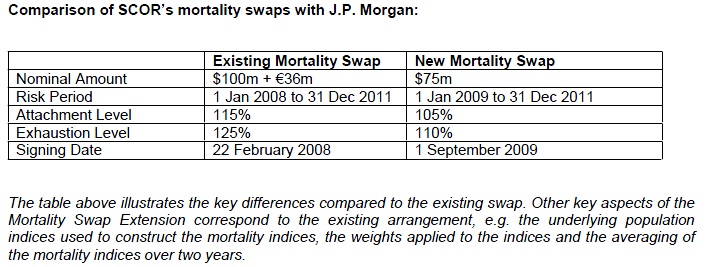

The risk swap is indexed against a weighted combination of US and European population mortality, measured over two consecutive calendar years. According to the structure of the arrangement, a payment will be triggered if, at any time during the period covered, the index exceeds 105%. At any index level between the trigger point of 105% and the exhaustion point of 110%, J.P. Morgan will pay to SCOR a pro-rata amount of the notional swap amount of USD 75 million, so that for example at an index level of 107.5%, 50% of the total amount becomes payable, and at an index level of 110% the full amount will be paid out. The risk swap is fully collateralized and thus SCOR bears no credit risk exposure.

The previous four-year mortality swap with J.P. Morgan, which was signed on 22 February 2008 provides for receipt of up to USD 100 million and EUR 36 million at any index level between the trigger point of 115% and the exhaustion point of 125%. Both transactions are indexed against a weighted combination of US and European population mortality, measured over two consecutive calendar years.

Jean-Luc Besson, Chief Risk Officer of SCOR Group, comments: “As a leading global life reinsurer with strong stakes in mortality reinsurance protection, we are taking the current threat of the Influenza A(H1N1) virus seriously. Although we currently don’t expect that the influenza virus will significantly increase mortality levels, we are convinced that pandemics could constitute material tail events for the insurance industry and may have corresponding financial repercussions on both sides of the balance sheet. With this second transaction with J.P. Morgan, SCOR demonstrates its stringent risk management.”