For the reinsurance business, climate change promises to offer growing cause for concern not only in terms of physical disruption and damage, but also with regard to the financial risks involved in transitioning to a low-carbon economy.

In this article Junaid Seria, Head of R&D and Governance, Pricing & Modelling at SCOR Global P&C, illustrates how we can assess the potential loss impacts of climate change and argues for a more prospective assessment of catastrophe models in light of observed climate trends. He calls for more collaboration in helping clients translate science around climate change and extreme events into the language of risk. He also outlines how SCOR can help clients in their transition to a low-carbon environment. Although climate change has not, to date, been a great disruptor for our industry, things will be quite different in the future.

Climate change and extreme events

In 1960 the carbon-dioxide level was 315 parts per million (ppm); unprecedented, but only 40ppm above what it had been two centuries earlier. The next 40ppm took just three decades. The 40ppm after that took just two. In 2018 we surpassed 415 ppm. This rapid increase in CO2 has translated into accelerated global temperature increases within a few decades. Climate models are only able to explain this rate of increase by considering human activities.

While the link between greenhouse gas emissions and temperature increases are established in science, the link between temperature increases and extreme events is less clear. While we cannot tell whether one event was or was not due to climate change, we can assess how much more (or less) likely types of events or event characteristics are, due to observed and projected climate trends. We do this by applying the scientific framework: (1) try to detect a trend over the background noise or natural variability and (2) try to attribute it to climate change. Emerging exposure concentrations is also a major loss driver.

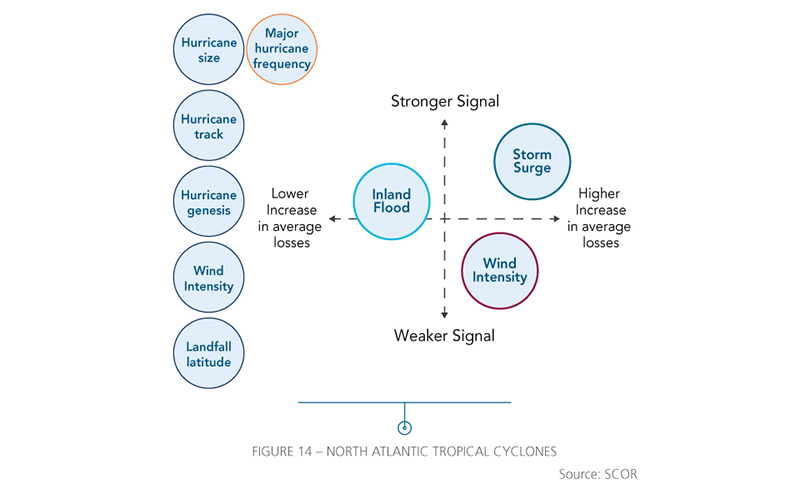

At SCOR, we started this work for US hurricanes, the most material weather peril to the global (re)insurance industry. We did this by trying to understand which characteristics of a hurricane might change in a warmer climate, but also whether observed changes are appropriately captured in our models. We reviewed the academic literature to assess the consensus view on each of these characteristics. We also partnered with software modelling vendor, KatRisk, to convert the scientific findings into loss impacts using a present-day industry portfolio. I really encourage more such collaboration between vendors and risk carriers.

While we considered a range of factors, such as hurricane genesis, frequency, track, and landfall latitude, the floodrelated factors held the most promise, in terms of lower relative uncertainty and higher impact. Given projected increases in wind intensity, rainfall rates and sea-level rises, we expect more severe flooding from hurricanes in a warmer world. These projections appear to validate well against recent experience, if we consider flooding from hurricanes in the US and Japan.

These studies help us tune our models to better reflect current climate risk and arguably forces us to think beyond our one-year time horizon. The global weather losses of 2017, 2018 and 2019 compel us to challenge our models on their skill in costing severe weather events appropriately. In fact, since 1950, if we consider global weather losses of $10 bn or more (inflation-adjusted) there have been only four years with two or more of these events in a year. All these multi weather cat years have occurred since 2004. Much of this is exposure growth, which is captured, but can we be as confident on the costing of current climate?

Despite the benefit of annual re-pricing, a more prospective assessment of models in light of climate trends may help us be less reactionary – thus serving clients better. Given the expertise required, our industry needs to join forces to extend this type of review to other perils and regions, especially for more complex perils, where there are many steps between temperature increases and genesis of the event. While end-of-century projections are of interest for society, our immediate focus is the current costing of climate perils, and the adjustments necessary to reflect non-stationary trends over the next 5-10 years.

Transition risks: what’s all the fuss about?

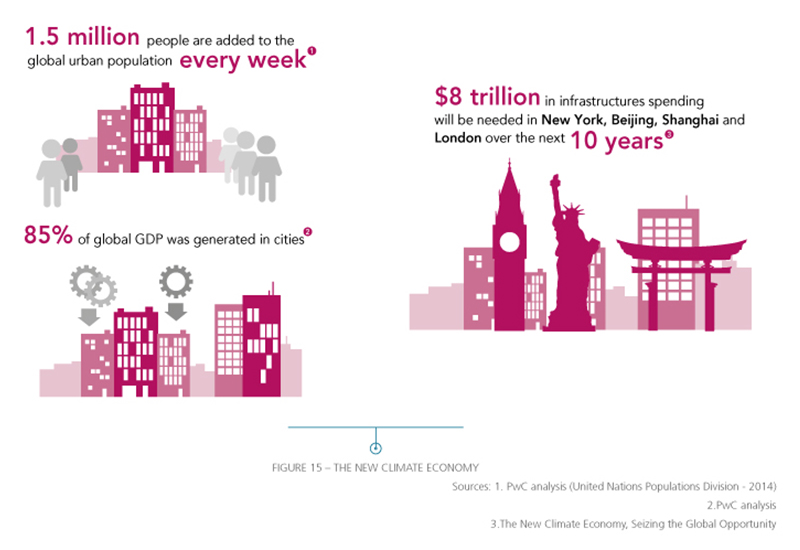

Since 1980, over the past 40 years we’ve doubled our CO2 emissions. If we want to meet the commitments under the Paris Accord we’ll need to half emissions from 40 bn tonnes to 20 bn tonnes per year, in just a decade. The later we leave it, the more negative emissions we need to stay within 2 degrees above pre-industrial temperatures. This is our great challenge of the 21st century. The Paris agreement gives governments licence to act. If we are to see radical policies to limit emissions, our carbon intensive clients will need to undergo significant business model transformation.

We need to support clients through this transition, not abandon them. There have been commitments in the past and it’s unclear if these commitments will be more successful than Rio or Kyoto. However, one does get the sense that there is a ground-swell of activism and action in several economic sectors, including our own.

Junaid Seria, Head of R&D and Governance, Pricing & Modelling, SCOR Global P&C.

Could climate change disrupt the laws of diversification?

Our business model is rather simple. We try to write risks that are uncorrelated in nature or geographically, and we try to write a lot of them. Climate change is influencing various lines of business across Life, Investments and P&C in different ways. The extent to which they will influence all of them in the same way should be a concern. Our ability to exploit the opportunities that arise from climate change will ensure our sustainability.

Regarding opportunities,

- SCOR’s underwriting teams are well-positioned to support insurance of wind across the supply chain from manufacturing of turbines to transit to construction and then also after hand-over. This sector becomes more attractive as the economics become more favourable. Parametric solutions (covering lack or excess of wind) can be attractive to windfarms to reduce volatility in their revenue. Should we see deregulation of wind electricity prices, we may see growing interest in such products.

- We see opportunities in both Solar Photovoltaic (PV) and solar thermal sectors. Further, our Alternative Solutions team for instance offers parametric solutions attached to warranty coverages.

- Melting ice caps is expected to shorten the Northwest passage from Shanghai to New York by about 4,000 km (2,500 miles) which is 19,500 km via Panama.

- Water is not the first thing we think about in terms of climate change impacts on (re)insurance, but it does offer opportunities. Climate change influences the water cycle in so far as where it rains, when it rains and how much it rains. Our Alternative Solutions team can help clients design parametric insurance solutions based on weather indices. These become more attractive with more intense (and volatile) weather, affecting for example hydro energy production and crop yields. Further, parametric index covers offer an efficient means of servicing markets under-served by traditional re/insurance.

- Forestry as a natural CO2 sink is expected to increase in demand, offering opportunity for more agriculture insurance.

- Underwriting criteria can be modified to incentivise an energy transition. This is being introduced by our Specialty Insurance Energy and Power underwriters.

The (re)insurance Industry needs to join forces to translate science around climate change and extreme events into the language of risk. We can leverage our expertise and technology to be Climate Risk Partners to the global economy and thus support an orderly transition.

Author

| Junaid is Head of R&D and Governance in the Pricing & Modelling department at SCOR Global P&C. Junaid joined SCOR in 2015. Together with scientists and actuaries in London, Paris, Zurich, Chicago and Singapore, his team conducts research, validates and builds cat models in support of Cat Pricing, Capacity Monitoring and Capital setting. Trained as an actuary, he has worked in Insurance, Reinsurance and consulting over the past 15 years with experience in Underwriting, Actuarial and Cat Risk management. He chairs the Institute and Faculty of Actuaries Cat Risk Working Party and serves as a cat modelling and climate change expert in working groups |