- The first nine months of 2018 fully demonstrate the relevance of SCOR’s strategy and the resilience of its business model, with sustained premium growth in the Group’s targeted geographical areas and business lines, excellent technical results in both Life and P&C reinsurance, and in both Treaty and Specialty, a continuing improvement in the investment income yield, a stable cost ratio that bears witness to the efficiency of the Group’s operations, and a high solvency ratio marginally above the optimal range.

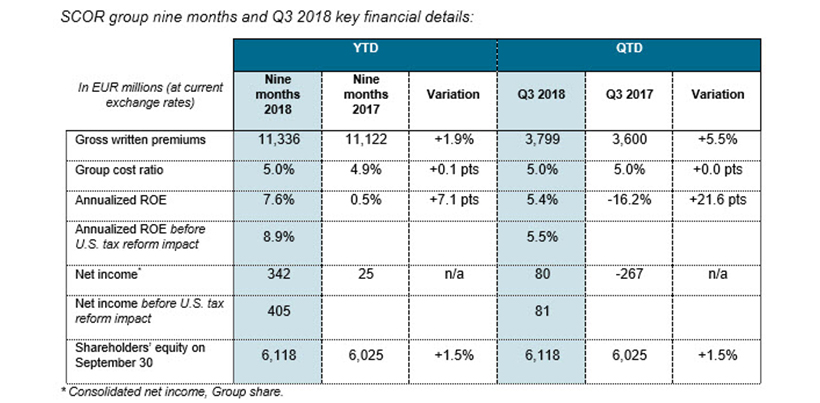

- Group net income reaches EUR 342 million for the first nine months of 2018, resulting in a return on equity (ROE) of 7.6%. The normalized[1] net income stands at

EUR 405 million and the normalized ROE reaches 8.9%, higher than the profitability target set out in the “Vision in Action” plan2.

- Gross written premiums total EUR 11,336 million in the first nine months of 2018, up 7.4% at constant FX compared to the same period in 2017. This strong growth is driven by the expanded and deepened franchise of the Group’s two divisions: Life and P&C business is up 9.2% and 5.0% respectively at constant FX.

- Technical results over the first nine months of the year are strong, as demonstrated by (1) the P&C net combined ratio of 93.6% - despite a high level of nat cat events across various regions, (2) a robust 7.0% Life technical margin, and (3) a return on invested assets of 2.5% driven by a continuing increase in the investment income yield.

- The Group’s estimated solvency ratio is 222% at September 30, 2018, marginally above the optimal range defined in the “Vision in Action” plan[2].

- Net operating cash flows are strong, standing at EUR 811 million for the first nine months of 2018, reflecting robust cash flows by both Life and P&C.

- SCOR’s financial leverage stands at 28.2% at September 30, 2018, temporarily above the range indicated in “Vision in Action”. The adjusted financial leverage ratio is 26.5% when considering the intended call of the CHF 250 million debt in November 2018[3].

- Shareholders’ equity is EUR 6,118 million at September 30, 2018. This translates into a book value per share of EUR 32.55 at September 30, 2018, compared to EUR 32.08 at June 30, 2018.

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “SCOR records a very solid performance in the first nine months of 2018. Excluding the impact of the U.S. tax reform, the Group has exceeded the targets set out in the plan “Vision in Action”, despite the numerous natural catastrophes that took place across various regions in the third quarter. This performance bears witness to the relevance of our strategy, which is based on a controlled risk appetite, a disciplined underwriting policy and an effective capital shield. The Group is in very good shape and well on track to meet the targets of “Vision in Action”.”

[1] Excluding the impact of U.S. tax reform (which was fully recognized in the second quarter of 2018). The full implementation of the new operational structure is still expected to occur before year-end, subject to standard regulatory approvals.

[2] See Appendix for “Vision in Action” targets.

[3] See press release distributed on September 10, 2013.