SCOR has continued to consistently apply its well-defined strategy and delivers a record level of net income in 2013, while maintaining a strong level of solvency.

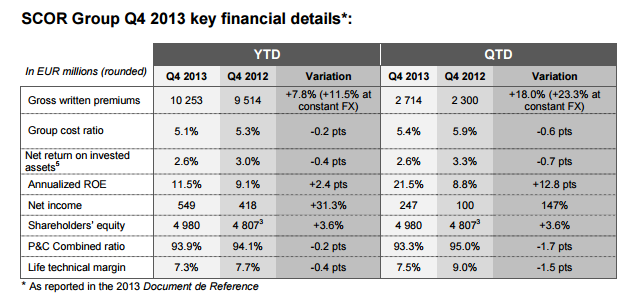

- Gross written premiums reach EUR 10 253 million, up 7.8% (11.5% at constant exchange rates), driven by healthy SCOR Global P&C renewals, major new contracts signed by SCOR Global Life and the Generali US contribution:

- SCOR Global P&C gross written premiums increase by 8.3% at constant exchange rates to EUR 4 848 million;

- SCOR Global Life gross written premiums reach EUR 5 405 million, up by 14.5% at constant exchange rates, with the Generali US acquisition contributing 4.5 percentage points and strong underlying growth of 10.2%.

- SCOR Global P&C’s 2013 net combined ratio stands at 93.9%, compared to 94.1% in 2012, in line with 2013 expectations as indicated in “Optimal Dynamics”.

- SCOR Global Life’s 2013 technical margin stands at 7.3%, compared to 7.7%2 in 2012, in line with 2013 expectations.

- Integration of Generali US is proceeding well, with an accretive contribution to the Q4 technical margin and a gain on purchase net of acquisition-related expenses of EUR 183 million recorded in the quarter.

- SCOR Global Investments achieves a 3.1% ongoing return on invested assets (excluding equity impairments), in line with its prudent investment strategy.

- Notable improvement in the Group cost ratio to 5.1%, from 5.3% in 2012.

- Operating cashflow generation of EUR 897 million, up 18% compared to 2012, with increased contributions from both the P&C and life business engines.

- SCOR delivers net income of EUR 549 million in 2013, a 31% increase over 2012, with a return on equity (ROE) of 11.5%.

- Shareholders’ equity stands at EUR 4 980 million at 31 December 2013 compared to EUR 4 807 million3 at 31 December 2012. Book value per share increases to EUR 26.64 at 31 December 2013, compared to EUR 26.163 at 31 December 2012.

- 2013 solvency ratio, according to the Group’s internal model, stands at 221%, at the top end of the “Optimal Dynamics” target range of 185-220%4.

- Proposed dividend of EUR 1.30 per share for 20131, up from EUR 1.20 for 2012, confirming SCOR’s superior risk/return value proposition to its shareholders and representing a payout ratio of 44%. SCOR has paid stable or increasing dividends since 2005. The proposed ex-dividend for 2013 will be set at EUR 1.30 on 12 May 2014 and the dividend will be paid on 15 May 2014.

1 2013 dividend subject to approval of the Shareholders’ Annual General Meeting on May 6, 2014.

2 2012 includes 0.3 pts of non-recurring items linked to GMDB run-off portfolio reserve release and 2013 includes 0.1 pt.

3 Shown shareholders’ equity is restated due to the retrospective application of IAS 19 “revised”. Q4 2012 published shareholders’ equity amounted to EUR 4,810 million and Q4 2012 published BVPS amounted to EUR 26.18.

4 Ratio of available capital over SCR, projected solvency ratio including Generali US.

5 Including equity impairments.

6 See press release of 01 October 2013.

7 See press release of 04 December 2013.

8 See press release of 23 December 2013.

9 See press release of 21 November 2013.

10 TSR: Total Shareholder Returns: represents the share price appreciation + dividends paid out.

11 See press release of 06 January 2014.

12 See press release of 05 February 2014.