Body

In the first nine months of 2016, SCOR continues to deliver high quality results in terms of earnings, profitability and cash flow generation. During the third quarter of 2016, both targets of the new strategic plan “Vision in Action” - profitability and solvency - have been achieved.

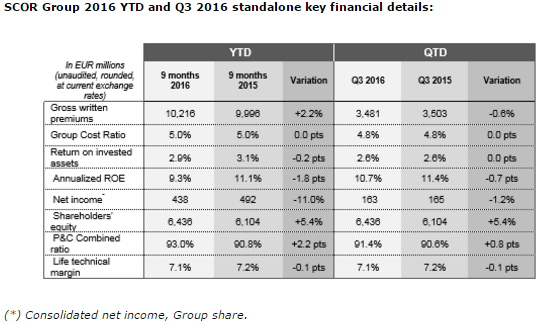

- Gross written premiums reach EUR 10,216 million at the end of the first nine months of 2016, up 4.4% at constant exchange rates compared to the first nine months of 2015 (+2.2% at current exchange rates), with:

- a strong contribution from SCOR Global Life, with gross written premiums reaching EUR 5,982 million over the period (+7.8% at constant exchange rates and +6.1% at current exchange rates);

- stable SCOR Global P&C gross written premiums at constant exchange rates (-0.1% at constant exchange rates, -2.8% at current exchange rates), standing at EUR 4,234 million in the first nine months of 2016.

- SCOR Global P&C records strong technical profitability in the first nine months of 2016 with a net combined ratio of 93.0%.

- SCOR Global Life records a robust technical margin of 7.1% in the first nine months of 2016.

- SCOR Global Investments achieves a solid return on invested assets of 2.9% in the first nine months of 2016, while implementing the normalization of the asset management policy.

- Group net income reaches EUR 438 million in the first nine months of 2016, down 11.0% compared to the first nine months of 2015 due to a higher number of natural catastrophes and a challenging macroeconomic environment. The annualized return on equity (ROE) stands at 9.3% in the first nine months of 2016, or 855 basis points above the risk-free rate1.

- The business model delivers a robust operating cash flow of EUR 1.3 billion as at 30 September 2016, compared to EUR 558 million for the same period in 2015. This results from the generation of strong recurring cash flows in 2016 and two exceptional items: SCOR Global P&C received a non-recurring fund withheld payment of around EUR 300 million, and SCOR Global Life benefitted from a timing difference in claims payments, which is expected to normalize by the end of 2016.

- Shareholders’ equity stands at EUR 6,436 million at 30 September 2016, compared to EUR 6,363 million at 31 December 2015 after the payment of EUR 278 million of dividends for the year 2015. This translates into a book value per share of EUR 34.65 at 30 September 2016.

- SCOR’s financial leverage stands at 25.1% at 30 September 2016.

- SCOR’s estimated solvency ratio at 30 September 2016 stands at 212%, within the optimal solvency range of 185%-220% as defined in the “Vision in Action” plan.

During the third quarter of 2016, SCOR launched its new strategic plan “Vision in Action”2, after having fully achieved the targets of its previous plan, “Optimal Dynamics”. “Vision in Action” relies on three dynamics to enhance its profitability and its solvency: build on the continuity and the consistency of previous plans, expand and deepen the franchise and normalize the asset management policy.

During the quarter, the successful redemption of two debts (EUR 350 million and CHF 650 million undated subordinated note lines), and the fact that their prefinancing benefitted from exceptional market conditions demonstrate both SCOR’s capacity to actively manage its financing and the quality of the Group’s franchise on the financial markets.

In September, SCOR’s insurance financial strength rating was upgraded by Moody’s to Aa3 from A1, with a stable outlook3. This upgrade reflects (i) SCOR’s improved franchise, (ii) its diversified business profile and lower exposure than peers to the segments currently under the most pricing pressure, (iii) the high stability of its profits and (iv) its strong and stable capitalisation. Taking all sectors into consideration and excluding government-related entities, SCOR is now the only company to have three “AA” ratings4 in France.

In October, for the second consecutive year, SCOR was named “North American Life Reinsurer of the Year 2016” by Reactions Magazine5, confirming the Group’s reinforced leadership in the US individual Life market.

A few days later, SCOR was named “Life Reinsurer of the Year 2016” by Asia Insurance Review6. This prestigious award is a recognition of SCOR’s success story in Asia-Pacific, where the Group has built a strong Life reinsurance platform to service its customers, with strong local presence and expertise.

Denis Kessler, Chairman & CEO of SCOR, comments: “Considering the extremely low interest rate environment, SCOR has delivered strong results since the beginning of 2016, in terms of profitability, solvency and cash flow generation. In the third quarter of 2016, the first quarter in which our plan “Vision in Action” has been implemented, the profitability and solvency targets have both been achieved. During the quarter, and following the upgrades to AA- in 2015 by Standard & Poor’s and Fitch, the upgrade of SCOR’s financial strength rating to Aa3 by Moody’s underscored the relevance of the Group’s strategy and business model. Finally, SCOR was recently named “Life Reinsurer of the Year 2016” in both the US and Asia. SCOR is well positioned to meet the needs of its clients throughout the world, and actively implementing its new strategic plan and is preparing the year-end renewals.”

1 Based on a 5-year rolling average of 5-year risk-free rates over the cycle, according to the new methodology disclosed with the “Vision in Action” strategic plan.

2 See the press release distributed on 7 September 2016.

3 See the press release distributed on 23 September 2016.

4 SCOR is rated AA- by Standard & Poor’s and Fitch, and Aa3 by Moody’s with a stable outlook. SCOR is rated A by AM Best, with a positive outlook.

5 See the press release distributed on 6 October 2016.

6 See the press release distributed on 17 October 2016.