Body

- SCOR delivers disciplined growth in the first half of 2018 through development of the Life franchise in Asia-Pacific and Financial Solutions, and successful P&C renewals with continued price and volume improvements.

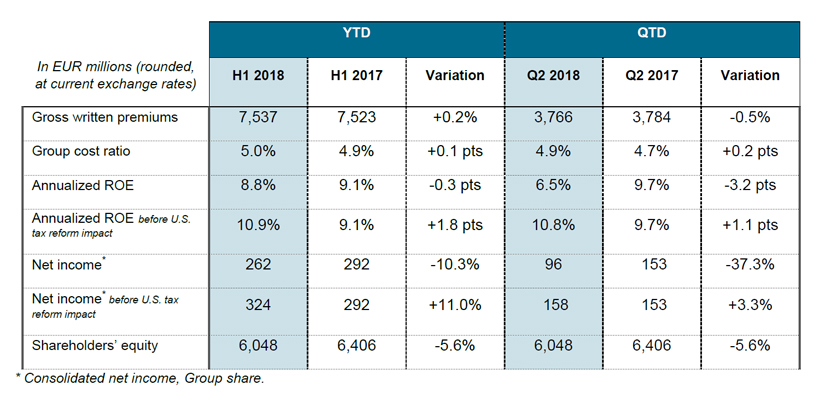

- Group net income reaches EUR 262 million for H1 2018. The annualized return on equity (ROE) is 8.8%, 804 bps above the 5-year risk-free-rate. Excluding the impact of U.S. tax reform of USD 75 million (EUR 62 million), net income would be EUR 324 million, which would be an increase of 11.0% compared to H1 2017, and the ROE would be 10.9%, demonstrating the strong core earnings of the Group.

- Gross written premiums total EUR 7,537 million, up 8.2% at constant FX compared to H1 2017 resulting from growth in both Life and P&C, which are up 10.5% and 4.9% respectively at constant FX compared to H1 2017.

- Technical results are strong, with a superior 91.4% P&C net combined ratio and a robust 6.9% Life technical margin, and a return on invested assets of 2.5% driven by a continuing increase in the income yield.

- The estimated solvency ratio is strong, standing at 221% at June 30, 2018, marginally above the optimal range of 185% - 220% defined in the “Vision in Action”1 plan.

- Net operating cash flows are EUR 253 million for the first half of 2018, reflecting strong cash flow by Life, partially offset by P&C payments on 2017 catastrophes.

- SCOR’s financial leverage stands at 28.4% at June 30, 2018, temporarily above the range indicated in “Vision in Action”. The adjusted financial leverage ratio is 26.6% when considering the intended call of the CHF 250 million debt in November 20182.

- One third of the EUR 200 million share buy-back program has been executed (EUR 67 million), and completion remains on track for July 2019.

- Shareholders’ equity is EUR 6,048 million at June 30, 2018, compared to EUR 6,225 million at December 31, 2017, after dividend payment of EUR 312 million. This translates into a book value per share of EUR 32.08 at June 30, 2018, compared to EUR 33.01 at December 31, 2017.

- The recent U.S. tax reform has required SCOR to implement certain changes to its operational structure. The accounting charge stemming from the implementation of SCOR’s new operational structure is accounted for in Q2 2018 and represents a total expense of USD 75 million (EUR 62 million), in the lower end of the USD 0 - 350 million range that had been communicated in SCOR’s full-year 2017 disclosure3. SCOR still expects the implementation of the new operational structure to be completed in H2 2018, subject to standard regulatory approvals. The Group expects a limited impact on the solvency ratio.

SCOR Group H1 and Q2 2018 key financial details

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “SCOR delivers strong results in the first six months of 2018, outperforming both its profitability and solvency targets. The Group continues to deliver disciplined and profitable growth, with both the Life and P&C divisions expanding their footprints in targeted territories and business lines and delivering robust technical profitability. Through the execution of its share buy-back program, the Group reaffirms its confidence in the strength of its underlying fundamentals, excellent ratings and optimal debt leverage. As we progress through the year, our firm focus on the Group’s profitability and solvency targets ensures stability for our clients and lasting value for our shareholders.”

1 See Appendix for “Vision in Action” targets.

2 See press release distributed on September 10, 2013.

3 See press release distributed on February 22, 2018.