-

SCOR SE Canada Branch

A leading provider of reinsurance in Canada

-

About SCOR

As a leading global reinsurer, SCOR offers its clients a diversified and innovative range of reinsurance and insurance solutions and services to control and manage risk. Applying “The Art & Science of Risk”, SCOR uses its industry-recognized expertise and cutting-edge financial solutions to serve its clients and contribute to the welfare and resilience of society.

The Group generated premiums of EUR 20.1 billion in 2024 and serves clients in more than 150 countries from its 37 offices worldwide.

For more information, visit: www.scor.com

-

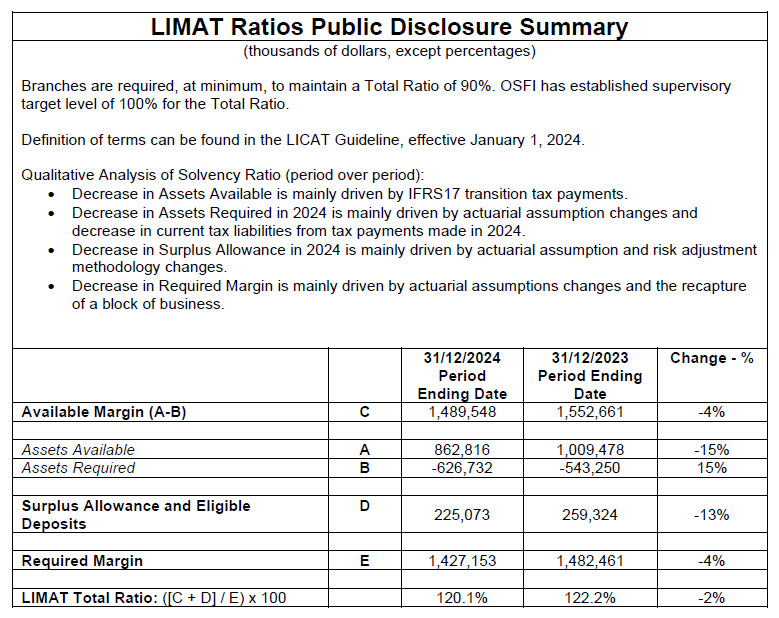

Minimum Capital Requirements for the reporting period ending December 31, 2024

The operations of the SCOR Group (“SCOR” or “the Group”), its subsidiaries and branches are subject to the regulatory requirements of the countries in which they operate. These rules are not limited to the authorization and monitoring of activities but also include strict provisions (for instance, minimum capital) to honor obligations and limit the risk of default and insolvency due to unforeseen events.

SCOR SE, Canadian Branch (“the Branch”) is subject to the regulations set forth by the Office of the Superintendent of Financial Institutions (“OSFI”). In accordance with the Superintendent’s regulations and guidelines, the Branch is required to maintain a minimum level of assets, depending on the type and amount of reinsurance policies in effect and on the nature of the Branch’s assets. OSFI oversees the distribution of the Branch’s income by monitoring compliance with the minimum margin requirements.

As part of its asset management, the Branch pursues sound capitalization and solvency objectives to ensure asset protection, meet the requirements established by OSFI and support development and growth.

To reach its objectives, the Branch has adopted sound asset management, business and financial practices to support its strategic directions and financial targets and maintain an adequate margin of assets over liabilities. Internal policies include the following:

- The preparation, follow-up and filing of short term and long-term financial forecasts with the Group’s management indicating financial and regulatory margin requirements;

- An investment policy providing, in particular, for the management of the assets and liabilities maturities to limit the risks related to the mismatching of assets and liabilities and to manage required regulatory margins;

- Product pricing reviews.

As part of the Group, the Branch has established a risk management system whose prime objectives are to identify, measure, monitor, manage and report exposure to strategic, underwriting, market, credit, liquidity, operational, retrocession and emerging risks and to maintain these exposures within acceptable limits. It is comprised of 1) a Risk Appetite Framework, which defines the types of risk SCOR is willing to accept as well as related risk tolerance limits, and 2) an Enterprise Risk Management Framework which covers a range of risk management mechanisms to ensure that the risk profile is dynamically optimized whilst remaining aligned with the risk appetite. In particular, control mechanisms, including risk management policies and various risk limits, are in place to manage all types of risks.

The Branch management is provided with regular risk reports that include a snapshot of the key risks that SCOR is exposed to and their trends, as well as an assessment whether these risks are qualitatively or quantitatively in line with SCOR’s strategy and risk appetite.

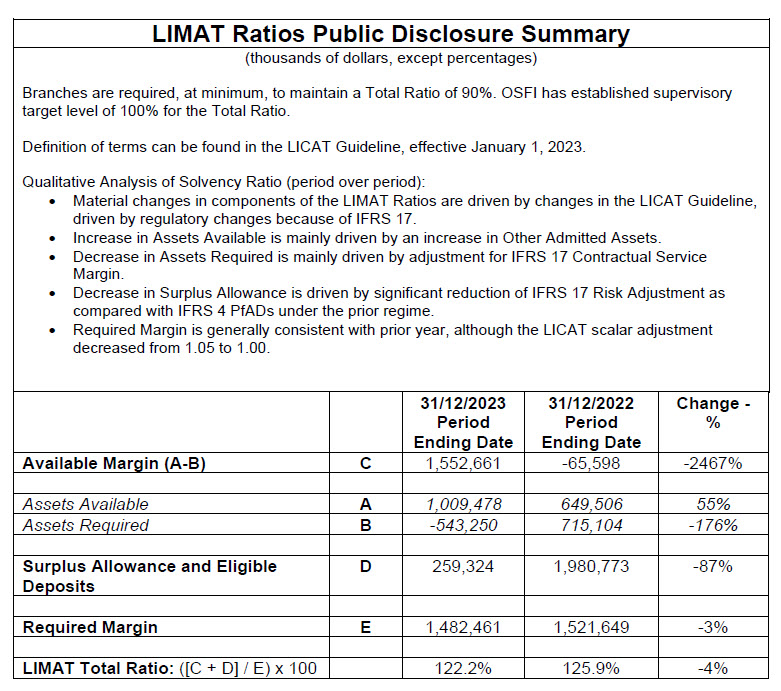

Minimum Capital Requirements for the reporting period ending December 31, 2023

The operations of the SCOR Group (“SCOR” or “the Group”), its subsidiaries and branches are subject to the regulatory requirements of the countries in which they operate. These rules are not limited to the authorization and monitoring of activities but also include strict provisions (for instance, minimum capital) to honor obligations and limit the risk of default and insolvency due to unforeseen events.

SCOR SE, Canadian Branch (“the Branch”) is subject to the regulations set forth by the Office of the Superintendent of Financial Institutions (“OSFI”). In accordance with the Superintendent’s regulations and guidelines, the Branch is required to maintain a minimum level of assets, depending on the type and amount of reinsurance policies in effect and on the nature of the Branch’s assets. OSFI oversees the distribution of the Branch’s income by monitoring compliance with the minimum margin requirements.

As part of its asset management, the Branch pursues sound capitalization and solvency objectives to ensure asset protection, meet the requirements established by OSFI and support development and growth.

To reach its objectives, the Branch has adopted sound asset management, business and financial practices to support its strategic directions and financial targets and maintain an adequate margin of assets over liabilities. Internal policies include the following:

- The preparation, follow-up and filing of short term and long-term financial forecasts with the Group’s management indicating financial and regulatory margin requirements;

- An investment policy providing, in particular, for the management of the assets and liabilities maturities to limit the risks related to the mismatching of assets and liabilities and to manage required regulatory margins;

- Product pricing reviews.

As part of the Group, the Branch has established a risk management system whose prime objectives are to identify, measure, monitor, manage and report exposure to strategic, underwriting, market, credit, liquidity, operational, retrocession and emerging risks and to maintain these exposures within acceptable limits. It is comprised of 1) a Risk Appetite Framework, which defines the types of risk SCOR is willing to accept as well as related risk tolerance limits, and 2) an Enterprise Risk Management Framework which covers a range of risk management mechanisms to ensure that the risk profile is dynamically optimized whilst remaining aligned with the risk appetite. In particular, control mechanisms, including risk management policies and various risk limits, are in place to manage all types of risks.

The Branch management is provided with regular risk reports that include a snapshot of the key risks that SCOR is exposed to and their trends, as well as an assessment whether these risks are qualitatively or quantitatively in line with SCOR’s strategy and risk appetite.

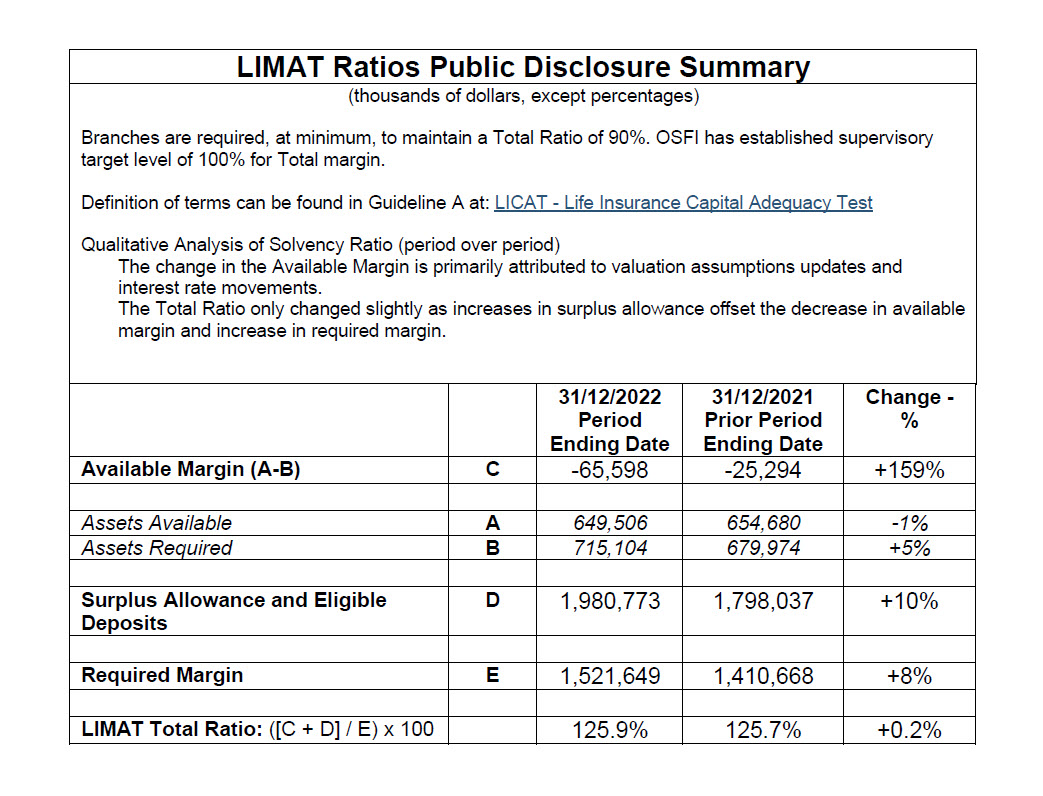

Minimum Capital Requirements for the reporting period ending December 31, 2022

The operations of the SCOR Group (“SCOR” or “the Group”), its subsidiaries and branches are subject to the regulatory requirements of the countries in which they operate. These rules are not limited to the authorization and monitoring of activities but also include strict provisions [for instance, minimum capital] to honor obligations and limit the risk of default and insolvency due to unforeseen events.

SCOR SE Canadian Branch (“the Branch”) is subject to the regulations set forth by the Office of the Superintendent of Financial Institutions (“OSFI”). In accordance with the Superintendent’s regulations and guidelines, the Branch is required to maintain a minimum level of assets, depending on the type and amount of reinsurance policies in effect and on the nature of the Branch’s assets. OSFI oversees the distribution of the Branch’s income by monitoring compliance with the minimum margin requirements.

As part of its asset management, the Branch pursues sound capitalization and solvency objectives to ensure asset protection, meet the requirements established by OSFI and support development and growth.

To reach its objectives, the Branch has adopted sound asset management, business and financial practices to support its strategic directions and financial targets and maintain an adequate margin of assets over liabilities. Internal policies include the following:

- The preparation, follow-up and filing of short term and long-term financial forecasts with the Group’s management indicating financial and regulatory margin requirements;

- An investment policy providing, in particular, for the management of the assets and liabilities maturities to limit the risks related to the mismatching of assets and liabilities and to manage required regulatory margins;

- Product pricing reviews.

As part of the Group, the Branch has established a risk management system whose prime objectives are to identify, measure, monitor, manage and report exposure to strategic, underwriting, market, credit, liquidity, operational, retrocession and emerging risks and to maintain these exposures within acceptable limits. It is comprised of 1) a Risk Appetite Framework, which defines the types of risk SCOR is willing to accept as well as related risk tolerance limits, and 2) an Enterprise Risk Management Framework which covers the range of Risk Management mechanisms to ensure that the risk profile is dynamically optimized whilst remaining aligned with the risk appetite framework. In particular, control mechanisms, including risk management policies and various risk limits, are in place to manage the risks.

Branch management is provided with regular risk reports that include a snapshot of the key risks that SCOR is exposed to and their trends, as well as an assessment whether these risks are qualitatively or quantitatively in line with SCOR’s strategy and Risk Appetite Framework.

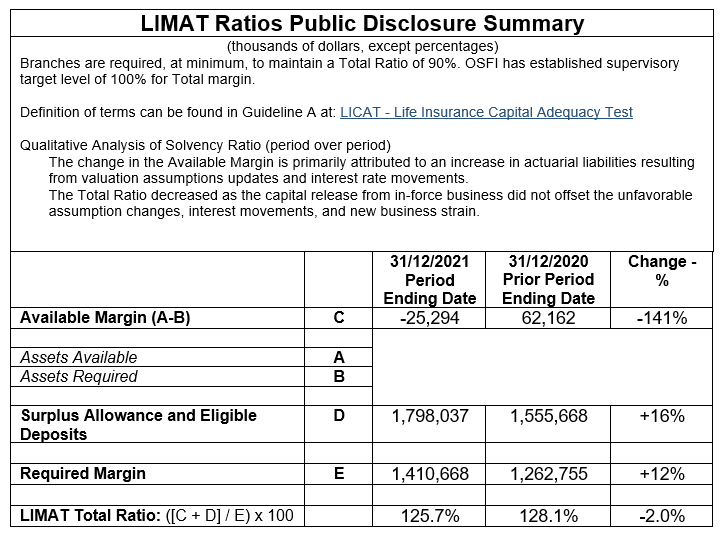

Minimum capital management requirements for the reporting period ending December 31, 2021

The operations of the SCOR Group (“SCOR” or “the Group”), its subsidiaries and branches are subject to the regulatory requirements of the countries in which they operate. These rules are not limited to the authorization and monitoring of activities but also include strict provisions [for instance, minimum capital] to honor obligations and limit the risk of default and insolvency due to unforeseen events.

SCOR SE Canadian Branch (“the Branch”) is subject to the regulations set forth by the Office of the Superintendent of Financial Institutions (“OSFI”). In accordance with the Superintendent’s regulations and guidelines, the Branch is required to maintain a minimum level of assets, depending on the type and amount of reinsurance policies in effect and on the nature of the Branch’s assets. OSFI oversees the distribution of the Branch’s income by monitoring compliance with the minimum margin requirements.

As part of its asset management, the Branch pursues sound capitalization and solvency objectives to ensure asset protection, meet the requirements established by OSFI and support development and growth.

To reach its objectives, the Branch has adopted sound asset management business and financial practices to support its strategic directions and financial targets and maintain an adequate margin of assets over liabilities. Internal policies include the following:

- The preparation, follow-up and filing of short term and long-term financial forecasts with the Group’s management indicating financial and regulatory margin requirements;

- An investment policy providing, in particular, for the management of the assets and liabilities maturities to limit the risks related to the mismatching of assets and liabilities and to manage required regulatory margins;

- Product pricing reviews.

As part of the Group, the Branch has established a risk management system whose prime objectives are to identify, measure, monitor, manage and report exposure to strategic, underwriting, market, credit, liquidity, operational, retrocession and emerging risks and to maintain these exposures within acceptable limits. It is comprised of 1) a Risk Appetite Framework, which defines the types of risk SCOR is willing to accept as well as related risk tolerance limits, and 2) an Enterprise Risk Management Framework which covers the range of Risk Management mechanisms to ensure that the risk profile is dynamically optimized whilst remaining aligned with the risk appetite framework. In particular, control mechanisms, including risk management policies and various risk limits, are in place to manage the risks.

Branch management is provided with regular risk reports that include a snapshot of the key risks that SCOR is exposed to and their trends, as well as an assessment whether these risks are qualitatively or quantitatively in line with SCOR’s strategy and Risk Appetite Framework.

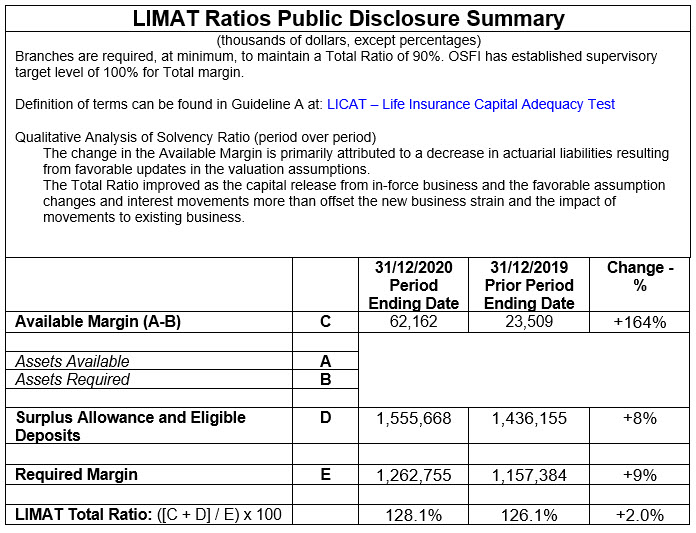

Minimum capital management requirements for the reporting period ending December 31, 2020

The operations of the SCOR Group (“the Group”), its subsidiaries and branches are subject to the regulatory requirements of the countries in which they operate. These rules are not limited to the authorization and monitoring of certain activities but also include strict provisions [for instance, minimum share capital] to honour unforeseen obligations and limit the risk of default and insolvency.

SCOR SE Canadian Branch (“the Branch”) is subject to the regulations set forth by the Office of the Superintendent of Financial Institutions (“OSFI”). In accordance with the Superintendent’s regulations and guidelines, the Branch is required to maintain a prescribed level of assets, depending on the type and amount of reinsurance policies in effect and on the nature of the Branch’s assets. OSFI oversees the distribution of the Branch’s income by monitoring compliance with the minimum margin requirements.

As part of its asset management, the Branch pursues sound capitalization and solvency objectives to ensure asset protection, meet the requirements established by OSFI and encourage development and growth.

To reach its objectives, the Branch has adopted sound asset management business and financial practices to support its strategic directions and financial targets and maintain an adequate margin. Internal policies are as follows:

- The preparation, follow-up and filing of short term and long-term financial forecasts with the Group’s management indicating financial and regulatory margin requirements;

- An investment policy providing, in particular, for the management of the asset and liability maturities to limit the risks related to the mismatching of assets and liabilities and manage required regulatory margins;

- Product pricing reviews.

As part of the Group, the Branch has established a risk management system whose prime objectives are to identify, measure, monitor, manage and report exposure to underwriting, strategic, market, credit, liquidity, operational, retrocession and emerging risks and to maintain these exposures within acceptable limits. It comprised by 1) a Risk Appetite Framework, which defines the types of risks SCOR is willing to accept as well as related risk tolerance limits, and 2) an Enterprise Risk Management Framework which is the range of Risk Management mechanisms which help to ensure that the risk profile is dynamically optimized whilst remaining aligned with the risk appetite framework. Control mechanisms, including risk management policies and various risk limits, are in place to manage the risks.

Branch management is provided with regular risk reports that include a snapshot of the key risks that SCOR is exposed to and their trends, as well as an assessment whether these risks are qualitatively or quantitatively in line with SCOR’s strategy and Risk Appetite Framework.

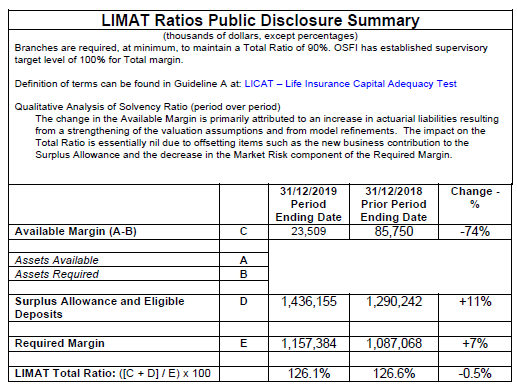

Minimum capital management requirements for the reporting period ending December 31, 2019

The operations of the SCOR Group (“the Group”), its subsidiaries and branches are subject to the regulatory requirements of the countries in which they operate. These rules are not limited to the authorization and monitoring of certain activities but also include strict provisions [for instance, minimum share capital] to honour unforeseen obligations and limit the risk of default and insolvency.

SCOR SE Canadian Branch (“the Branch”) is subject to the regulations set forth by the Office of the Superintendent of Financial Institutions (“OSFI”). In accordance with the Superintendent’s regulations and guidelines, the Branch is required to maintain a prescribed level of assets, depending on the type and amount of reinsurance policies in effect and on the nature of the Branch’s assets. OSFI oversees the distribution of the Branch’s income by monitoring compliance with the minimum margin requirements.

As part of its asset management, the Branch pursues sound capitalization and solvency objectives to ensure asset protection, meet the requirements established by OSFI and encourage development and growth.

To reach its objectives, the Branch has adopted sound asset management business and financial practices to support its strategic directions and financial targets and maintain an adequate margin. Internal policies are as follows:

- The preparation, follow-up and filing of short term and long-term financial forecasts with the Group’s management indicating financial and regulatory margin requirements;

- An investment policy providing, in particular, for the management of the asset and liability maturities to limit the risks related to the mismatching of assets and liabilities and manage required regulatory margins;

- Product pricing reviews.

As part of the Group, the Branch has established a risk management system whose prime objectives are to identify, measure, monitor, manage and report exposure to underwriting, strategic, market, credit, liquidity, operational, retrocession and emerging risks and to maintain these exposures within acceptable limits. It comprised by 1) a Risk Appetite Framework, which defines the types of risks SCOR is willing to accept as well as related risk tolerance limits, and 2) an Enterprise Risk Management Framework which is the range of Risk Management mechanisms which help to ensure that the risk profile is dynamically optimized whilst remaining aligned with the risk appetite framework. Control mechanisms, including risk management policies and various risk limits, are in place to manage the risks.

Branch management is provided with quarterly risk reports that include a snapshot of the key risks that SCOR is exposed to and their trends, as well as an assessment whether these risks are qualitatively or quantitatively in line with SCOR’s strategy and Risk Appetite Framework.Minimum Capital Management Requirements For the Reporting Period Ending December 31, 2018

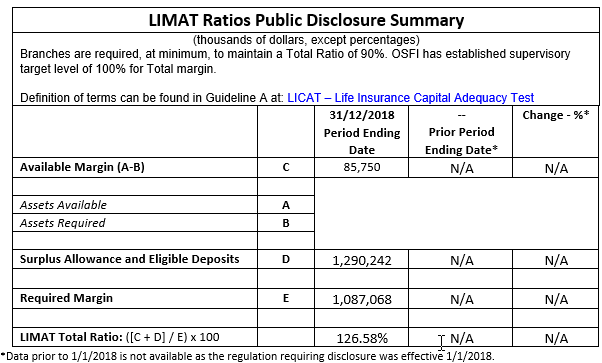

The operations of the SCOR Group (“the Group”), its subsidiaries and branches are subject to the regulatory requirements of the countries in which they operate. These rules are not limited to the authorization and monitoring of certain activities but also include strict provisions [for instance, minimum share capital] to honour unforeseen obligations and limit the risk of default and insolvency.

SCOR Global Life Canadian Branch (“the Branch”) is subject to the regulations set forth by the Office of the Superintendent of Financial Institutions (“OSFI”). In accordance with the Superintendent’s regulations and guidelines, the Branch is required to maintain a prescribed level of assets, depending on the type and amount of reinsurance policies in effect and on the nature of the Branch’s assets. OSFI oversees the distribution of the Branch’s income by monitoring compliance with the minimum margin requirements.

As part of its asset management, the Branch pursues sound capitalization and solvency objectives to ensure asset protection, meet the requirements established by OSFI and encourage development and growth.

To reach its objectives, the Branch has adopted sound asset management business and financial practices to support its strategic directions and financial targets and maintain an adequate margin. Internal policies are as follows:

- The preparation, follow-up and filing of short term and long-term financial forecasts with the Group’s management indicating financial and regulatory margin requirements;

- An investment policy providing, in particular, for the management of the asset and liability maturities to limit the risks related to the mismatching of assets and liabilities and manage required regulatory margins;

- Product pricing reviews.

As part of the Group, the Branch has established a risk management system whose prime objectives are to identify, measure, monitor, manage and report exposure underwriting, strategic, market, credit, liquidity, operational, retrocession and emerging risks to maintain these exposures within acceptable limits.

It comprised by:

- a Risk Appetite Framework, which defines the types of risks SCOR is willing to accept as well as related risk tolerance limits, and

- an Enterprise Risk Management Framework which is the range of Risk Management mechanisms which help to ensure that the risk profile is dynamically optimized whilst remaining aligned with the risk appetite framework. Control mechanisms, including risk management policies and various risk limits, are in place to manage the risks.

Branch management is provided with quarterly risk reports that include a snapshot of the key risks that SCOR is exposed to and their trends, as well as an assessment whether these risks are qualitatively or quantitatively in line with SCOR’s strategy and Risk Appetite Framework.