David

Ferguson

Underwriting and Claims Development Manager

December 27, 2024

When the Association of British Insurers (ABI) in the UK published its protection claims paid statistics for 2022 in May this year, it confirmed that insurers paid out £6.85 billion to support individuals and families and stated that the vast majority of claims are paid1. They commented that ‘Individual policies paid out 287,000 life insurance, income protection and critical illness claims in 2022, totalling £4.64 billion. The average pay-out from these policies increased for the third year in a row, from £14,931 to £15,448 (9%). Group policies, which provide protection products through an employer, paid out £2.21 billion in claims.’

1.Protection insurers pay out £6.85 billion in 2022 to support individuals and families | ABI

It further stated that ‘The number of new individual claims paid has remained consistent at around 98% since 2017. In more than half of the declined claims, customers had not told their insurer key details about themselves or their circumstances when they took out the policy.’ This is very positive news and is a sign that the industry protects individuals and families at their time of greatest need. But it’s also worth looking at how the industry is performing in other ways. One way to consider this is through published complaints data. There are many sources of complaints data including individual protection provider data based on complaints insurers receive from their customers. A very important source for the industry is the data that is reported by the Financial Ombudsman Service (FOS) through its periodic updates and annual complaints data.

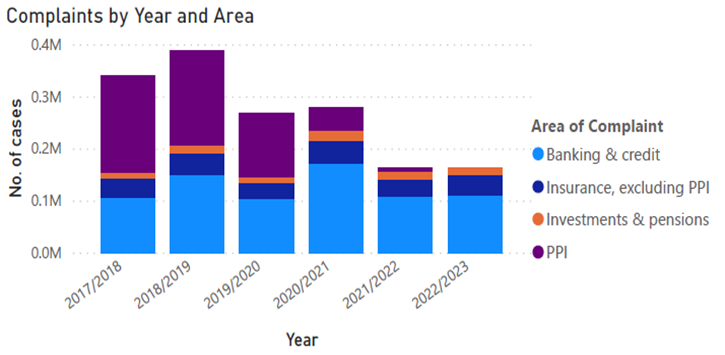

In September, SCOR compiled a summary of annual complaints data by the UK Ombudsman. For the year ended 31st March 2023, The Ombudsman reported a total of 163,749 complaints to its service across all financial products.

Complaints for Banking and credit products have fluctuated since 2018, reaching their lowest point in 2022 and rising only slightly to 110,023 for the current year.

Complaints about Insurance products are stable year-on-year but rose by roughly 20% from 33,127 last year to 39,730 for the current year. The highest number of complaints was 42,346 in 2019. There were 13,996 complaints about Investments and pensions.

PPI complaints have fallen away from an extraordinary 'high' of 186,417 in 2017/2018. Last year there were only 5,300 complaints and the Ombudsman has not reported any for the current year given that the deadline to submit complaints about this product has long since passed.

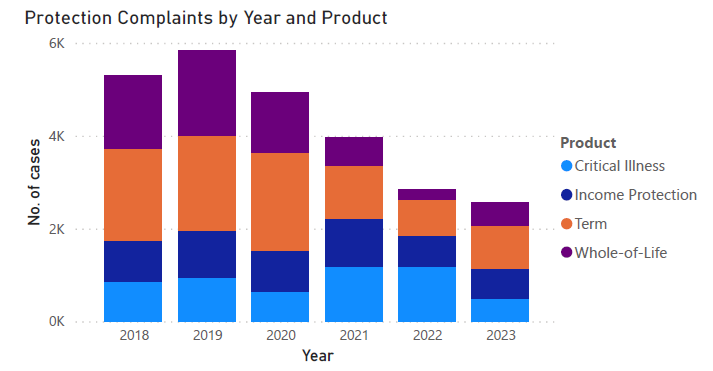

Focusing on Protection products specifically, since 2018, there has been a clear downward trend; from a starting point of 5,291 in 2018, they now stand at 2,563 for the current year, down from 2,850 last year.

The largest fall has been in Critical Illness Insurance complaints from 1,183 last year to just 498 in 2023, while Term Assurance complaints have increased slightly, and Income Protection complaints have remained fairly static.

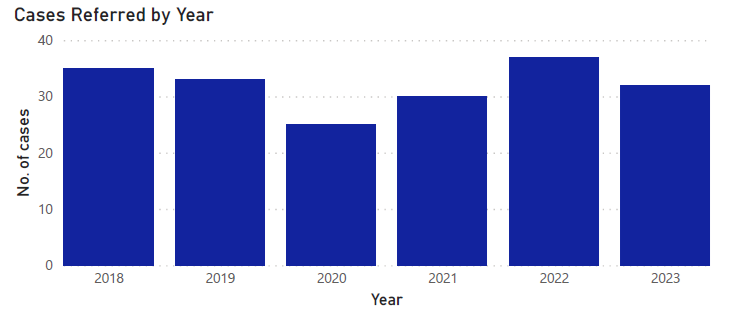

We closely monitor the effect of claims referred to the Ombudsman on polices reinsured with SCOR. In the year ended 31st March 2023, there were 7,541 new notified claims to SCOR, down slightly from 7,687 last year. 243 claims (4.6%) of these claims were declined.

The total number of reinsured cases referred to the Ombudsman was 32, down from 37 last year. Just 2 claims were upheld in favour of the customer representing an uphold rate of 6.3% and a total sum reinsured of £126,250. These two claims were for Critical Illness where there was, in the Ombudsman’s view, insufficient evidence to deny a claim for Benign brain tumour (a highly technical argument on the policy definition) and no persuasive evidence that the claimant had misrepresented a history of hypertension in a claim for Heart attack.

This means that just 0.4% of claims reinsured with SCOR were referred to the Ombudsman showing that our clients are making the right decisions to decline in the vast majority of claims. SCOR's experience at the Ombudsman remains very positive with a low number of cases referred since 2018.The lowest number of cases occurred in 2020 and it is encouraging to see the number of cases of misrepresentation fall this year compared to 2022. The low uphold rate shows that our clients continue to make the right decision on the majority of claims.

The protection industry can justifiably view its claims paid and declined statistics and Ombudsman data, positively. Overall, the industry does a good job at protecting individuals and their families and the complaints data from at least one source is a further sign that the industry performs well, but clearly the industry can always do more to help vulnerable customers. We must therefore acknowledge that where claims are not paid, this has a negative impact on individuals and their families, and the industry must always look for ways to continue to deliver better customer outcomes through:

This is exactly why continuous improvements and changes to coverage under products such as critical and terminal illness insurance are so important and why in particular, we welcome the FCA review of terminal illness, mentioned in our TI article in this edition. We will continue to monitor these trends in 2024 and beyond as the industry strives to ensure better outcomes for all customers and we also hope to focus on the position regarding claims in the Irish protection market in the future.

CONTACT

David

Ferguson

Underwriting and Claims Development Manager