Carolyn

Covington

Vice President, Actuary - Experience Analysis

Optimizing post-level term (PLT) profitability is more important than ever as the number of term policies in the PLT period continues to grow. 20-year level term policies have already started reaching the end of the level term period, with 30-year term policies on the horizon.

Given the significance of post level term products, it’s no surprise the SOA sponsored three PLT experience studies to date, in 2010, 2014 and 2021. It is clear from these studies that the premium jump at the end of term is a key driver of anti-selective policyholder behavior.

As the premium jump increases, fewer policyholders are willing to pay the higher premiums. Those that are willing to pay higher premiums are worse risks and have higher mortality. Consequently, improving PLT profitability has largely been focused on optimizing the premium jump when entering the PLT period.

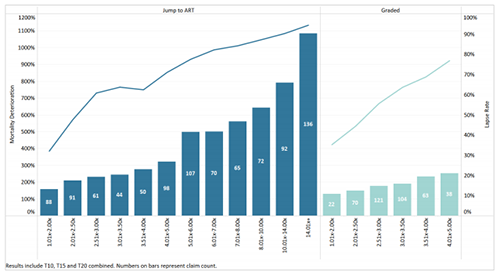

Figure 1 - Shock Lapse in PLT Duration 0 & Mortality Duration in PLT Duration 1 by Initial Premium Jump and PLT Structure

Level premium term life products were originally designed with a large premium increase at the end of the level term period followed by smaller annual increments based on an ultimate YRT rate scale. This jump to ultimate premium structure resulted in high shock lapses at the end of the level term period. The worse risks persisted into the PLT period, and the high mortality deterioration negatively impacted PLT profitability.

To improve PLT profitability, some companies started moving to a graded PLT design. Unlike the jump to ultimate PLT design, premiums in the graded PLT design gradually grade from the level term premium into the ultimate YRT rate scale over several years. The smaller initial premium jump results in lower initial shock lapses and mortality deterioration than the higher premium jumps common in the jump to ultimate PLT design. After the initial premium jump through the end of the grading period, the graded PLT design has higher premium jumps than the jump to ultimate PLT design.

The graded PLT design is growing in popularity. In the 2014 SOA PLT study, only a few companies used a graded PLT design. Survey results from the 2021 SOA PLT study show more companies now use a graded PLT design.

This survey conducted in March 2019 included 25 companies that account for roughly half of all 2020 US term sales by face amount. Of the 25 companies surveyed, 36% changed inforce premiums from a jump to ultimate to a graded PLT design.

For companies that change PLT premiums on inforce policies, a rate change notice is generally sent to policyholders between 30 and 60 days before the end of the level term period. Rate changes are also communicated to agents, and the communication may vary from policy form and by year.

Despite the large increase in companies moving to a graded PLT design, the jump to ultimate PLT design remains the dominant design. Common reasons companies reported for not changing in force PLT rates are:

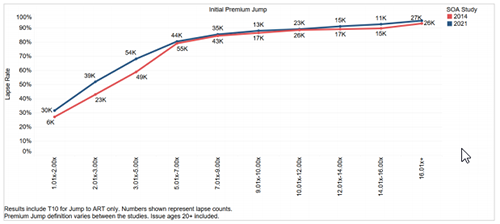

Both the 2014 and 2021 SOA PLT studies show similar results and have credible shock lapse and mortality deterioration data for the jump to ultimate PLT design.

Figure 2 - Shock Lapse Rates by SOA Study and Initial Premium Jump Group

The 2021 SOA PLT study is the first SOA PLT study that includes graded PLT data. While the data for the graded PLT design is less credible than for the jump to ultimate design, the 2021 SOA PLT study includes more insights on the graded PLT design than before.

Additionally, the SOA plans to release a predictive model based on the 2021 SOA PLT study data. The predictive model, along with the insights from the 2021 SOA PLT study, provide the industry with better tools to compare different PLT premium structures.

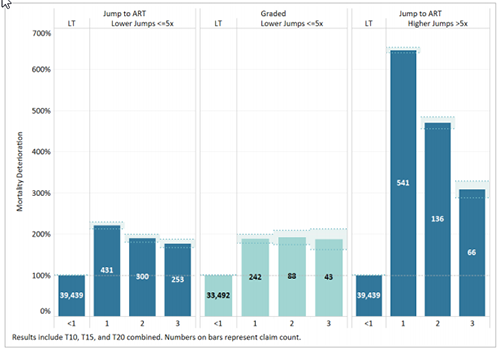

Figure 3 - Mortality Deterioration by PLT Duration, PLT Structure & Initial Premium Jump Grp

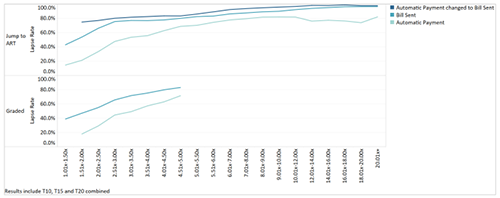

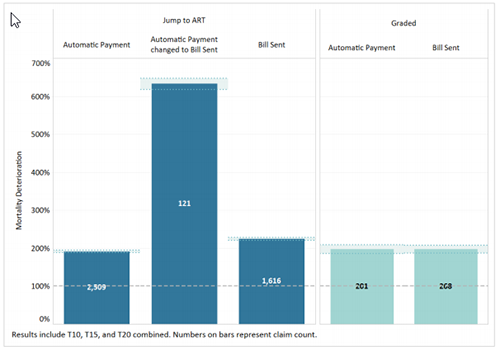

The 2021 SOA PLT study shows billing type is a key explanatory variables of PLT policyholder behavior. Changing the billing type from automatic payment during the level term period to a bill sent for PLT premiums results in the highest shock lapse and mortality deterioration levels.

Figure 4 - Shock Lapse by Initial Premium Jump, Billing Type and PLT Structure

Figure 5 - Mortality Deterioration by Billing Type and PLT Duration 1+

Most companies do not change the billing type at the end of the level term period, with only 16% of companies surveyed doing so. Some of the companies that do not change the billing type indicated they communicate the premium increase to policyholders by:

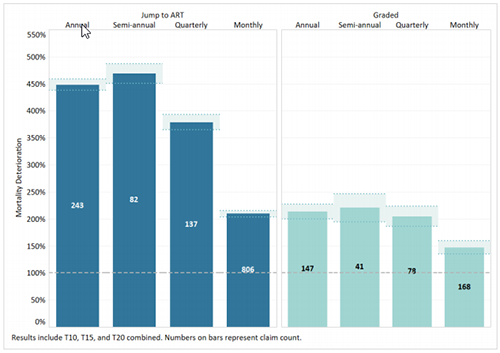

The 2021 SOA PLT study also shows the premium mode is a key explanatory variable of PLT policyholder behavior. Even fewer companies reported changing the premium mode, with only 8% of companies surveyed reporting they change the premium mode from quarterly to monthly.

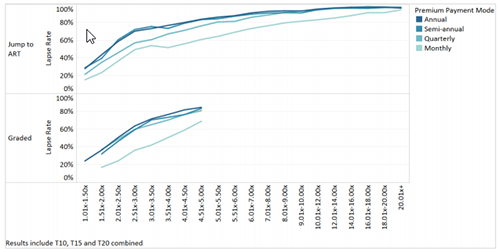

While limited data was available in the 2021 SOA PLT study to analyze the impact of changing premium modes, there was sufficient data in the study to evaluate differences in policyholder behavior by premium mode. Monthly premium modes have lower shock lapse and mortality deterioration than less frequent premium modes. This is likely because the premium increase appears smaller to the policyholder when spread over more payments.

Figure 6 - Shock Lapse by Initial Premium Jump, Premium Mode and PLT Structure

Figure 7 - Mortality Deterioration by Premium Mode and PLT Duration 1

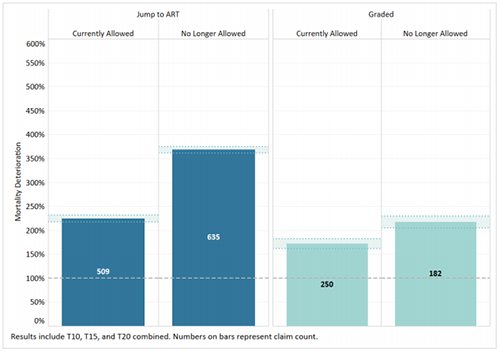

The availability of a conversion option impacts the mortality deterioration in the PLT period. Policies where conversions are still allowed at the end of the level term period have lower mortality deterioration than policies where conversions are no longer allowed. This is likely caused by shifting some of the anti-selective mortality from PLT to conversions when conversions are allowed at the end of the PLT.

The availability of a conversion option should be considered in setting PLT and conversion mortality assumptions, as it will impact where the mortality deterioration will be distributed between PLT and conversions.

Figure 8 - Mortality Deterioration by Conversion Option Available and PLT Duration 1

Insurers have numerous management actions and product design choices at their disposal to maximize PLT profitability. Not changing the billing type for policyholders entering the PLT period improves PLT profitability by minimizing anti-selection. Additionally, the availability of a conversion option should be considered when evaluating conversion and PLT profitability as it impacts the distribution of anti-selective mortality experience between PLT and conversions.

Most importantly, designing an optimal PLT premium structure is key to maximizing PLT profitability. The upcoming PLT predictive model, combined with insights from the 2021 SOA PLT study, will provide more information to evaluate the profitability of different PLT premium structures.

CONTACT

OUR EXPERTS

Carolyn

Covington

Vice President, Actuary - Experience Analysis