Reinsurance tools to support the resilience of economies and communities

November 28, 2019

In this blog, Vincent Foucart and Eric Le Mercier discuss the role of reinsurance in helping to build resilience in economies and communities around the world. They look at the “insurance protection gap” – the difference between economic losses in disaster-stricken countries, and what is effectively covered by insurance. And they examine ways of helping to bridge this gap.

Another key action is to bridge the insurance protection gap: the difference between the economic losses in a country hit by disaster and what is effectively covered by insurance. In vulnerable countries, this gap can be huge and over the past 20 years, protection gaps have tended to grow.

Insurance penetration varies by economic sector as well as by country. Regulatory and behavioral patterns, as well as the frequency of natural catastrophes, are also important. Yet even in developed countries like the US and Japan, the largest economic losses stemming from natural catastrophes are unevenly covered. Take the example of hurricane Katrina, where only 52% was covered.

Reinsurers are in a unique position to help protect societies and the economy. They can facilitate comprehension, mitigation and protection thanks to:

- their extensive expertise in data analysis, risk modelling and risk transfer solutions

- their shock-absorbing capability

- their fundamental function of pooling risks to optimize diversification benefits.

Public authorities’ broad set of missions also make them key partners, and state-backed financial institutions are particularly relevant players. Reinsurers can cooperate with public authorities on multiple fronts, for example through climate and infrastructure finance.

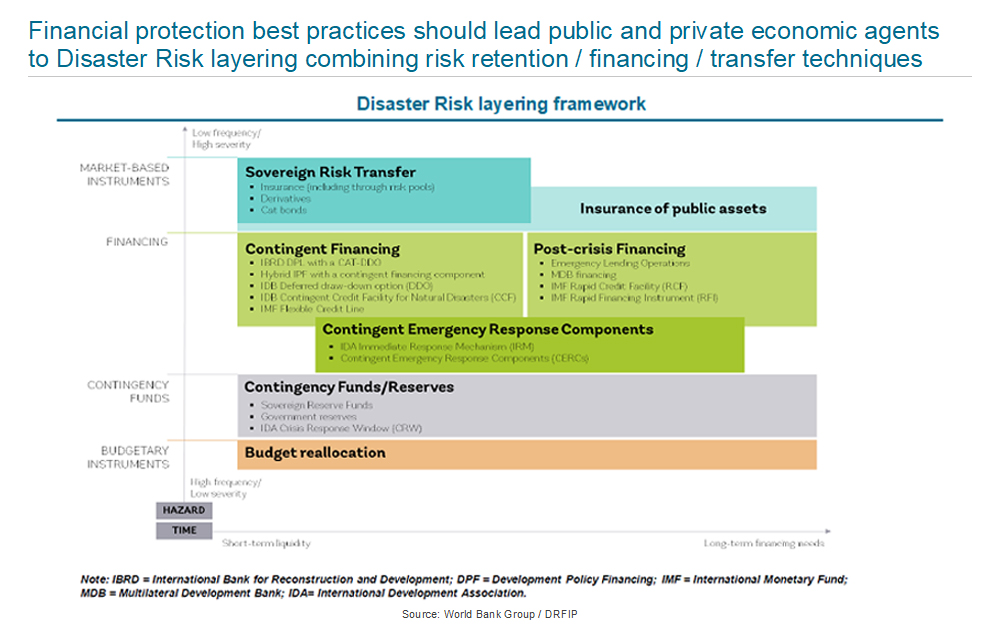

But no one can go it alone. Pooling risk is key. Addressing the growing frequency and severity of disasters requires the combined efforts of governments and the private sector in the form of strong and innovative public-private partnerships.

Eric Le Mercier, Chief Underwriting Officer Alternative Solutions.

Protecting the welfare of citizens and communities is an integral part of the reinsurance industry’s corporate mission. SCOR is committed to helping to close the insurance gap and has put together a number of teams to help do so. One of the challenges they face is to grow the sphere of insurable risks. Changes in the macro-economic environment, technology, and data are contributing to growing this sphere.

This is the focus of SCOR’s Alternative Solutions. Working with countries, multilateral lending institutions, bilateral development agencies, export credit agencies and domestic and regional finance institutions, we are finding numerous ways and approaches to bridge the protection gap and build resilience where it is most needed.