At the 2019 SCOR Annual Conference, Daniel Theben and Henry Bovy led an interactive discussion on the expanding risk universe – and what it means for the (re)insurance industry. The challenge for insurers is to manage the downsides of existing and new emerging risk while seizing opportunities to provide new solutions and support for their clients. This requires (re)insurers to pro-actively identify, assess and capture emerging risks in their risk models, once relevant for their risk profile.

By Daniel Theben, Chief Risk Officer, SCOR Global P&C, Henry Bovy, Head of Treaty Property Cat Analytics, SCOR Global P&C

The risk universe is expanding and evolving. It is increasingly challenging to understand this universe, and to respond to it. Yet as insurers and reinsurers, we need to keep an eye out for the unexpected. A growing number of emerging risks may not even be on our radar screens yet, especially since many of these risks are systemic and have a tendency to be “slow burners”.

There are various definitions of risk. At SCOR, we consider the core characteristics of emerging risks to be the following:

· They present a very high degree of uncertainty.

· They are difficult to quantify, to assess in terms of frequency and severity, and to anticipate in terms of potential future consequences.

This includes not only new threats, but also at those that are known, but are rapidly developing.

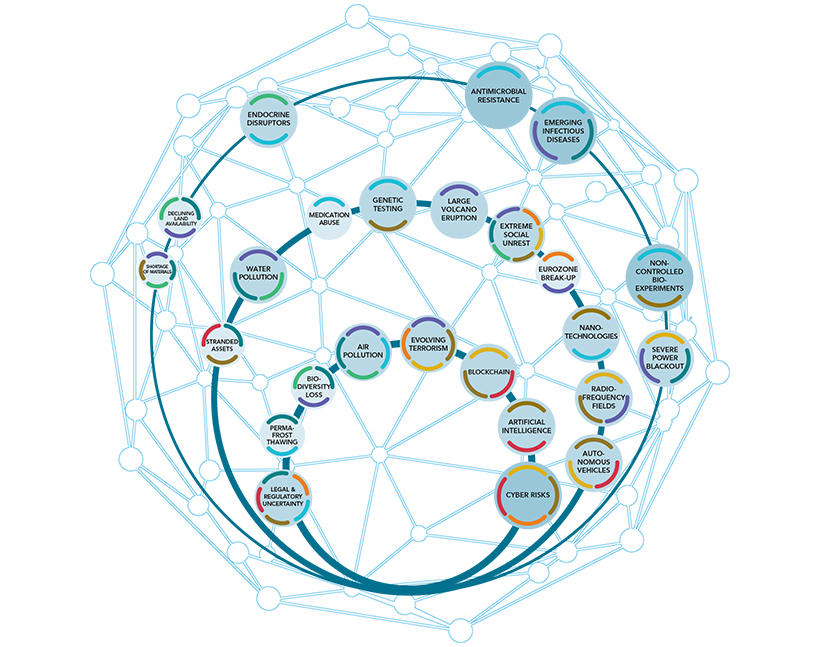

At SCOR, we consider a wide range of emerging risks. One of our starting points is to look at the linkages between risks and trends. Evolving health trends, changing demographics, shifting social and geopolitical landscapes, emerging technologies, hyper-connectivity, new business and finance models, global climate change and deterioration of the environment all have potential associated risks. What’s more, emerging risks and trends don’t operate in isolation; each one is connected to many other factors and phenomena.

Emerging risks can have myriad and diverse impacts on the (re)insurance industry. Take climate change – a risk that is at the top of everyone’s thoughts. Climate change can, of course, lead to more frequent property claims related to natural catastrophes, challenges future business profitability. On the casualty side, it has the potential to increase litigation against companies because of their contributions to carbon emissions and to increase health and healthcare costs, with potential impacts on workers compensation lines. In terms of life insurance, we need to consider things like the impact of heat waves on mortality or chronic conditions, or the changing patterns of disease occurrence resulting from the migration of disease vectors such as mosquitos.

At the same time, emerging risks provide raw material for new (re)insurance solutions. For example, as the frequency and severity of cyber threats increases, cyber is becoming one of the biggest areas of opportunity in terms of increasing demand for insurance solutions. The gaps in our understanding of these risks, however, result in huge challenges around loss-estimation and risk-pricing. A model is a tool that needs to be fed with a considerable amount of data on frequency, etc. if it is to be useful, and we are still far from having the data we need on new risk like cyber.

Daniel Theben, Chief Risk Officer, SCOR Global P&C

(Re)insurance of autonomous cars is another example. There is potential for decreasing claims and therefore increasing profitability thanks to a reduced frequency in accidents. Yet at the same time, there is the possibility of larger claims resulting from system failures, as well as the difficulty in assigning fault in the case of an accident.

How do we handle this expanding risk universe at SCOR? We have an emerging risks process that is open to all colleagues through an internal collaborative website. Staff are encouraged to add new risks as they hear about them or are exposed to them in the course of their daily lives. From this database, SCOR specialists select those topics they feel have the greatest potential to impact us – both in terms of risk and of opportunity. Then risk assessments – from an underwriting angle as well as from the perspective of the impact on SCOR’s operations and/or reputation – on a scenario basis are performed, reviewed and discussed by a multidisciplinary expert group at a quarterly meeting. From this process, the risks with the most significant potential impacts are selected for regularly reporting to management to aid developing business case initiatives and mitigation strategies for negative risk exposures.

Our communications department also contributes with an ongoing news search on subjects that could impact the (re)insurance industry, using key words such as climate change, pandemic or glyphosate. New keywords are added as “hot topics” emerge.

Once emerging risks are identified, an ongoing monitoring and a dedicated risk mapping process ensure material risks are captured within SCOR’s risk models. The modelling approach consists of three phases: understanding the exposure (insureds, notional exposures); understanding the risk through more realistic scenarios (probable maximum loss); modelling of many scenarios (full stochastic model).

Given the potential downside and the importance for developing new risk solutions, emerging risks are a key component of strategic decision making at SCOR.