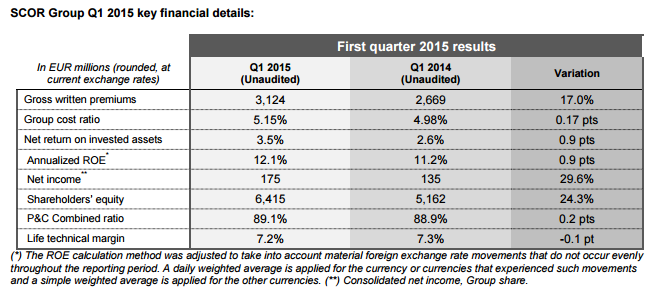

- Gross written premiums reach EUR 3,124 million, up 17.0% at current exchange rates compared to 2014 (+5.1% at constant exchange rates). This significant growth is driven by the contribution of the two business engines, SCOR Global P&C and SCOR Global Life:

- SCOR Global P&C gross written premiums increase by 16.3% at current exchange rates (+5.2% at constant exchange rates) to EUR 1,398 million;

- SCOR Global Life gross written premiums reach EUR 1,726 million, up by 17.7% at current exchange rates (+5.0% at constant exchange rates).

- SCOR Global P&C delivers strong Q1 2015 technical profitability with a net combined ratio of 89.1%, compared to 88.9% in Q1 2014, in an environment of low natural catastrophe losses.

- SCOR Global Life’s technical margin stands at 7.2% for the first three months of 2015, compared to 7.3% for the same period in 2014.

- As announced today, SCOR Global Life’s Market Consistent Embedded Value (MCEV) reaches EUR 4.7 billion in 2014 (EUR 25.50 per share), up 6.2% compared to 2013.

- SCOR Global Investments achieves an enhanced 3.5% return on invested assets thanks to its active portfolio management, in an historically low yield environment.

- Group net income reaches EUR 175 million in the first quarter of 2015, an increase of 30% compared to 2014. The annualized Return on equity (ROE) stands at 12.1%1.

- Shareholders’ equity increases by 12% over the quarter to reach EUR 6,415 million at 31 March 2015, compared to EUR 5,729 million at 31 December 2014, translating into a book value per share of EUR 34.35 at 31 March 2015, compared to EUR 30.60 at 31 December 2014. The strong net income contribution and very strong foreign exchange impact (of around EUR 414 million) were the main drivers for the increase.

- SCOR’s 2015 solvency ratio2 , as defined by the 2014 internal model, stands at 224%, marginally above the optimal range as defined in the “Optimal Dynamics” plan.

- SCOR’s financial leverage decreased to 20.8% at 31 March 2015, compared to 23.1% at 31 December 2014.

1 The ROE calculation method was adjusted to take into account material foreign exchange rate movements that do not occur evenly through the reporting period. A daily weighted average is applied for the currency or currencies that experienced such movements and a simple weighted average is applied for the other currencies.

2 This estimate is based on the 2014 internal model, taking into account the available capital at year-end 2014 divided by the SCR as at that date, allowing for planned business in 2015. The internal model will be subject to a review and approval process conducted by the ACPR over the coming months.