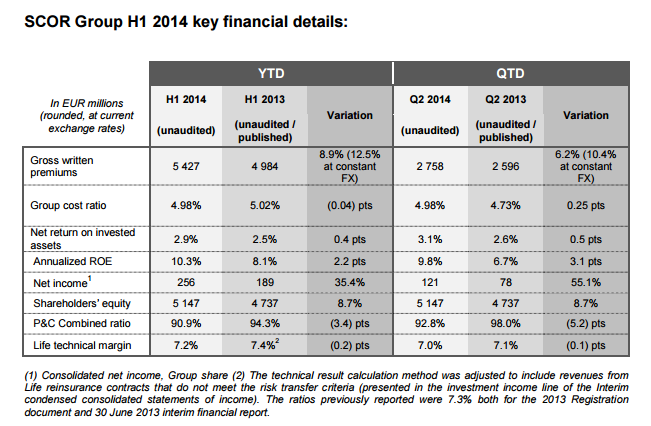

In the first half 2014, SCOR delivers a solid performance that continues to combine growth, profitability and solvency:

- Gross written premiums reach EUR 5,427 million, up 12.5% at constant exchange rates (+8.9% at current exchange rates) compared to the first half 2013, driven by healthy SCOR Global P&C renewals and major new contracts signed by SCOR Global Life as well as last year’s Generali US Life Re acquisition:

- SCOR Global P&C gross written premiums increase by 4.7% at constant exchange rates to EUR 2,400 million;

- SCOR Global Life gross written premiums reach EUR 3,027 million, up 19.5% at constant exchange rates (or 2.6% on a pro-forma basis).

- SCOR Global P&C delivers excellent technical profitability, with a net combined ratio of 90.9% in the first half 2014, compared to 94.3% in H1 2013. This solid ratio is driven by a further improvement in the attritional loss ratio and a low level of natural catastrophes during the first half.

- SCOR Global Life’s technical margin reaches 7.2% in the first half 2014, compared to 7.4%1 on a pro-forma basis in H1 2013, confirming the on-going evolution in the underlying mix.

- SCOR Global Investments achieves a 2.9% return on invested assets for the first half 2014, thanks to its prudent asset management strategy, and continues the rebalancing of its investment portfolio in line with “Optimal Dynamics”.

- SCOR records positive shareholders’ equity development, with book value per share increasing to EUR 27.39 at 30 June 2014 (versus EUR 26.64 at 31 December 2013), after distribution of a dividend of EUR 1.3 per share (+8% vs 2012) on 15 May 2014, for a total amount of EUR 243 million.

- Group net income2 reaches EUR 256 million in the first half 2014, up 35% versus the EUR 189 million recorded in the first half 2013. SCOR delivers strong profitability with an annualised ROE of 10.3%.

- SCOR’s financial leverage stands at 20.8% at 30 June 2014, well below the 25% ceiling indicated in the “Optimal Dynamics” plan.

- SCOR’s capital position according to the Group Internal Model is very strong, with a solvency ratio of 231% in 2014, an increase versus the 2013 solvency ratio of 221%3.

- the completion of the Generali US integration and repayment of the USD 228 million bridge loan; in P&C, the creation of a new business unit dedicated to the “Alternative Solutions” initiative, as set out in the “Optimal Dynamics” plan, and the strengthening of the Group’s London market presence through the launch of a Lloyd’s Managing Agency;

- the completion of several key Life transactions in the Longevity and Financial Solutions markets;

- the creation of a combined Cologne-Zurich hub, effective 1 October 2014, which enhances the Group’s operational efficiency4.

1 The technical result calculation method was adjusted to include revenues from Life reinsurance contracts that do not meet the risk transfer criteria (presented in the investment income line of the Interim condensed consolidated statements of income). The ratios previously reported were 7.3% both for the 2013 Registration document and 30 June 2013 interim financial report.

2 Consolidated net income, Group share.

3 The 2014 solvency ratio is the available capital at year-end 2013 divided by the SCR as of that date, allowing for planned business in 2014. The 2013 Solvency Ratio of 221% included an estimate of the impact of the acquisition of Generali US in 2013.

4 See press release of 23 June 2014.