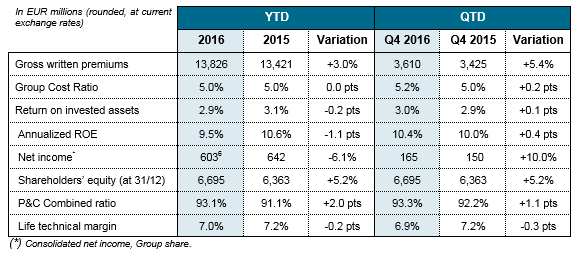

- Gross written premiums reach EUR 13,826 million in 2016, up 5.3% at constant exchange rates compared to 2015 (+3.0% at current exchange rates), with:

- a strong contribution from SCOR Global Life, with gross written premiums reaching EUR 8,187 million over the period (+8.3% at constant exchange rates and +6.4% at current exchange rates);

- an increase in SCOR Global P&C gross written premiums, which stand at EUR 5,639 million at the end of 2016, up 1.2% at constant exchange rates (-1.5% at current exchange rates).

- SCOR Global P&C records strong technical profitability in 2016, with a net combined ratio of 93.1%.

- SCOR Global Life records a robust technical margin of 7.0% in 2016, reflecting the change in business mix in accordance with “Vision in Action”.

- SCOR Global Investments achieves a robust return on invested assets of 2.9% in 2016, while being on track regarding the execution of its “Vision in Action” asset management policy.

- The Group cost ratio remains stable compared to 2015 at 5.0% of premiums.

- Group net income reaches EUR 603 million in 2016. The annualized return on equity (ROE) stands at 9.5% in 2016, or 883 basis points above the risk-free rate1, after taking into account the impact of the French corporate tax rate decrease on deferred taxes. Excluding this impact, the 2016 net income would be EUR 660 million and the ROE would be 10.4%. The ROE for the second half of 2016 stands at 10.6%, and at 12.5% excluding the impact on deferred taxes.

- The business model delivers a very strong operating cash flow of EUR 1,354 million as at 31 December 2016, compared to EUR 795 million at 31 December 2015. As well as the generation of strong recurring cash flows in 2016, this is due to one exceptional item: SCOR Global P&C received a non-recurring fund withheld payment of approximately EUR 300 million. Excluding this exceptional item, the operating cash flow stands at EUR 1 billion in 2016.

- Shareholders’ equity stands at EUR 6,695 million at 31 December 2016, compared to EUR 6,363 million at 31 December 2015 after the payment in May 2016 of EUR 278 million of cash dividends for the year 2015. This translates into a record book value per share of EUR 35.942 at 31 December 2016, compared to EUR 34.03 at 31 December 2015.

- SCOR’s financial leverage stands at 24.4% at 31 December 2016.

- Carried by a strong operating performance, SCOR’s estimated solvency ratio at 31 December 2016 stands at 225% compared to 211%3 at year-end 2015, above the optimal range of 185% - 220% as defined in the “Vision in Action” plan.

- SCOR proposes to the Annual General Meeting an increased dividend of EUR 1.654 per share for 2016, up from EUR 1.50 for 2015, representing a payout ratio of 50.7%. The ex-dividend date for 2016 will be set on 2 May 2017 and the dividend will be paid on 4 May 2017.

- SCOR could consider share buy-backs over the next 24 months. The Group’s solvency ratio stands at a high level, above the optimal range. SCOR also benefits from solid underlying fundamentals, excellent ratings and optimal debt leverage. In view of this, out of the specific management actions provided by the Group’s solvency scale, SCOR could consider accelerating its growth (provided that such growth meets the profitability target of the “Vision in Action” plan), adapting its risk profile, increasing the dividend growth rate and/or buying back shares. The level of excess capital above the optimal range is approximately EUR 200 million as at 31 December 2016. The terms of the share buy-backs (amount and timing) will be settled by the Board of Directors, in accordance with the Group’s growth performance.

- SCOR is also progressing in its project to optimize its legal entities and expects to complete the merger of SCOR SE, SCOR Global P&C SE and SCOR Global Life SE5 in early 2019. The potential savings of the reorganization may reach up to EUR 200 million in solvency capital.

- Thanks to its high level of diversification, the Group is ready to leverage on the positive prospects that the reinsurance market offers, both in P&C and Life;

- Overall, SCOR will benefit from the foreseeable increase in interest rates;

- SCOR has built a secure and fungible capital base, enabling high financial flexibility.

1 Based on a 5-year rolling average of 5-year risk-free rates over the cycle, according to the new methodology disclosed with the “Vision in Action” strategic plan.

2 Record book value level since the launch of the strategic plan “Back on Track” in 2002.

3 The estimated solvency ratio at YE 2015 of 211% was adjusted for the two debts that were called in Q3 2016 (the 6.154% undated deeply subordinated EUR 257 million notes called in July 2016 and the 5.375% fixed to floating rate undated subordinated CHF 650 million notes called in August 2016). The estimated solvency ratio based on Solvency II requirements was 231% at year-end 2015.

4 2016 dividend subject to approval of the Shareholders’ Annual General Meeting on 27 April 2017.

5 Refer to 2016 Investor Day presentation, in particular slide 102.

6 After taking into account the impact of the French corporate tax rate decrease on deferred taxes. Excluding this impact, the 2016 Net income would be EUR 660 million.