Alexandre

Garcia

Media Relations

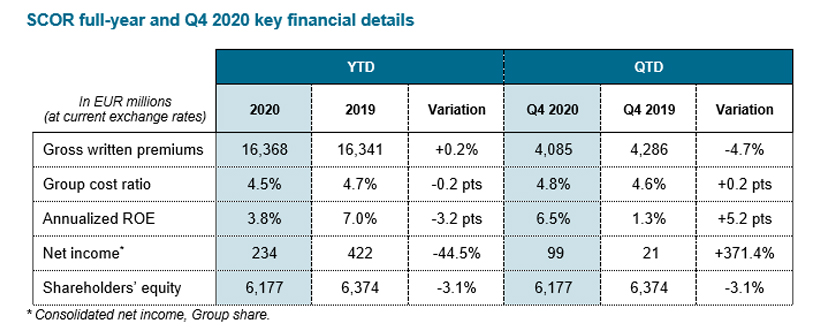

SCOR absorbs the shock of Covid-19, recording a net income of EUR 234 million in 2020, and proposes a dividend of EUR 1.80 per share

2020 was marked by the historic global shock of Covid-19, as well as by a series of natural catastrophes and large man-made losses. SCOR successfully passed this real-life stress test, once again demonstrating the resilience of its business model and its shock-absorbing capacity. The Group accomplished its mission, honoring all its commitments to its clients and contributing to the protection of the people and property affected by these losses, while delivering a good set of results.

SCOR continues to actively implement its strategic plan “Quantum Leap”, focused on the twofold targets of profitability and solvency, accelerating its use of new technologies while continuing its actions in terms of sustainable development and social responsibility.

The Covid-19 crisis is still ongoing and continues to present significant uncertainties for 2021. SCOR’s solvency ratio at the end of 2020, which takes into account projected Covid-19 claims across 2021, stands at 220%, at the upper end of the optimal solvency range. Furthermore, the Group maintains a very strong level of liquidity standing at almost EUR 2.0 billion. All four rating agencies have affirmed the Group’s financial rating at a level of “AA-”1. With this very strong capital position, SCOR is proposing a dividend of EUR 1.802 per share for the fiscal year 2020.

SCOR believes that Covid-19 is helping to create the conditions for stronger reinsurance growth along with a positive pricing dynamic. Covid-19 is driving a general increase in risk aversion which in turn is driving higher demand for risk coverage throughout the world. On the P&C side, Covid-19 reinforces the general market hardening observed across all lines and all regions with the low yield environment an additional catalyst. SCOR took full advantage of these favorable conditions and the depth of its franchise to produce an excellent outcome in the January 2021 renewals. Covid-19 is also creating the conditions for an epochal transformation of Life reinsurance based not only on higher awareness of the importance of Life & Health coverage, but also upon the acceleration of its use of new technologies, from underwriting to claims management.

SCOR is well-placed in this beneficial reinsurance industry environment. The Group will continue to scale its global platform and expertise to seize market opportunities, leveraging its strong Tier 1 credentials based upon the consistent execution of a clear and proven strategy, a recognized market leading position with a high-quality franchise, a very strong financial profile, a recognized technical expertise and no legacy issues.

***

Denis Kessler, Chairman & Chief Executive Officer of SCOR, comments: “Covid-19 is a historic shock. Pandemic risk is obviously well known to reinsurers. Infectious diseases figure prominently in the risk maps SCOR draws up each year. The study and modeling of risk was an integral part of our risk management when Covid-19 struck. With hindsight, we underestimated the truly global reach of such a phenomenon, as well as the critical impact of the various – unmodelable – decisions taken by governments to contain the spread of the virus, which ultimately had a major impact on the (re)insurance industry’s exposure to this crisis. The measures taken to contain Covid-19, particularly lockdowns, have affected all areas of economic and social life. This has become a multi-faceted crisis – health-related, social, economic, financial and even geopolitical. It has therefore impacted reinsurers, in terms of both assets and liabilities, on both the Life and P&C sides. The Group has successfully passed this real-life stress test by absorbing this major shock. SCOR ended 2020 profitably and solvently. The Group’s fundamentals remain very strong, as demonstrated by the excellent results we would have recorded in the absence of Covid-19 – which cost the Group EUR 640 million in 2020 – as well as by the level of solvency achieved at the end of December. This enables the Group to pursue its active shareholder remuneration policy, with a dividend of EUR 1.80 per share for 2020 to be proposed at the Annual General Assembly. SCOR is very well positioned to benefit from the general market hardening in P&C reinsurance, as demonstrated by the excellent renewals recorded at January 1, 2021. Similarly, the Group is pursuing its development in Life reinsurance, particularly in Asia. SCOR continues to implement its “Quantum Leap” strategic plan with determination. I would like to express my warmest thanks to the Group’s employees for having kept the company running and for delivering for all our clients during this very challenging time.”

***

SCOR is successfully managing and absorbing the impact of Covid-19 both operationally and financially.

In 2020, SCOR has been proactive in taking immediate actions to contribute to help stop the spread of Covid-19. The Group adopted early and strict prevention measures to protect the health of its employees and was active in regularly sharing its knowledge and expertise on Covid-19.

SCOR has applied its modeling expertise to conduct a thorough assessment of all its exposures to the health, economic and financial crisis from Covid-19. Based on data currently available, information received from cedants to date and the results of the models used, SCOR has recorded a total cost of Covid-19 in 2020 for Life, P&C and Investments at EUR 640 million5.

The situation is as follows:

1. Please refer to the press releases from Moody’s (published on May 7, 2020), S&P (published on June 18, 2020), Fitch (published on September 15, 2020) and A.M. Best (published on September 25, 2020). AM Best’s Financial Strength Rating of “A+” (different scale from the other rating agencies) and Long-term Issuer Credit Rating (ICR) of “aa -” (same scale as the other rating agencies).

2. 2020 dividend subject to approval of the 2021 shareholders’ Annual General Meeting, pursuant to the decision of the Board of Directors at its meeting of February 23, 2021, to adopt the Group’s accounts and consolidated financial statements as of December 31, 2020.

3. Based on a 5-year rolling average of 5-year risk-free rates (48 bps in the fourth quarter of 2020)

4. Normalized for natural catastrophes (7% budget cat ratio) and the cost of Covid-19 (excluding equity impairments)

5. Net of retrocession and before tax

6. Net of retrocession and reinstatement premiums, and before tax

CONTACT

Alexandre

Garcia

Media Relations

Thomas

Fossard

Investor Relations