-

SCOR Smart Credit

-

How can the SCOR Smart Credit engine help you?

Trade Credit insurance is under-resourced in most regions, but the demand for working capital financing and lender protection is stronger than ever, supported by greater access to e-commerce platforms and by vibrant growth-drivers such as Micro SMEs. Opportunities abound, but insurers often lack the digital means to handle the volume of transactions generated by an ever-growing portfolio.

To help them solve this challenge, SCOR has launched the SCOR Smart Credit digital pricing-engine: a data-driven, automated tool that helps insurance companies to reliably analyze merchant credit risks. Its designed to increase the efficiency of the underwriting process without compromising on quality or consistency, all the while scaling to support the number of transactions coming from e-commerce platforms and from offline micro SME storefronts.

-

About the tool

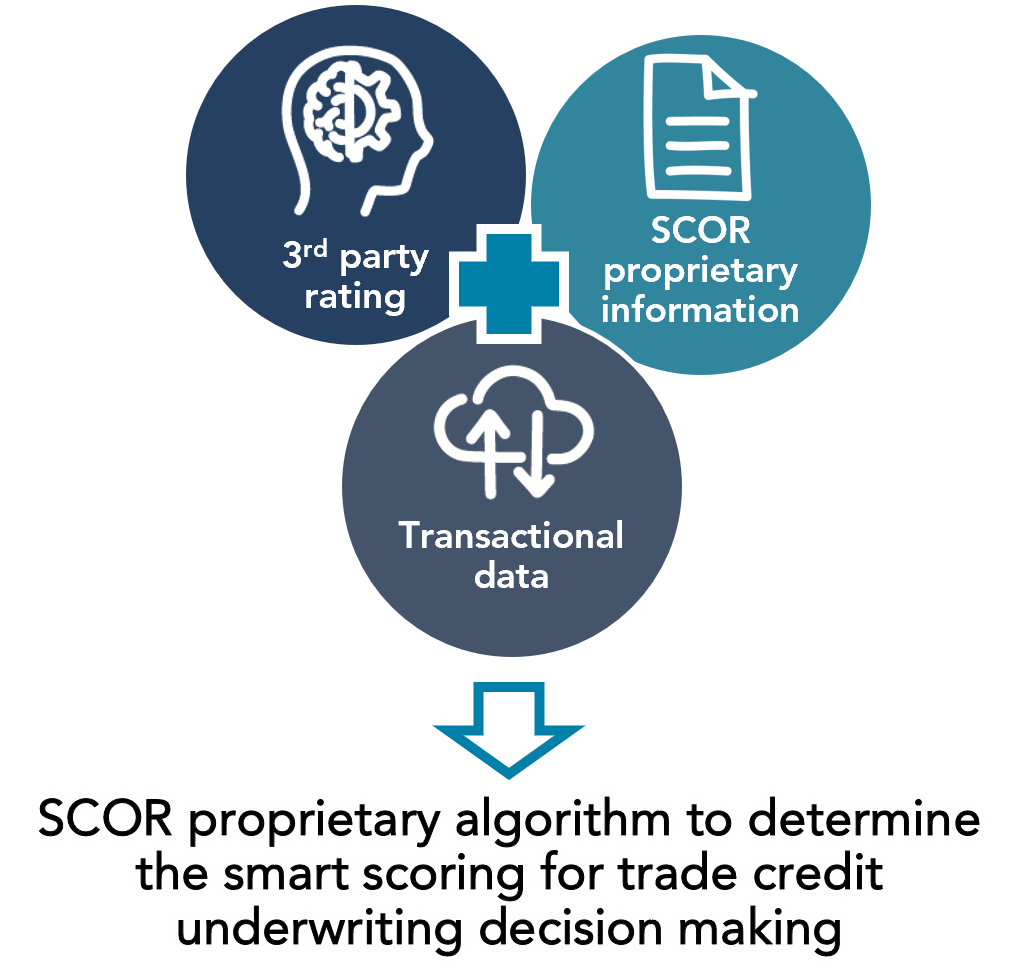

The engine analyzes each credit submission for purchases made by the merchant's costumers. Then, the merchant's data is run through a propietary SCOR algorithm. The process generates a score that helps to project how likely the merchant is to make an insurance claim, and is used to determine the credit limit and/or premium of their policy. This automation means the whole process can be repeated efficiently and effectively, as many times as necessary, and much faster than with traditional credit insurance techniques.

Using the SCOR Smart Credit Tool gives insurers access to SCOR's expertise in trade credit products, exposure, and pricing, and enables them to reduce the cost and operational risk of implementing a high-volume digital trade credit solution. Data-driven analysis of the underlying risks via an API enhances the quality of the portfolio, futher reducing risk.

-

Let's grow your trade credit insurance portfolio

-

Related articles