-

Financial Solutions

Unlocking value with capital optimization

-

Life insurance companies are increasingly focused on optimizing their capital requirements

In today’s world, Life insurers are facing complex capital management and / or reporting challenges.

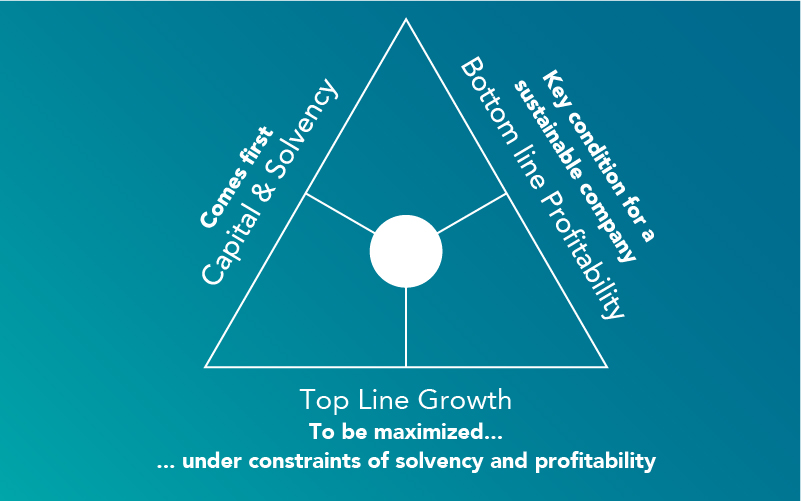

In addition to global headwinds for the insurance industry caused by macroeconomic conditions and tough competition for business growth, regulatory (i.e. Solvency II) and accounting changes (i.e. IFRS 17 and Principle-Based Reserving (PBR)) are putting additional pressure on our clients to find the optimal spot within the so called “Magic Triangle”.In this context, we propose specific solutions to our clients to help them optimize their solvency and capital position.

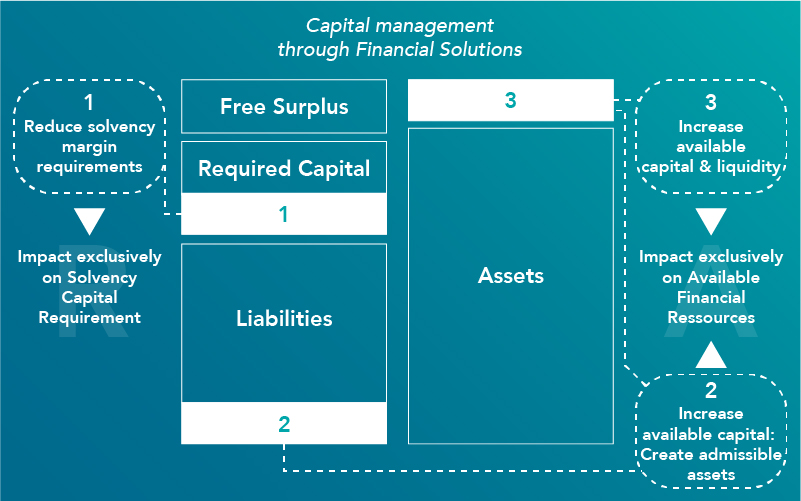

As a global reinsurer, SCOR has positioned itself as a key partner to its clients, providing tailor-made solutions acting on both the capital available and the capital required.

SCOR offers local market support to its clients by leveraging its global expertise

As a pioneer in Europe with several large financial solutions back in 2013, SCOR has developed teams around the world to cope with local regulations and provide innovative solutions to its clients on their specific needs.

Our local financial solutions experts benefit from SCOR’s global footprint to leverage on global resources. In particular:- SCOR can offer a broad and deep actuarial pricing expertise on biometric risks for each of the key markets of consideration; SCOR can also offer the support of Legal teams for reviewing the drafting of contract wording

- SCOR’s P&C alternative solutions team can also play a key role in some specific situations

Our Financial Solutions offer

The goal of SCOR's financial soclutions team is to support their financial needs in three major ways:

-

These solutions are designed to

- release solvency requirements;

- remove conservatism in solvency requirements;

- improve risk diversification;

- improve profitability indicators.

These solutions most often can be applied to capital-intensive Lines of Business and help to finance business growth or dividend payment

These solutions are designed to

- alleviate the need for conservatism in terms of reserving requirements;

- improve profitability indicators;

- transform inadmissible / intangible assets into admissible assets.

These solutions most often can be applied to long-term business with stringent reserving rules and help to finance business growth or dividend payment.

These solutions are designed to:

- free-up capital and cash;

- transform inadmissible / intangible assets into admissible / tangible assets

They most often are applied to long-term business and help to finance business growth or dividend payment.

-

Locally, our offer is adapted to our clients' needs

In Asia-Pacific, our team provides clients with:

- Redundant reserve solutions

- Contingent VIF financing

- M&A financing

- New business financing

For any questions on the above please contact Tony Ho

In EMEA, our team provides clients with:

- Solvency capital optimization solutions

- VIF Financing

- Contingent reinsurance

- Lapse reinsurance

- M&A financing

- IFRS financing solutions

For any questions on the above please contact Sarah Sengdy

In the Americas our team provides clients with:

- Surplus relief

- Redundant reserve financing

- Biometric In-force transactions

- M&A financing

- Group/Individual Life RBC Relief

For any questions on the above please contact Brian Lo

-

For more details, please refer to our previous communications

SCOR Global Life completes a major transaction in Spain

SCOR Global Life strengthens its financial solutions offering with an important VIF monetization transaction

CONTACT

OUR EXPERTS

-

Bruno

Latourrette

Head of Financial Solutions

-

Alexandre

Tzenev

Global Head of Business Development, Financial Solutions, L&H

-

Peter

Nowell

Head of Structured Asset Solutions

-

Tony

Ho

Head of Financial Solutions, APAC and Global Head of Delivery

-

Diana

Munk

Global Head of Structuring, Financial Solutions

-

Sarah

Sengdy

Head of Financial Solutions EMEA | Life

-

Brian

Lo

Head of US Financial Solutions