-

SCOR Digital Solutions

-

SCOR Digital Solutions is SCOR Life & Health’s digital solutions platform. Drawing on strong technological foundations, it combines SCOR’s industry-recognized expertise and data capabilities to help our clients navigate through and capitalize on the future of underwriting and claims systems, maximizing market potential globally, driving better financial and operational performance, and delivering the best possible customer experience.

SCOR Digital Solutions is a globally scalable, adaptable and modular underwriting and claims technology platform, combining SCOR Life & Health’s core digital assets, including:

Velogica is SCOR Digital Solutions’ state-of-the-art, automated underwriting suite. It streamlines the insurance purchase pathway by offering superior customer journeys and market-specific customizations. Advanced automation technology augments human underwriting, allowing for swift, automatic policy issuance and diminishing the need for manual intervention. It employs advanced reflexive questioning techniques, backed by behavioral science, to address a variety of consumer needs in a single, easy-to-use and efficient process.

Velogica is SCOR Digital Solutions’ state-of-the-art, automated underwriting suite. It streamlines the insurance purchase pathway by offering superior customer journeys and market-specific customizations. Advanced automation technology augments human underwriting, allowing for swift, automatic policy issuance and diminishing the need for manual intervention. It employs advanced reflexive questioning techniques, backed by behavioral science, to address a variety of consumer needs in a single, easy-to-use and efficient process.Velogica uniquely interprets both medical and non-medical third-party data sources, aligning them with disclosed information through rules and advanced algorithms. This process enables instant, intelligent underwriting recommendations adapted to local market requirements and regulatory standards.

The solution integrates seamlessly with supplementary electronic services and data analytics, offering clients a comprehensive platform that establishes a genuine digital purchase pathway with ongoing data insights. Furthermore, SCOR has developed a GenAI-powered underwriting assistant, delivering increased efficiency and driving better decision making by providing faster access to enriched information.

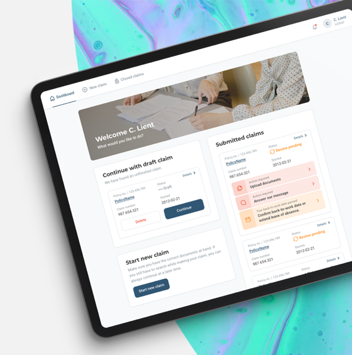

VClaims is an award-winning digital claims solution tailored for the life and health market, leveraging SCOR’s leading reinsurance risk knowledge and experience.

VClaims is an award-winning digital claims solution tailored for the life and health market, leveraging SCOR’s leading reinsurance risk knowledge and experience.It streamlines the claims process through automated, rules-based outcomes. VClaims simplifies the claimant journey with online submission and automated assessments, leading to higher customer satisfaction. Insurers benefit from reduced costs, faster processing times, and enhanced risk management through intelligent triaging and risk detection.

VClaims offers easy, low-cost deployment options that integrate seamlessly with existing systems. It has the flexibility to partner with third-party services, including fraud detection services and SCOR’s own proprietary AI capabilities.

The solution leverages advanced behavioral science techniques and provides comprehensive, data-driven insights that drive better decision making, improved business performance, and superior customer outcomes.

Adopting VClaims enhances the overall claims proposition, making it a strategic choice for insurers.

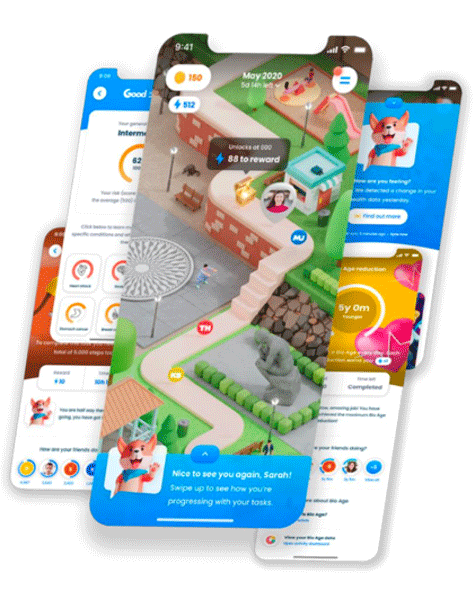

SCOR Digital Solutions’ HealthTech arm regroups SCOR’s health and wellness solutions. By combining increasingly accessible traditional and digital customer health data with AI/ML-supported data science, we achieve evidence-based outcomes. Biometric, lifestyle, and behavioral data is used to effectively drive customer engagement and portfolio risk management. Solutions include:

- Biological Age Model (BAM): SCOR’s sophisticated health risk calculator that uses wearable data to calculate reinsurance-backed, biometric risk scores.

- Good Life: An award-winning health & wellness engagement platform leveraging customer digital biomarkers and wearable data to create gamified, personalized, and highly engaging user journeys. Good Life has proven results in terms of reducing customer lapse rates and improving customer health.

- Good Health: A predictive risk solution that works with electronic health record (EHR) data to produce morbidity, mortality and incidence rate scores for overall health and a range of critical illnesses.

Our suite of award-winning solutions has demonstrated outcomes in both engagement and risk management. These solutions are available as a full suite or as lightweight embedded offerings.

BeeTech is a market-leading platform for underwriting and claims, driven by effectively quantifying and managing insurance risk in APAC. Leveraging SCOR’s extensive expertise, along with deep local market knowledge, BeeTech offers a sophisticated risk quantification platform that uses advanced risk quantification methods and profound insurance knowledge to assess individual health risks throughout the entire insurance lifecycle, including sales, underwriting, claims, and policy lapse predictions.

It provides precise risk categorization by combining comprehensive data with cutting-edge insurance knowledge, supported by reinsurance expertise and machine learning. Furthermore, BeeTech creates a comprehensive modeling system that spans the full insurance lifecycle and offers flexible API integration to seamlessly blend into an insurer's existing systems.

BeeTech continues to lead industry transformation by providing unparalleled risk assessment and health management solutions.

-

Global Customer Study

SCOR Digital Solutions conducts an annual research with more than 12,500 insurance consumers in 22 key markets around the world, ensuring our solutions are always imbued with the voice of today’s consumers.

Previous editions of the Global Consumer Study are available at the bottom of this page.